After spending 10 billion dollars, can the “big” acquisition of Shandong Gold (01787) continue to grow at a high rate?

As the Lunar New Year approaches, gold jewelry is entering a peak sales season. Although international gold prices are still high, it is impossible to stop major gold stores from ushering in a wave of consumption.

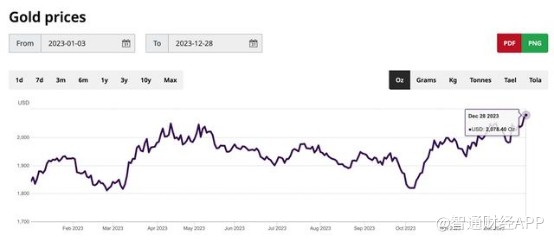

Since reaching an all-time high in early December 2023, international gold prices have only experienced a brief retracement. On January 21, international gold prices rose again to 2029 US dollars/ounce, which seems to indicate that gold will continue to be a popular investment target in the market in the new year.

Currently, most institutions are still bullish on the 2024 gold price, but CME chief economist Erik Norland (Erik Norland) also pointed out that the current gold price fully reflects expectations of interest rate cuts. If the US economy experiences a “soft landing” in the future and the Federal Reserve only cuts interest rates by 75 basis points, this may be bad for gold.

Over the past year, against the backdrop of rising gold prices, many gold concept stocks in the secondary market also “rose by hearing the news.” However, from the perspective of the diff layout, the valuation of Shandong Gold (01787), which has excellent resource endowments, is at a low level, and its excellent performance in the third quarter also attracted investors' attention.

Net profit increased in the third quarter, and mineral gold reserves ranked among the highest

According to the Zhitong Finance App, according to public information, Shandong Gold's business mainly includes the production and sale of gold mining, special equipment for gold mining, and construction decoration materials (excluding products restricted by national laws and regulations). The main products include standard gold ingots, investment gold bars and silver ingots, etc., forming a complete industrial chain integrating gold exploration, design, R&D, mining, beneficiation, refining, deep processing and sales of gold products, and mining equipment manufacturing, and has an industry-leading scientific and technological research and development system, as well as mining finance business and capital investment and financing support platforms.

Looking at the historical time dimension, after recording a net profit loss of about 200 million yuan in 2021, Shandong Gold's performance has stopped falling and rebounded. In 2022, revenue increased 48% year on year, and net profit also returned to the level of about 1.2 billion yuan; in the latest financial report, the positive trend continued, achieving revenue of 41,323 billion yuan in the first three quarters of 2023, an increase of 3.75% year on year, and net profit of 1,345 billion yuan, up 94.12% year on year, with basic earnings per share of 0.23 yuan. Among them, net profit for the third quarter was 465 million yuan, up 239.59% year on year.

The recovery in the company's performance is unquestionably linked to the rise in gold prices in recent years.

Looking back at 2023, the world gold price repeatedly reached new highs in a high interest rate environment and continued to fluctuate at a high level of 2,000 US dollars per ounce. According to data from the World Gold Council, in the first three quarters of 2023, global demand for gold remained stable and exceeded the average of the past ten years. This was mainly due to net purchases by the central bank and the development of the jewelry manufacturing industry. Factors such as interest rates, the level of inflation, geopolitical risks, the multipolarization trend of the global reserve currency system, and ESG are all the main factors driving central banks to continue to buy money in the future.

During the year, domestic gold production and sales were booming, and gold and silver jewelry became the fastest growing category among retail categories throughout the year. According to the latest statistics released by the China Gold Association, domestic raw gold production in 2023 was 375.155 tons, up 0.84% year on year; in 2023, the country's gold consumption was 1089.69 tons, an increase of 8.78% compared with the same period in 2022. The People's Bank of China increased its gold holdings by a total of 224.88 tons throughout the year. From November 2022 to December 2023, the People's Bank of China has increased its gold holdings for 14 consecutive months.

Strong gold prices have also supported the upward trend in the performance of listed companies in the gold sector. According to statistics, out of 11 gold-related listed companies that have disclosed their semi-annual reports, the net profit of 7 listed companies achieved year-on-year growth. Companies such as Shandong Gold, Yintai Gold (000975.SZ), and CICC Gold (600489.SH) had the highest net profit growth in the first half of the year.

On the one hand, the price of gold is the core variable affecting the performance of gold stocks; on the other hand, as a mineral resource stock, the valuation logic of Shandong Gold also places importance on the quantity and quality of resource reserves.

According to the Zhitong Finance App, gold resources are divided into mineral gold and smelted gold. Minerals are produced in mines and gold mines, and most of them are precipitated by hot springs gushing out of the ground through fine cracks in the rock; smelted gold requires precise smelting and extraction before it can be obtained. Although the cost of smelted gold shows a trend of decreasing year by year, it is still much higher than mineral gold, so the investment value of gold resource stocks is mainly measured by mineral gold production.

