The Market Doesn't Like What It Sees From AE Multi Holdings Berhad's (KLSE:AEM) Revenues Yet As Shares Tumble 35%

Unfortunately for some shareholders, the AE Multi Holdings Berhad (KLSE:AEM) share price has dived 35% in the last thirty days, prolonging recent pain. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 50% loss during that time.

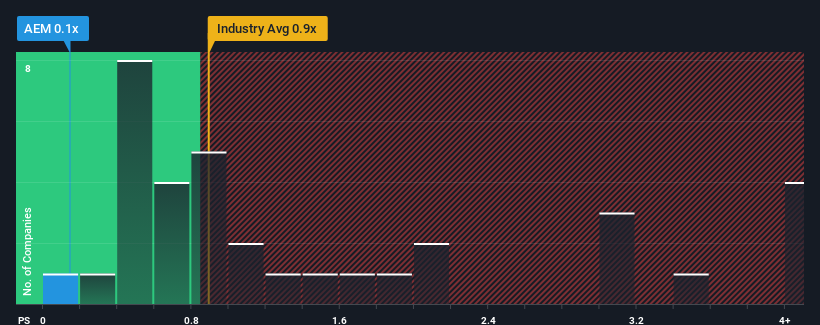

After such a large drop in price, AE Multi Holdings Berhad's price-to-sales (or "P/S") ratio of 0.1x might make it look like a buy right now compared to the Electronic industry in Malaysia, where around half of the companies have P/S ratios above 0.9x and even P/S above 3x are quite common. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for AE Multi Holdings Berhad

How Has AE Multi Holdings Berhad Performed Recently?

AE Multi Holdings Berhad has been doing a good job lately as it's been growing revenue at a solid pace. It might be that many expect the respectable revenue performance to degrade substantially, which has repressed the P/S. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Although there are no analyst estimates available for AE Multi Holdings Berhad, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Is There Any Revenue Growth Forecasted For AE Multi Holdings Berhad?

The only time you'd be truly comfortable seeing a P/S as low as AE Multi Holdings Berhad's is when the company's growth is on track to lag the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 8.4% last year. Pleasingly, revenue has also lifted 36% in aggregate from three years ago, partly thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Comparing the recent medium-term revenue trends against the industry's one-year growth forecast of 42% shows it's noticeably less attractive.

With this in consideration, it's easy to understand why AE Multi Holdings Berhad's P/S falls short of the mark set by its industry peers. It seems most investors are expecting to see the recent limited growth rates continue into the future and are only willing to pay a reduced amount for the stock.

What We Can Learn From AE Multi Holdings Berhad's P/S?

AE Multi Holdings Berhad's recently weak share price has pulled its P/S back below other Electronic companies. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

In line with expectations, AE Multi Holdings Berhad maintains its low P/S on the weakness of its recent three-year growth being lower than the wider industry forecast. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. If recent medium-term revenue trends continue, it's hard to see the share price experience a reversal of fortunes anytime soon.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with AE Multi Holdings Berhad, and understanding them should be part of your investment process.

If you're unsure about the strength of AE Multi Holdings Berhad's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal