Does the weak yen scare away foreign investors? BlackRock: The return on Japanese stocks is actually greatly discounted

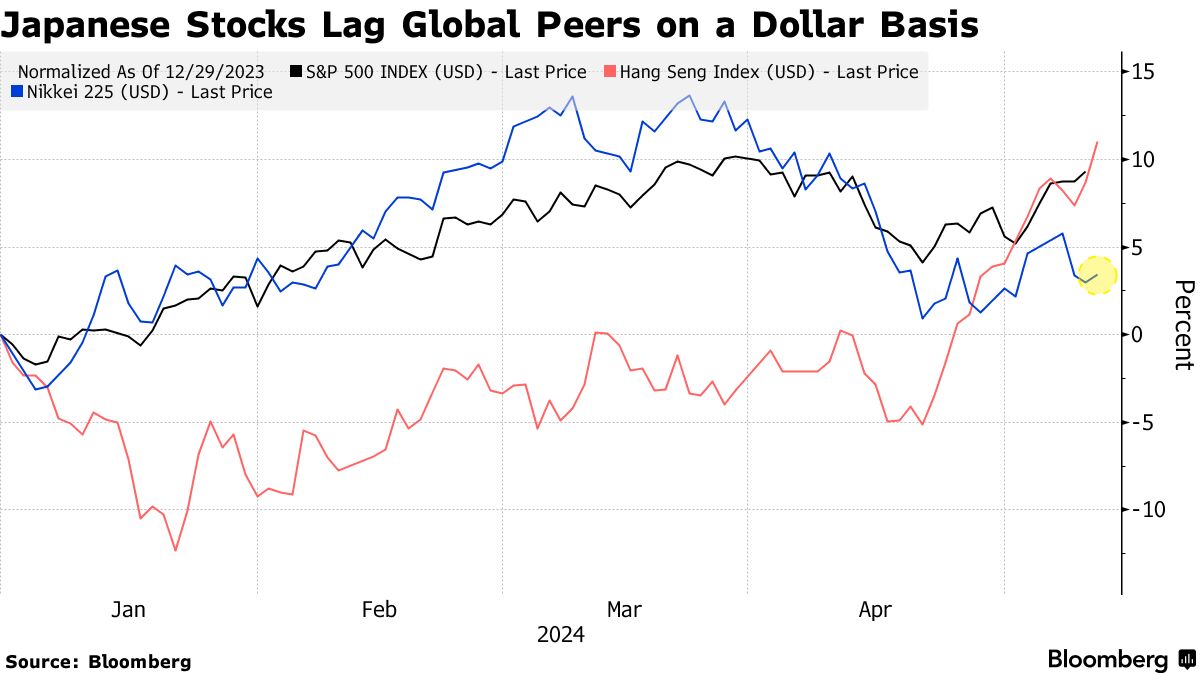

The weak yen is causing foreign investors to stay away from the Japanese stock market. The Nikkei 225 Index (NK225) has risen 14% this year, outperforming its global peers. However, for US dollar investors, after the yen fell to its lowest point in 34 years, the Nikkei 225 index's increase actually shrunk to just over 3%, which is far lower than the 9.5% increase in the S&P 500 index and the 11% return of the Hang Seng Index (in US dollars).

Yue Bamba (Yue Bamba), BlackRock's head of active investment in Japan, said in an interview in Tokyo: “If the yen continues to depreciate, it will become more difficult to invest in Japanese stocks. When you talk about Japan with global investors, forex is definitely everyone's top concern.”

