Group Intelligence Consulting: The game between traditional car companies and new forces intensifies “going overseas” and “smart driving” as keywords

The Zhitong Finance App learned that after entering 2024, since the global economy is still in a weak recovery stage, the automobile market will show a long-term slow recovery trend after chips and production capacity are no longer factors in determining automobile sales, and the accelerated penetration of new energy vehicles will be the key to affecting changes in the industry pattern. As the market with the highest penetration rate of new energy sources in the world, the mainland China market is bound to lead the world regardless of the intensity of the competitive environment and the trend of technological upgrading, and as a result, it has become a competitive Red Sea region. During this period, both emerging new energy vehicle brands and traditional car companies will face unprecedented opportunities and challenges. “Intelligent driving” and “globalization” are key points for car companies to achieve long-term operation and brand success. That is, continuing to lay out advanced intelligent driving technology and focus on the global market will be the key to future success.

Global article: There are no chip bottlenecks, and the automobile industry is moving towards a healthy situation as inflation falls

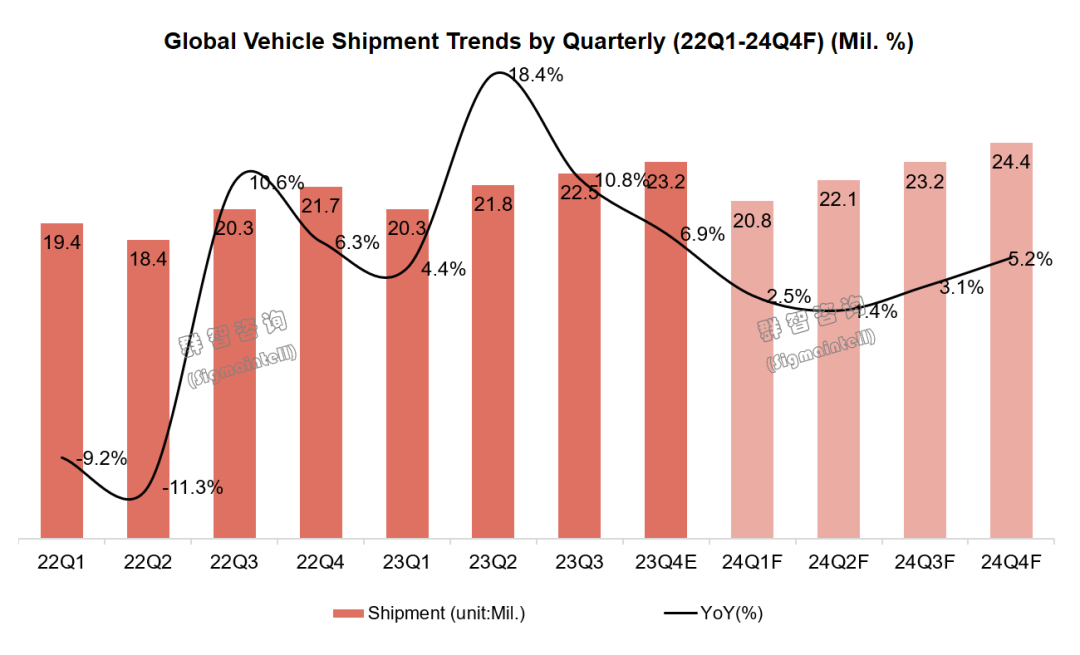

Looking at 2023, the global automobile industry has woken up from its slumber as planned. Chip supply, industry competition, etc. are gaining strength from the supply side and the demand side, respectively, leading to a huge recovery in automobile sales throughout the year. According to data from Qunzhi Consulting, global automobile shipments in 2023 were about 87.8 million units, an increase of 10% over the previous year. Judging from the quarterly trend, due to factors stemming from the re-outbreak of the global epidemic in the second quarter of 2022 and a sharp decline in automobile production with insufficient chips, the year-on-year growth rate was relatively the fastest in the second quarter of 2023, but judging from absolute month-on-month shipments, it has maintained steady growth throughout the year. It can be seen that the recovery of the automobile industry was relatively steady rather than overnight. According to Qunzhi Consulting's forecast, global automobile shipments will continue to grow steadily in 2024, but due to the high growth base in 2023, the quarterly increase will be within 5%. The annual sales volume is expected to reach 90.5 million units, an increase of about 3% over the previous year.