According to information, the mining enterprises under the jurisdiction of Shandong Gold are distributed in Shandong, Fujian, Inner Mongolia, Gansu, Xinjiang, etc., as well as countries such as Argentina in South America and Ghana in Africa, and have been among the top in the country for many years in terms of mineral gold processing and trading volume.

Specifically, in terms of mineral gold production, Shandong gold mine production is second only to Zijin Mining, ranking second in the industry for many years. In the first half of 2023, Shandong Gold achieved mineral gold production of 19.57 tons, second only to Zijin Mining's 32 tons, which is equivalent to 13.98% of the country's mineral gold. Jiaojia Gold Mine, Sanshandao Gold Mine, Xincheng Gold Mine, and Linglong Gold Mine owned by Shandong Gold have been on the “Top Ten Gold Production Mines in China” for many years, with cumulative production exceeding 100 tons. It is the only listed company in China with four mining companies with cumulative gold production exceeding 100 tons.

In addition to being a “golden mountain,” Shandong Gold continues to expand its resource reserves through prospecting, mergers and acquisitions, etc. In the first half of the year, the company successfully competed for mining rights at the Longnan Bridge Gold Mine in Gansu with 866 million yuan. The mining area held about 42 tons of gold metal, about 116 tons of associated silver metal, and distributed many high-quality mineral rights in the surrounding area. The future resource reserves were considerable; it completed the acquisition of control of Yintai Gold, which ranked the top ten in the domestic gold industry. After the transaction was completed, it held a total of 641 million shares of Yintai Gold, accounting for 23.099% of Yintai Gold's total share capital.

Looking ahead, the World Gold Council predicts that the central bank's gold purchases in 2024 will still exceed expectations, and gold prices will still have upward momentum; many institutions have also given bullish expectations. J.P. Morgan, HSBC, and Goldman Sachs all predict that gold prices will rise in the new year, while Fawad Razaqzada (Fawad Razaqzada), a senior analyst at Jiasheng Group, has set gold price targets for 2024 at 2,200 US dollars and 2,360 US dollars, believing that 2024 gold prices will set new records.

However, in addition to the price of gold bringing upward momentum to the company's performance, the problems of Shandong Gold's high reputation and high debt are also worth paying attention to.

Behind a series of large acquisitions, debt may become a hidden concern for the future

According to the Zhitong Finance App, the gold mining and smelting industry is a typical capital-intensive industry. Mine development and construction projects generally have the characteristics of “high budget amounts, large construction capital requirements, and long construction cycles.”

In December, Shandong Gold issued an announcement stating that it will reduce the target financing increase from 7.383 billion yuan to no more than 4.6 billion yuan, and that it plans to use all of the funds raised for the “Shandong Gold Mining (Laizhou) Co., Ltd. Jiaojia Mining Area (Integrated) Gold Resource Development Project” project. This fixed increase began in June 2022, and the initial plan is to raise no more than 9.9 billion yuan in capital.

At the same time, the company's financial situation showed the characteristics of high debt. According to the 2023 three-quarter report, as of the end of the third quarter of this year, the company's short-term loans and long-term loans reached 20.672 billion yuan and 27.762 billion yuan respectively, and the monetary capital on the account was 11.815 billion yuan. From 2020 to the end of the third quarter of 2023, the balance ratio of Shandong Gold continued to rise, at 50.43%, 59.41%, 59.55%, and 60.68%, respectively.

By the end of the third quarter of 2023, Shandong Gold's goodwill had reached 13.083 billion dollars. Higher goodwill indicates that it may face the risk of significant depreciation in the future.

Furthermore, the company's higher operating costs have also partially reduced the company's profit margin. The company's management expenses for the first three quarters of 2023 were nearly 1.8 billion yuan. The Q3 financial expenses ratio was 2.7%, and the management expenses ratio was 4.34%, all higher than competitors in the same industry.

On the evening of January 26, after spending 12.76 billion yuan to acquire Yintai Gold, Shandong Gold issued another announcement to acquire exploration and prospecting rights at a price of 10.334 billion yuan for the largest single gold mine ever discovered in China, the Xiling Village Gold Mine in Laizhou City, Shandong Province.

Considering the factors of high investment in mine development and a long cycle, this acquisition may further put pressure on the company's debt structure and put a higher test on the company's operating profitability.

Simply put, with the industry's top two resource reserves and outstanding main business, Shandong Gold is expected to benefit from rising gold prices and continue to grow in future performance. However, the company's debt pressure is high, and costs and expenses are higher than those of peers, resulting in weak profit margin indicators, which also poses a risk of uncertainty. From a market perspective, the company's stock price is currently at a historically low level, and it is expected that 2024 will usher in a certain increase.