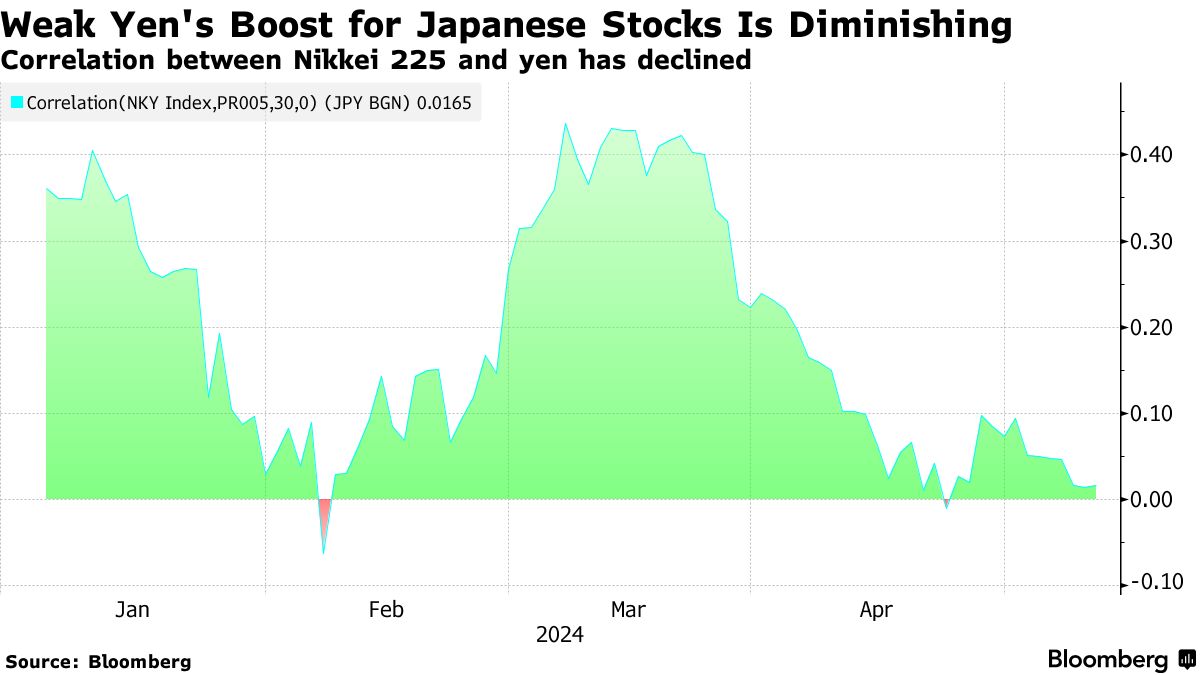

The depreciation of the yen boosted exporters' profits, and exporters' profits have always been a factor driving up the Japanese stock market. However, the Nikkei 225 Index has fallen more than 6% from its record high due to concerns that the yen will increase the burden of domestic consumer spending and corporate import costs.

Bamba believes that the future performance of the yen depends more on the actions of the Federal Reserve than the Bank of Japan. If the Federal Reserve does not cut interest rates, the yen may gradually fall to the 170 range against the US dollar. If the Federal Reserve cuts interest rates, it is “entirely possible” that the pair will return to the 130-135 level.

The exchange rate of the yen against the US dollar is currently around 155.88, and Bamba believes this level is “undervalued.” He said the fair value of the yen was “much higher” than the current level and “could easily reach 130.” He said that if the exchange rate of the yen breaks through 150 against the US dollar, overseas investors will be relieved to return to the stock market.

The Japanese government may have interfered in the market at least twice in the past few weeks to support the yen. Bamba said that the Tokyo authorities may continue to work to support the yen because the long-term weakness of the yen “is becoming a troubling political issue.”

Bamba anticipates that the Bank of Japan may raise interest rates in July or October, and that the central bank will reduce the amount of purchases of Japanese treasury bonds until then. He believes that Bank of Japan Governor Ueda Kazuo's attitude towards exchange rates has clearly changed recently, which has advanced the schedule for normalizing monetary policy to a certain extent.

The Bank of Japan unexpectedly cut treasury bond purchases on Monday in an attempt to weaken its influence in the country's treasury bond market.

Other investors also believe that the Bank of Japan will boost the yen by raising interest rates. Pioneer Group expects Japan's benchmark interest rate to rise to 0.75% by the end of the year, while the current interest rate range is 0% to 0.1%. Pacific Investment Management expects the Bank of Japan to raise interest rates three times this year, 25 basis points each time.

Hedge funds, on the other hand, are betting on a further weakening of the yen. Short-term capital has begun to buy Japanese yen put options with an exercise price in the 160 to 161 range.

However, Bamba is optimistic about the Japanese stock market for a long time. He said that although macroeconomic factors such as the Arab-Israeli conflict and the hawkish rhetoric of the Federal Reserve have curtailed investors' interest in risky assets, the fundamentals of the Japanese stock market are still strong, driven by corporate reforms, domestic investment, and wage growth.