Mainland China section: The reshaping of the pattern intensifies, and “going out to sea” and “smart driving” become key words throughout the year

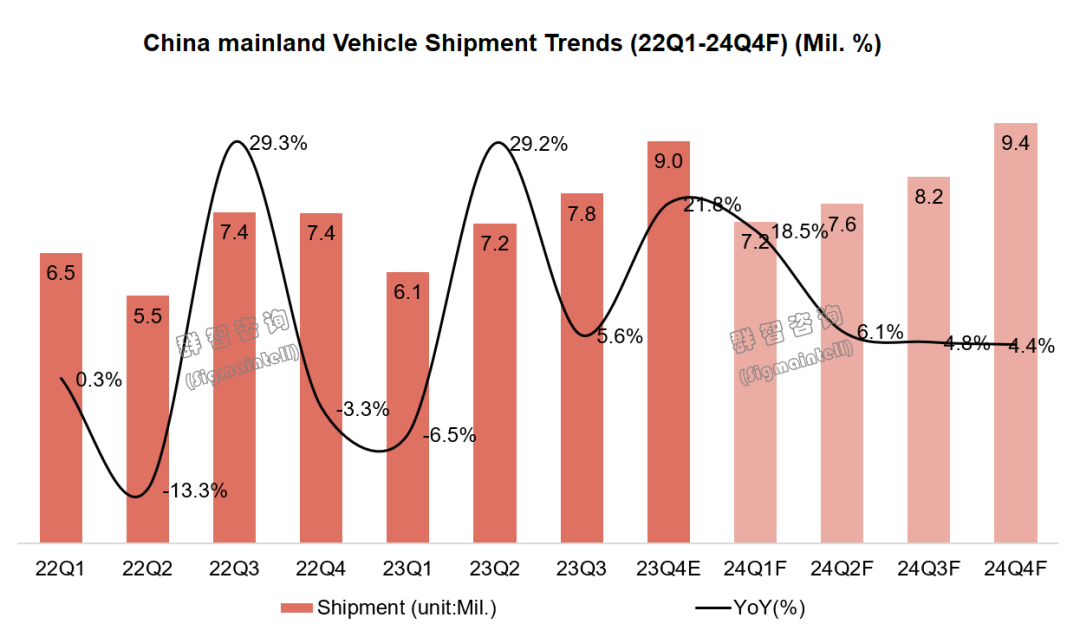

In 2023, the automobile market in mainland China experienced troughs and highs, and finally ushered in a historic peak in sales. According to statistics from Qunzhi Consulting, automobile sales in mainland China reached about 30 million units for the first time in 2023, an increase of about 12% over the previous year, reaching a record high. In the mainland China market, which continues to expand, “going overseas” and “smart driving” became important keywords after “new energy” and “independent brands” in 2023, bearing witness to the development of the Chinese automobile market. In terms of export data, exports for the full year of 2023 reached 4.91 million vehicles, an increase of 58% over the previous year. As a result, China became the number one automobile exporter in the world for the first time. According to relevant data from China Customs statistics, the export trade value of domestic automobile companies increased by nearly 50% year-on-year in 2023. In addition to the increase in sales volume, the average export price also continued to rise, and the Chinese automobile industry is moving towards the head of the global market.

In addition to exports, “smart driving” is another key keyword in 2023. According to Qunzhi Consulting data, the penetration rate of new cars equipped with L2 or higher intelligent driving functions in mainland China reached more than 70% in 2023, an increase of about 10 percentage points compared to 2022, and the penetration rate is expected to exceed 90% by 2028. With the gradual implementation of policies related to L3 autonomous driving in China, it is expected that domestic smart driving technology and safety will make a big leap forward. Qunzhi Consulting predicts that in 2024, the domestic high-end intelligent driving installation rate and automobile export rate will further increase rapidly, which will drive domestic car sales to continue to grow. It is expected that in 2024, automobile sales in mainland China will exceed 32 million units, an increase of about 8% over the previous year.

Car Companies Section: The game between traditional car companies and new forces intensifies, and the new energy circuit becomes a red sea of competition

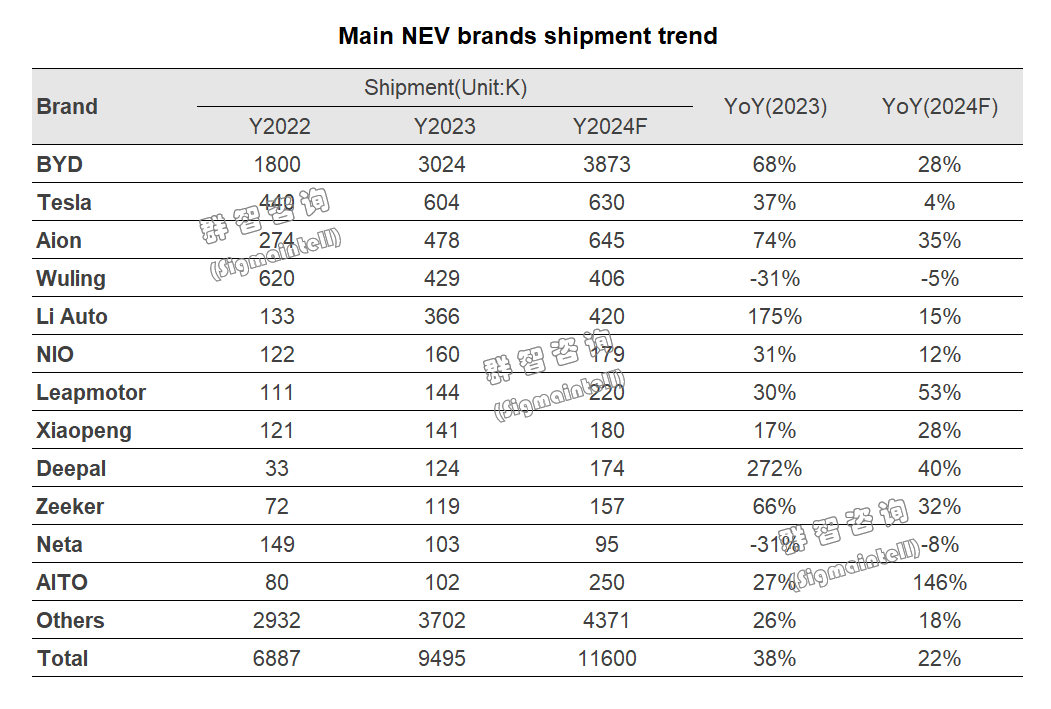

According to statistics from Qunzhi Consulting, sales of new energy vehicles in mainland China reached about 9.5 million units in 2023, an increase of 38% over the previous year, and the penetration rate reached 32%, up from about 6 percentage points in 2022. As a key game point between traditional car companies and new car companies, competition in the NEV market is also becoming more intense as it continues to grow. According to statistics from Qunzhi Consulting, among the major NEV brands (NEVs) in mainland China in 2023, BYD still topped the domestic NEV sales list with sales of 3.02 million units, followed by Tesla China, Aeon, and Ideal. In addition, many independent NEV brands also had outstanding performances.

Looking at specific manufacturers:

BYD (BYD)

BYD Auto successfully achieved its sales target in 2023, historically exceeding 3 million units, an increase of 68% over the previous year, ranking first among domestic passenger car companies and global NEV companies. Currently, the basic sales volume of BYD cars comes from the two core series Dynasty and Ocean. Furthermore, due to the strength of the Denza (Denza) brand, which has been in place for the past year, in the large-scale MPV market, it has successfully achieved a breakthrough in the brand's upward trend. With the launch and delivery of high-end brands such as Fangchengbao and Yangwang in the second half of 2023, BYD is expected to further increase its brand value. After 2024, all BYD models will fully cover the 0 to 1 million yuan range, and it will also be the first domestic independent car brand to achieve a full price range. According to Qunzhi Consulting's forecast, BYD Auto's sales volume in 2024 is expected to exceed 3.8 million units, up 28% year on year. On the one hand, the technical gap with BYD gradually narrows due to the extensive implementation of new energy vehicle racetracks by other domestic manufacturers; on the other hand, due to the increasingly competitive market environment, some brands that were not as cost-effective as BYD have also begun to implement price reduction strategies. This will have a certain impact on BYD's sales growth in 2024.

