3 Growth Companies With High Insider Ownership And 66% Earnings Growth

As global markets navigate a complex landscape marked by record highs in U.S. indices and unexpected inflationary pressures, investors are keenly observing the earnings season for insights into future economic trends. Amidst this backdrop, growth companies with high insider ownership stand out as potentially robust investments due to their alignment of interests between management and shareholders, particularly when these companies demonstrate significant earnings growth.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Lavvi Empreendimentos Imobiliários (BOVESPA:LAVV3) | 11.9% | 21.1% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 34% |

| Arctech Solar Holding (SHSE:688408) | 37.8% | 29.8% |

| Clinuvel Pharmaceuticals (ASX:CUV) | 10.4% | 27.4% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 105.8% |

| Adveritas (ASX:AV1) | 21.2% | 144.2% |

| Plenti Group (ASX:PLT) | 12.8% | 106.4% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.4% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 14.0% | 95% |

| UTI (KOSDAQ:A179900) | 33.1% | 134.6% |

Let's dive into some prime choices out of the screener.

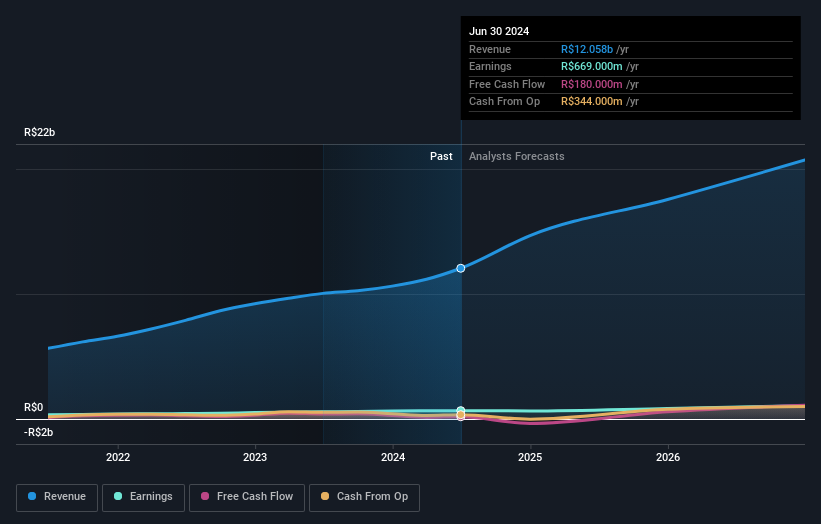

GPS Participações e Empreendimentos (BOVESPA:GGPS3)

Simply Wall St Growth Rating: ★★★★★☆

Overview: GPS Participações e Empreendimentos S.A. operates in Brazil, offering a range of services including facilities management, security, logistics, utility engineering, industrial services, catering, and infrastructure support with a market cap of R$12.63 billion.

Operations: The company generates revenue through its diverse service offerings in facilities, security, logistics, utility engineering, industrial services, catering, and infrastructure support across Brazil.

Insider Ownership: 24%

Earnings Growth Forecast: 19.9% p.a.

GPS Participações e Empreendimentos shows potential for growth with a forecasted annual profit increase of 19.9%, outpacing the Brazilian market's average. Recently added to the Brazil IBRX Index, it reported a net income rise to BRL 138 million for Q2 2024. The company's revenue is expected to grow at 20.8% annually, surpassing market expectations, while its price-to-earnings ratio of 18.9x suggests it is valued below industry averages despite some concerns about debt coverage by operating cash flow.

- Click here and access our complete growth analysis report to understand the dynamics of GPS Participações e Empreendimentos.

- Our valuation report here indicates GPS Participações e Empreendimentos may be undervalued.

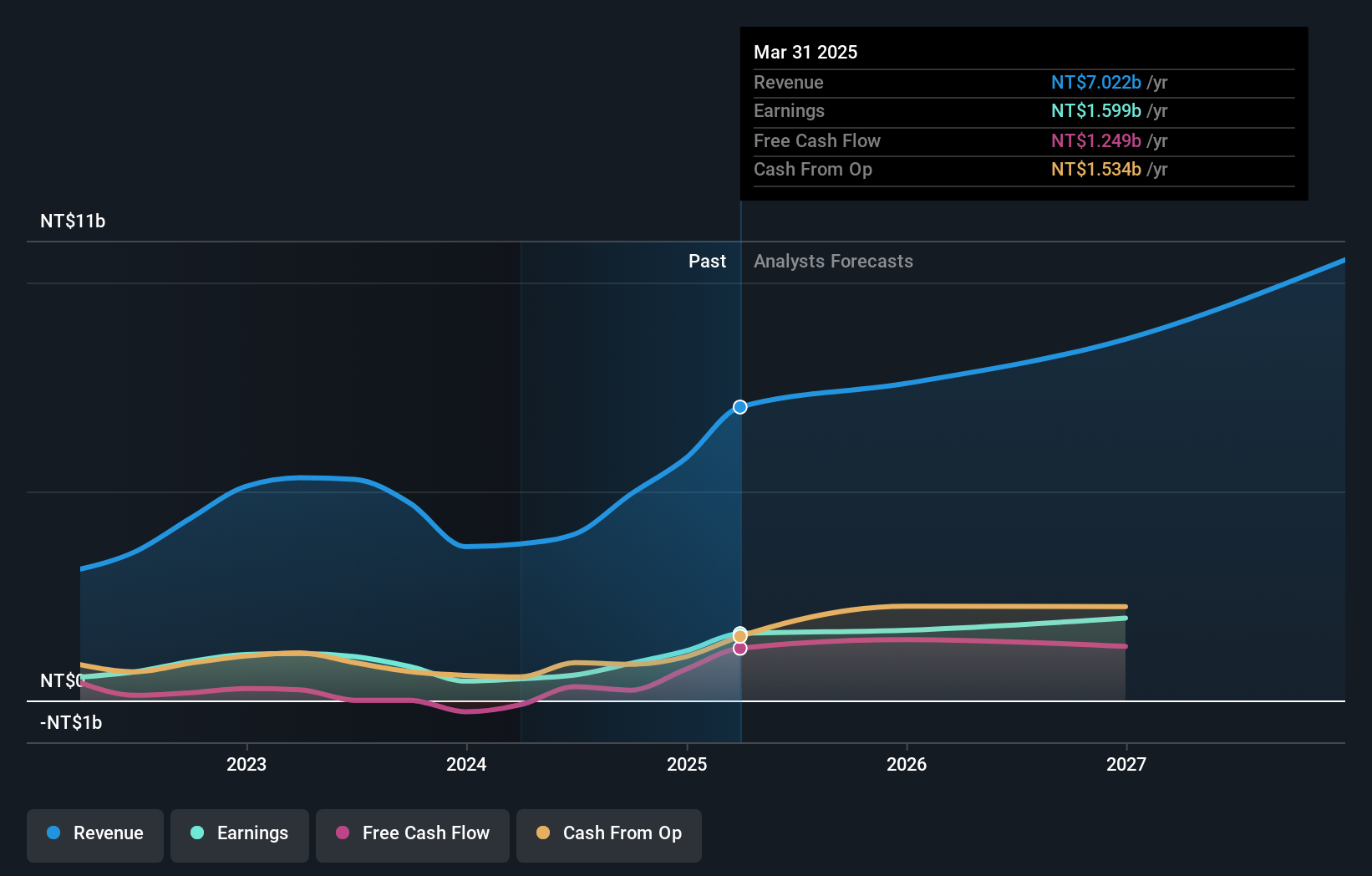

WinWay Technology (TWSE:6515)

Simply Wall St Growth Rating: ★★★★★☆

Overview: WinWay Technology Co., Ltd. designs, processes, and sells optoelectronic product test fixtures and integrated circuit test interfaces globally, with a market cap of NT$43.46 billion.

Operations: The company generates revenue from the manufacture and sales of photoelectric product testing tools, amounting to NT$3.99 billion.

Insider Ownership: 22.9%

Earnings Growth Forecast: 66.4% p.a.

WinWay Technology is poised for significant growth, with earnings projected to increase 66.44% annually, far exceeding the Taiwan market average. Despite legal challenges involving trade secret lawsuits that have not significantly impacted financials, the company reported strong Q2 2024 results with net income rising to TWD 224.12 million from TWD 135.69 million a year prior. Trading below its fair value estimate and boasting high revenue growth forecasts of 46.3%, WinWay remains an intriguing prospect for investors focused on growth companies with substantial insider ownership.

- Dive into the specifics of WinWay Technology here with our thorough growth forecast report.

- Our expertly prepared valuation report WinWay Technology implies its share price may be too high.

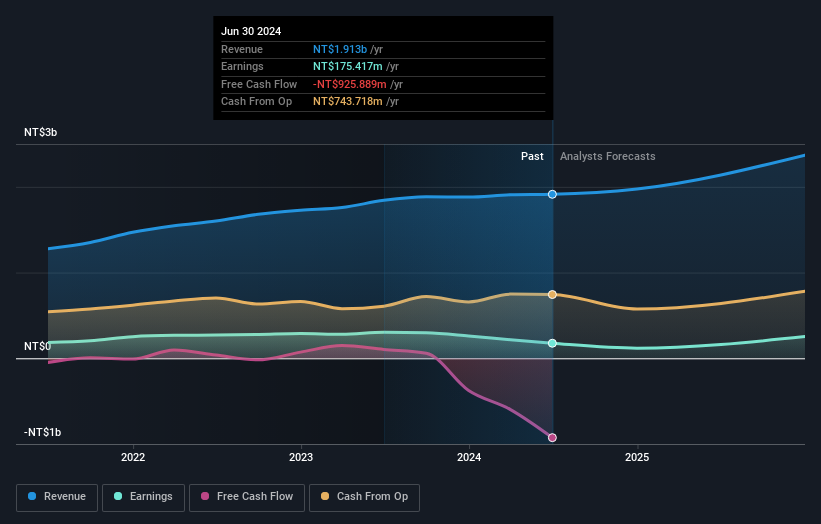

Msscorps (TWSE:6830)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Msscorps Co., Ltd. specializes in the testing and analysis of electronic materials across Asia, the United States, and international markets, with a market cap of NT$11.03 billion.

Operations: The company generates revenue primarily from its Testing and Analysis Service, amounting to NT$1.91 billion.

Insider Ownership: 10.9%

Earnings Growth Forecast: 34.8% p.a.

Msscorps is experiencing challenges despite projected earnings growth of 34.8% annually, surpassing Taiwan's market average. Recent financials indicate a decline, with Q2 net income at TWD 40.74 million compared to TWD 81.16 million the previous year, and EPS halving to TWD 0.87. Revenue growth forecasts of 15.2% are modestly above market expectations but fall short of high-growth benchmarks. Insider ownership remains significant, although recent board changes may impact strategic direction.

- Get an in-depth perspective on Msscorps' performance by reading our analyst estimates report here.

- Our comprehensive valuation report raises the possibility that Msscorps is priced higher than what may be justified by its financials.

Key Takeaways

- Take a closer look at our Fast Growing Companies With High Insider Ownership list of 1483 companies by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal