Swedish Exchange Highlights Three Growth Companies With High Insider Ownership

Amidst a backdrop of global economic recalibrations and market adjustments, the Swedish stock market continues to present intriguing opportunities for investors. This article focuses on three growth companies in Sweden that not only demonstrate promising expansion potentials but also feature high insider ownership, a factor that can signal strong confidence in the company's future from those who know it best.

Top 10 Growth Companies With High Insider Ownership In Sweden

| Name | Insider Ownership | Earnings Growth |

| CTT Systems (OM:CTT) | 16.9% | 21.6% |

| Sun4Energy Group (NGM:SUN4) | 12.6% | 49.6% |

| BioArctic (OM:BIOA B) | 35.1% | 48.2% |

| Spago Nanomedical (OM:SPAGO) | 16.1% | 52.1% |

| Calliditas Therapeutics (OM:CALTX) | 11.6% | 49.9% |

| InCoax Networks (OM:INCOAX) | 14.9% | 104.9% |

| Yubico (OM:YUBICO) | 37.5% | 42% |

| KebNi (OM:KEBNI B) | 32.5% | 90.4% |

| Egetis Therapeutics (OM:EGTX) | 17.6% | 91.9% |

| SaveLend Group (OM:YIELD) | 24.8% | 88.5% |

Below we spotlight a couple of our favorites from our exclusive screener.

BioArctic (OM:BIOA B)

Simply Wall St Growth Rating: ★★★★★★

Overview: BioArctic AB (publ) focuses on developing biological drugs for central nervous system disorders in Sweden, with a market capitalization of approximately SEK 17.93 billion.

Operations: The company generates its revenue primarily from the biotechnology segment, totaling SEK 615.99 million.

Insider Ownership: 35.1%

Earnings Growth Forecast: 48.2% p.a.

BioArctic, a Swedish biopharmaceutical company, exhibits promising growth with its revenue forecast to expand significantly at 37.6% per year. Despite trading 72.4% below its estimated fair value, analysts predict an 80.4% potential increase in stock price. Recent strategic alliances, like the one with Eisai on Alzheimer's treatment BAN2802, underscore its innovative edge and commitment to addressing critical health issues. However, insider buying has not been substantial in the past three months, suggesting mixed confidence from within.

- Navigate through the intricacies of BioArctic with our comprehensive analyst estimates report here.

- Our valuation report unveils the possibility BioArctic's shares may be trading at a discount.

Sectra (OM:SECT B)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Sectra AB (publ) operates in the medical IT and cybersecurity sectors across Sweden, the United Kingdom, the Netherlands, and other parts of Europe, with a market capitalization of SEK 45.43 billion.

Operations: The company generates revenue primarily from its Imaging IT Solutions and Secure Communications segments, which reported SEK 2.45 billion and SEK 301.16 million respectively.

Insider Ownership: 30.3%

Earnings Growth Forecast: 15.7% p.a.

Sectra, a Swedish company specializing in digital pathology and imaging solutions, has demonstrated robust growth with its recent FDA clearance enhancing its market position in the US. This approval, coupled with new contracts in Germany and Canada for its radiology and enterprise imaging solutions, underscores Sectra's commitment to expanding its technological footprint and operational efficiency. Although insider transactions have been quiet recently, Sectra's strategic advancements suggest a strong internal confidence aligned with its 13.9% forecasted annual revenue growth.

- Click to explore a detailed breakdown of our findings in Sectra's earnings growth report.

- Our comprehensive valuation report raises the possibility that Sectra is priced higher than what may be justified by its financials.