Tesla China (Tesla)

Tesla China sold about 630,000 units in mainland China in 2023, a year-on-year increase of 37%, and its position in the domestic market is still second only to BYD. However, as domestic autonomous car brands struggle to catch up with Sandian technology, intelligent driving, and smart cockpits, the technical advantages of their products have now been drastically reduced compared to other brands. Previously, their once-leading autonomous driving has also gradually been caught up and surpassed by Xiaopeng and Huawei manufacturers. Judging from the sales growth rate, with the exception of BYD, brands such as Ideal, Aeon, Extreme Krypton, and Deep Blue have all surpassed Tesla in 2023. This also lights up a dangerous signal for Tesla's market situation in China in 2024. Although its Model3/y and others have been upgraded to the HW4.0 platform one after another, the advantages of reducing production costs have not been reflected in product prices, and high cost performance is still the key to market competition in the fiercely competitive Chinese market.

According to Qunzhi Consulting's forecast, Tesla's sales volume in China in 2024 is expected to be 6.3 million units, an increase of about 4% over the previous year. Since Tesla's new pickup truck model has failed to be sold domestically, the release of the previously popular Model 2 model is also expected to be postponed. Tesla's basic sales volume in China in 2024 is still a ModelY model, but with pressure from more products such as the Xiaopeng G6 and Zhiji LS6, Tesla will once again need to consider product costs and sales prices again.

GAC Aion

In 2023, GAC Aian sold about 478,000 units in China, an increase of 74% over the previous year, ranking second among the world's pure electric brands in sales and third among new energy vehicle brands. With the advantages of relying on GAC's supply chain and the excellent passenger space and cost performance ratio of its Aions/Y models, AEON has received great recognition from consumers, and currently has a common monopoly position with BYD in the southern part of mainland China. In 2023, the development of GAC Aian achieved a qualitative breakthrough. On the one hand, the Aian brand, which is the cornerstone, has formed a stable brand reputation with popular models such as the Aion S, Aion Y, and Aion V. The products occupy a stable share of the market within 200,000 yuan with extremely high quality/price ratios, providing a foundation for GAC Aian to achieve progress.

On the other hand, the high-end development of the Haobo brand has begun to bear fruit. As the first supercar model to be mass-produced in China, the Haobo GT has received widespread attention. Furthermore, GAC Aian is actively investing in overseas markets. The first export model, the AION Y Plus, has begun to be officially launched in the Southeast Asian market. In the future, GAC Aian will gradually cover the global market, with the goal of becoming China's own “Volkswagen” or “Toyota.” Qunzhi Consulting predicts that GAC Aian's sales volume is expected to reach 645,000 units in 2024, continuing to maintain a 35% year-on-year high growth rate.

Wuling Motors (Wuling)

In 2023, Wuling NEV's domestic sales volume was about 429,000 units, down 31% year on year. As a new energy vehicle brand that began to compete at the same time as BYD in 2021, it has failed to achieve continuous growth in the past year. Currently, the main sales volume of Wuling New Energy Vehicles is still A00 class compact cars. Although larger A0 and A-class models have been launched one after another, due to competition from other manufacturers, it is difficult for Wuling, which originally had limited brand value, to achieve an upward breakthrough. Qunzhi Consulting predicts that sales of Wuling NEVs are expected to be around 406,000 units in 2024. As the low-end compact car market gradually fills up and competition increases, sales will still decline slightly year on year.

Li Auto (Ideal Car)

Ideal Auto's sales volume reached 366,000 units in 2023, up 175% year on year. Judging from the sales growth rate and main models, it is the best performing car company in the country. Ideal Auto relies on hard work on medium and large household SUV tracks. Its product concept of “car and home” enables it to thoroughly understand the needs of end users, and its automotive products are widely recognized by consumers as a result. In the past year, in the first half of the NEV circuit, Ideal Auto is already in a leading position. In the future, with the investment of more pure electric models such as the Mega and the decline in mid-range and low-end models, it is expected that it will continue to maintain its leading position in the second half of the NEV circuit in the future. However, since other manufacturers have also carried out extremely thorough research on their products and market positions, such as the layout of new models of brands such as Genjie and Zero Run, their sales growth rate will be affected to a certain extent after entering 2024, and the “price war” will still dominate the competitive pattern between brands. Qunzhi Consulting predicts that the ideal car sales volume is expected to reach 4.2 million units in 2024. The forecast is relatively conservative. The reason for this is mainly due to the rise of questioning brands and strong competition.

NIO (NIO)

NIO Auto's sales volume in 2023 was about 160,000 units, up 31% year on year. Although market performance was sluggish in the first half of 2023, with the launch of the new ES6 in the second half of the year and the price drop brought about by the divestment of power exchange rights, its annual sales picked up to a certain extent. After entering 2024, since NIO Auto has completed the iteration of all models on the NT2.0 platform, and since NIO's main brand has no new models scheduled to be delivered this year other than minor facelift, it is expected that sales will not increase significantly while maintaining the current price level of the product. However, after entering the second half of 2024, with the launch of a sub-brand equipped with the new NT3.0 platform and 800V technology, its market performance is expected to recover and stand in the first tier of domestic high-end new energy brands. Qunzhi Consulting predicts that in 2024, NIO's sales volume is expected to reach 179,000 units, an increase of 12% over the previous year. The main driving factors affecting the growth will be price strategy and the launch effect of new brands.

Leapmotor

In 2023, Zero Sports sold 144,000 units domestically, an increase of 30% over the previous year. Although there has been a slight decline in sales since the first half of the year, it is difficult for a short period of time to stop the momentum of market recovery. Entering the second half of 2023, Zero Sports has optimized the product line and cost pricing of the existing model C11/C01, leading to a significant increase in sales, and Strantis Group's acquisition of its shares has injected capital into its future development. After 2024, Zero Sports Auto's product competitiveness will be further reflected due to the release of new technology platforms based on lower costs and the successive launches of models such as the C10 and C16 with large space and high configuration. Looking at the whole of 2023, the “price war” will fill the entire automobile market, and it was Zero Sports cars that first led this trend. The brand will be a weather vane for speeding up the popularization of smart cockpits and intelligent driving in the middle and lower end markets in China. Qunzhi Consulting predicts that in 2024, the sales volume of Zero Sports cars is expected to break the 200,000 mark and reach 220,000 units, an increase of 53% over the previous year. The increase in product value will have a certain impact on manufacturers such as Ideal and Xiaopeng.

Xiaopeng Motors (Xiaopeng)

Xiaopeng Motors will sell approximately 141,000 units in 2023, up 30% year on year. Looking at the first half of the year alone, its sales volume fell to a rock bottom, and the main reason why its sales were blocked was that the pace of product release was greatly affected by poor market feedback on the G9 model released in late 2022. Coupled with the introduction of competitive models such as the L9 and L8 models during the same period, Xiaopeng Motor faced great difficulties. After entering the middle and second half of 2023, with the facelift of the P7i/G9 model and the G6's high cost performance ratio, and pioneering the launch of the 800V high-pressure quick-charging die-casting integrated platform, its sales volume picked up greatly. In particular, its XNGP autonomous driving function, which is at the leading level in China, is one of the core of its products.

After entering 2024, despite capital injection from the Volkswagen Group, in order to achieve steady growth, in addition to being able to maintain the competitiveness of its own products, Xiaopeng also needs to control various aspects such as cost and after-sales. While facing the impact of products such as wisdom and questioning the world, only by maintaining its own quality and reputation can it stabilize its position. The newly upgraded P7 model and the new G7 will be the key to Xiaopeng Motor's success. Qunzhi Consulting predicts that in 2024, with the improvement of Xiaopeng Motor's product line planning and the implementation of intelligent driving XNGP functions one after another, sales volume is expected to reach 1.8 million units, an increase of more than 50% over the previous year.

Deep Blue Car (Deepal)

Deep Blue Auto sold about 124,000 units in 2023, up 272% year on year. As a new new energy brand owned by Changan Automobile, it has quickly gained market recognition in the Chinese market due to its excellent cost performance ratio. Judging from the product layout, Deep Blue Auto is adding cars and SUV tracks at the same time, and mainly focuses on extended-range models. The strategic replication of the ideal car was very successful, and as a result, it successfully gained a foothold in the 200,000 yuan market. After entering 2024, in addition to launching two to three new models, Deep Blue will also invest more in intelligence to make up for this relative shortcoming. In terms of market layout, Deep Blue Auto also plans to enter Southeast Asia, Europe, America, Middle East and other regions one after another, with the goal of brand globalization. Qunzhi Consulting conservatively predicts that sales of Deep Blue cars will reach 174,000 units in 2024, and with the gradual success of the overseas strategy, their sales volume is expected to grow further on a domestic basis.

Zeeker

In 2023, Krypton's domestic sales volume was about 119,000 units, an increase of 66% over the previous year. As a high-end pure electric brand under Geely Automobile Group, its Zeeker001 single product models have received great success and recognition in the domestic market. Although brands such as Zeeker009/X were launched in 2023, the main sales volume still comes from 001. It can be seen that its product and market positioning advantages are obvious. After entering 2024, it is expected that the market will be further broadened as new models such as 007 are delivered to Kyokrypton Motors. In terms of overseas layout, in 2023, Jikrypton will successively land in many countries and regions, enter the European automobile market base, and take the lead in setting up the first batch of overseas offline stores in Sweden and the Netherlands. This is an important step in Gekrypton's overseas strategy. Qunzhi Consulting predicts that sales of Krypton cars are expected to reach 157,000 units in 2024, an increase of 32% over the previous year.

Neta Auto

Nacha Auto sold about 103,000 units in 2023, down 31% year on year. It is currently the only brand among the top five remaining new car companies to decline. As the ToB market is becoming more saturated, Nacha Auto's weakness in the ToC market is becoming more prominent, and models such as the Nacha S/GT that plan to achieve the brand's upward impact on the consumer market have not been successful. Looking at the whole of 2023, Nacha Auto had problems such as the chaotic pace of product replacement, high price of new products, and low marketing investment. Among them, marketing issues are the most critical to the decline in sales. Continued entry into the consumer market and brand recognition is essential for new players in the automotive industry.

2023 has already become history. If Nacha Auto wants to break out of the trough after entering 2024, it first needs to revise its product pricing strategy and product replacement strategy. The car needs to step up its marketing efforts and promote it well in the domestic market. Furthermore, overseas markets should also be actively deployed. Currently, the penetration rate of new energy vehicles in mainland China is far higher than the global average. The domestic market will become increasingly involved, and going overseas will be an important step in achieving increased sales and profits. Qunzhi Consulting predicts that domestic sales of Nacha Auto will still be difficult to grow in 2024. It is expected to reach around 95,000 units, down 8 percentage points from 2023. However, it is believed that with Nacha Auto's internal adjustments and speeding up overseas operations, it is expected that after a year, it will be possible to get out of the current difficult situation.

Q Kai Auto (AITO)

QJ Auto's sales volume in 2023 was 102,000 units, an increase of 27% over the previous year. In the first half of 2023, due to the accelerated iteration of new products in the domestic market and the impact of the “price war,” sales of QINGJIE Auto were slightly sluggish, with sales volume of only 23,000 units in the first half of 2023. However, with the update and price drop of the M5 and M7 smart driving versions, and the empowerment of Huawei's new advanced intelligent driving ADS2.0 and Hamonyos smart cockpit, Qanjie's car sales experienced a huge reversal after entering the second half of the year. Judging from the sales volume of single models, it once approached the ideal L series. After entering 2024, with the delivery of the M9 model and the iterative renewal of the M5 model, it is expected that with its excellent product strength and channels, Quanjie Auto will continue to grow in the next year in a continuous game with other manufacturers. According to Qunzhi Consulting's forecast, Qunjie Auto sales are expected to reach 250,000 units in 2024, an increase of nearly 150% over the previous year.