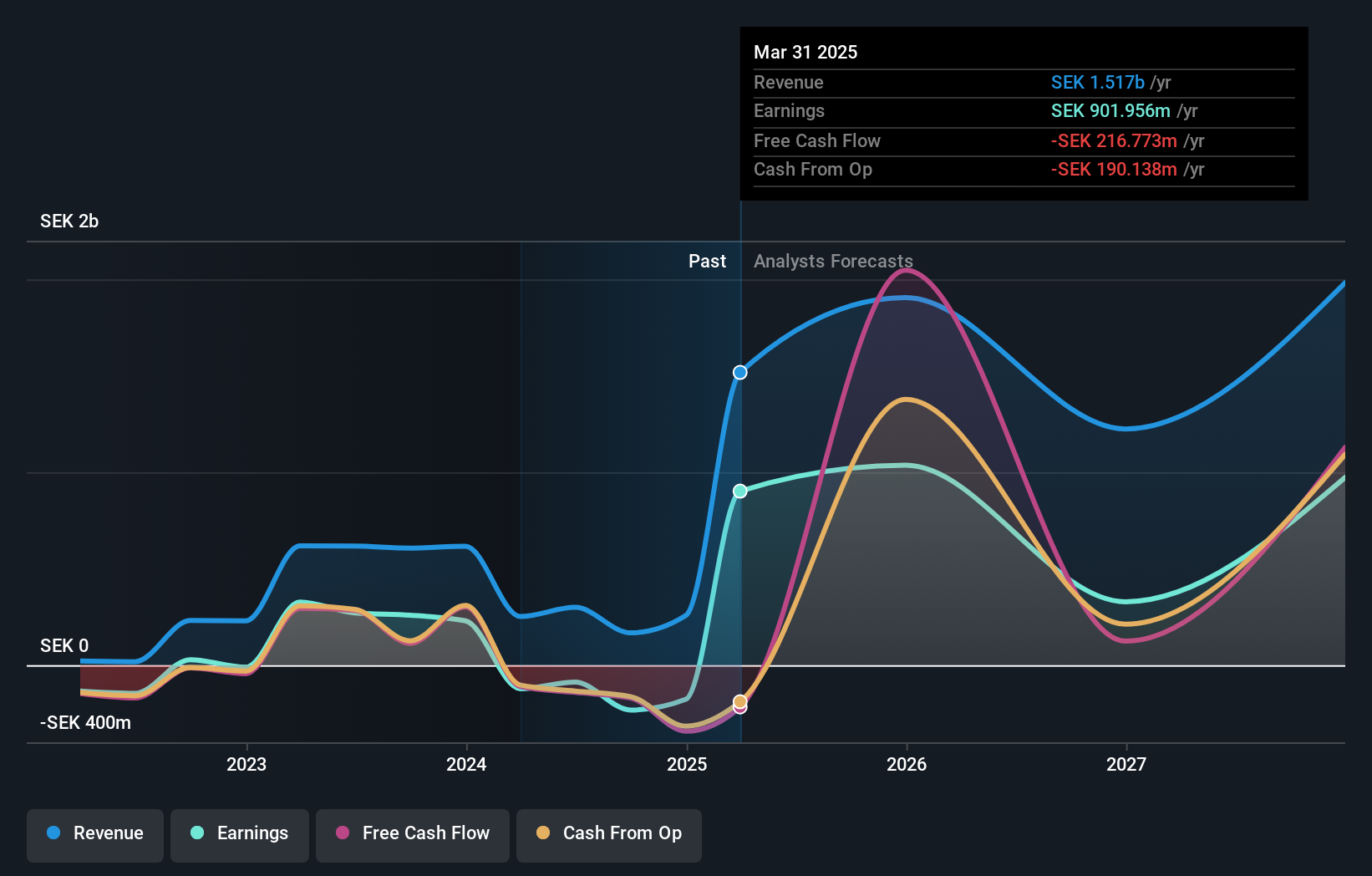

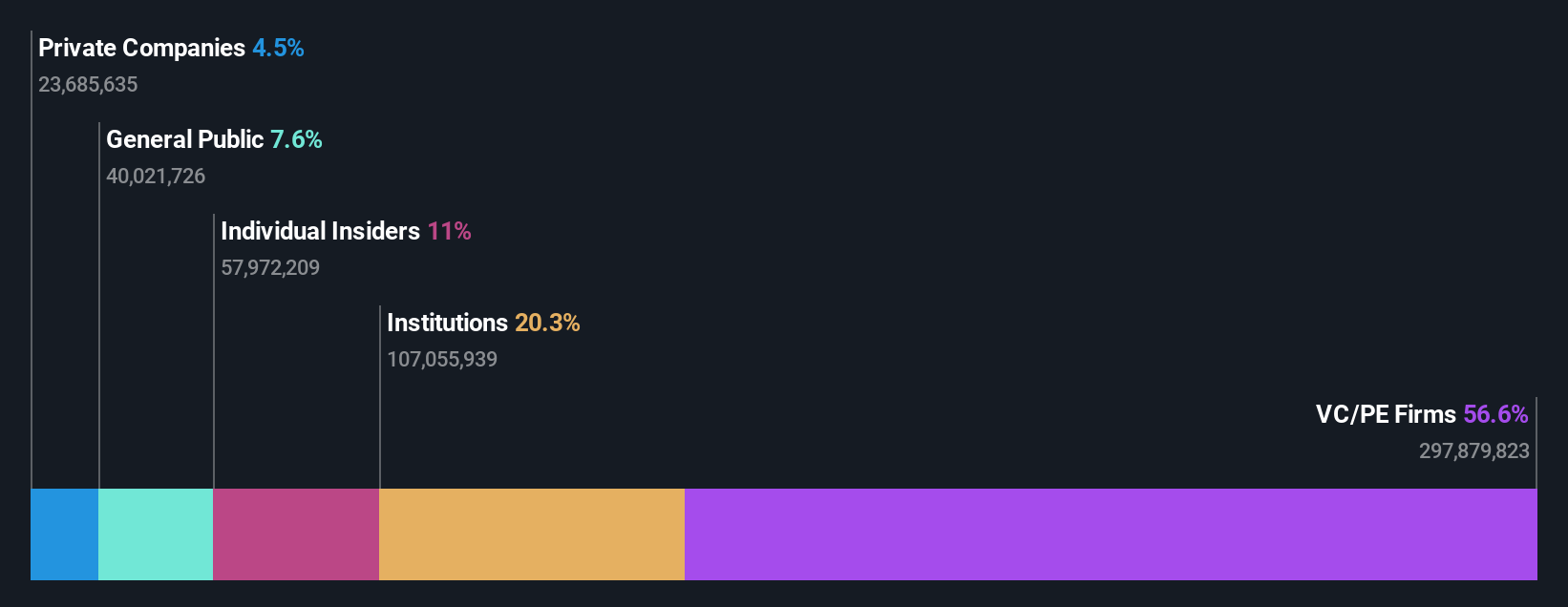

Vimian Group (OM:VIMIAN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Vimian Group AB operates globally in the animal health sector and has a market capitalization of approximately SEK 17.74 billion.

Operations: The company generates its revenue internationally in the animal health sector.

Insider Ownership: 11%

Earnings Growth Forecast: 59.1% p.a.

Vimian Group, a Swedish growth company with high insider ownership, is trading at 38.3% below its estimated fair value and has shown promising financial developments. Recently reporting a Q1 sales increase to €91.3 million from €88.08 million year-over-year and net income of €3.5 million, the company's earnings are expected to grow significantly at 59.1% annually over the next three years, outpacing the Swedish market's 13.8%. However, interest payments are not well covered by earnings and there has been shareholder dilution in the past year.

- Get an in-depth perspective on Vimian Group's performance by reading our analyst estimates report here.

- In light of our recent valuation report, it seems possible that Vimian Group is trading behind its estimated value.

Key Takeaways

- Click this link to deep-dive into the 81 companies within our Fast Growing Swedish Companies With High Insider Ownership screener.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com