High Insider Ownership Growth Stocks On The Swedish Exchange For October 2024

As global markets navigate a complex landscape marked by fluctuating economic indicators and shifting policy expectations, the Swedish market remains an area of interest for investors seeking growth opportunities. In this environment, companies with high insider ownership often attract attention due to their potential alignment of interests between management and shareholders, which can be particularly appealing amidst ongoing economic uncertainties.

Top 10 Growth Companies With High Insider Ownership In Sweden

| Name | Insider Ownership | Earnings Growth |

| CTT Systems (OM:CTT) | 16.9% | 24.8% |

| Truecaller (OM:TRUE B) | 29.7% | 21.7% |

| Magle Chemoswed Holding (OM:MAGLE) | 14.9% | 72.2% |

| Biovica International (OM:BIOVIC B) | 18.3% | 78.5% |

| BioArctic (OM:BIOA B) | 34% | 98.4% |

| Yubico (OM:YUBICO) | 37.5% | 42.2% |

| InCoax Networks (OM:INCOAX) | 20.1% | 115.5% |

| KebNi (OM:KEBNI B) | 36.3% | 86.1% |

| C-Rad (OM:CRAD B) | 16.1% | 34% |

| OrganoClick (OM:ORGC) | 23.1% | 109.0% |

We'll examine a selection from our screener results.

NOTE (OM:NOTE)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: NOTE AB (publ) offers electronics manufacturing services across Sweden, Finland, the United Kingdom, Bulgaria, Estonia, China, and other international markets with a market cap of SEK3.76 billion.

Operations: The company's revenue segments include SEK988.44 million from the Rest of World and SEK3.02 billion from Western Europe.

Insider Ownership: 27.4%

Earnings Growth Forecast: 20% p.a.

NOTE AB is trading at a good value, 28.2% below its estimated fair value, and shows promising growth prospects with earnings expected to grow significantly at 20% annually, outpacing the Swedish market. Despite recent declines in sales and net income for Q3 2024, NOTE's revenue growth forecast of 11.6% surpasses the broader market's 1.2%. However, there has been significant insider selling recently, which may warrant investor attention.

- Dive into the specifics of NOTE here with our thorough growth forecast report.

- The analysis detailed in our NOTE valuation report hints at an deflated share price compared to its estimated value.

Sectra (OM:SECT B)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Sectra AB (publ) operates in the medical IT and cybersecurity sectors across Sweden, the United Kingdom, the Netherlands, and other parts of Europe with a market cap of SEK55.95 billion.

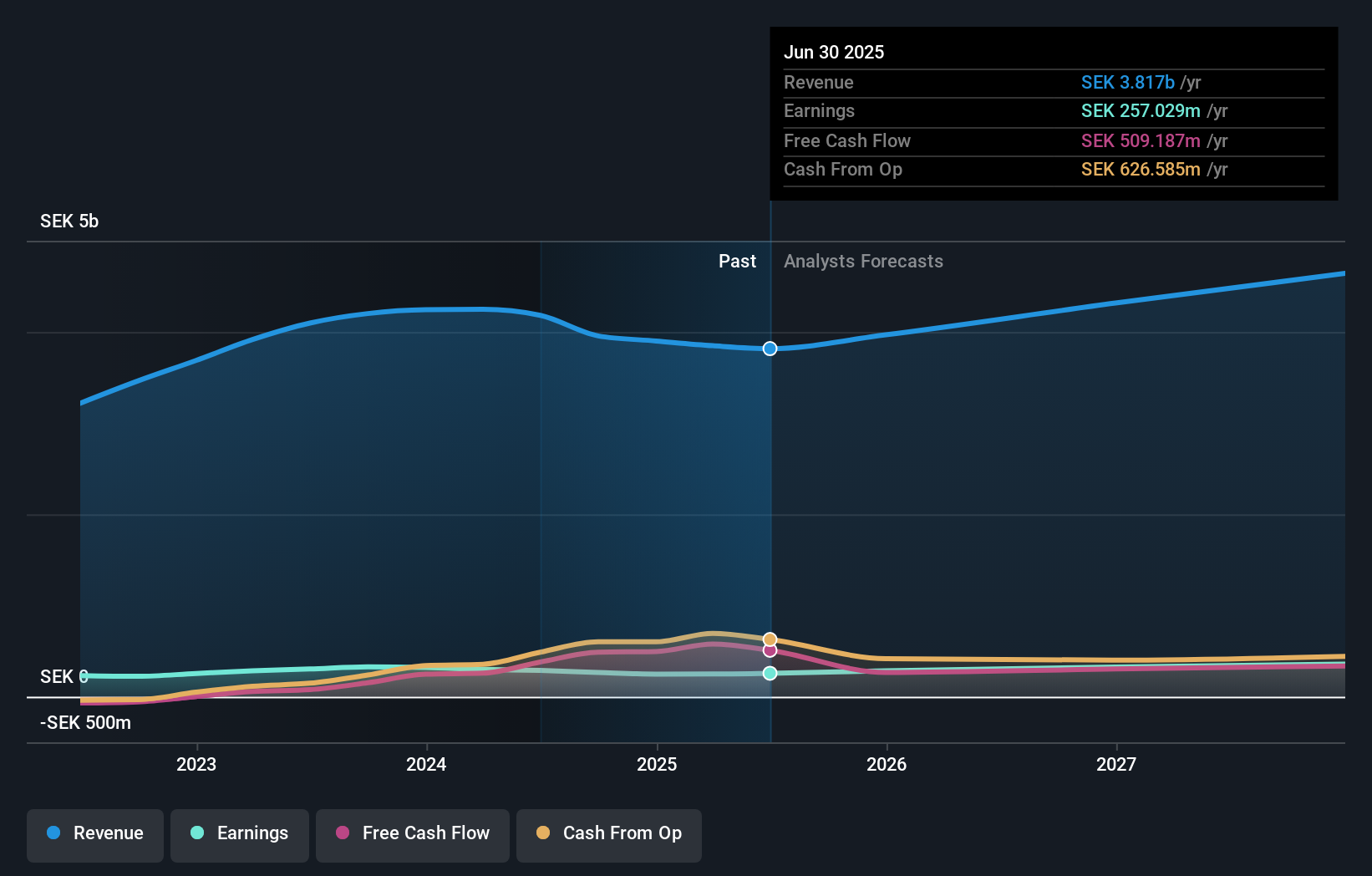

Operations: The company's revenue is primarily derived from its Imaging IT Solutions segment, which accounts for SEK2.67 billion, followed by Secure Communications at SEK388.55 million and Business Innovation at SEK90.77 million.

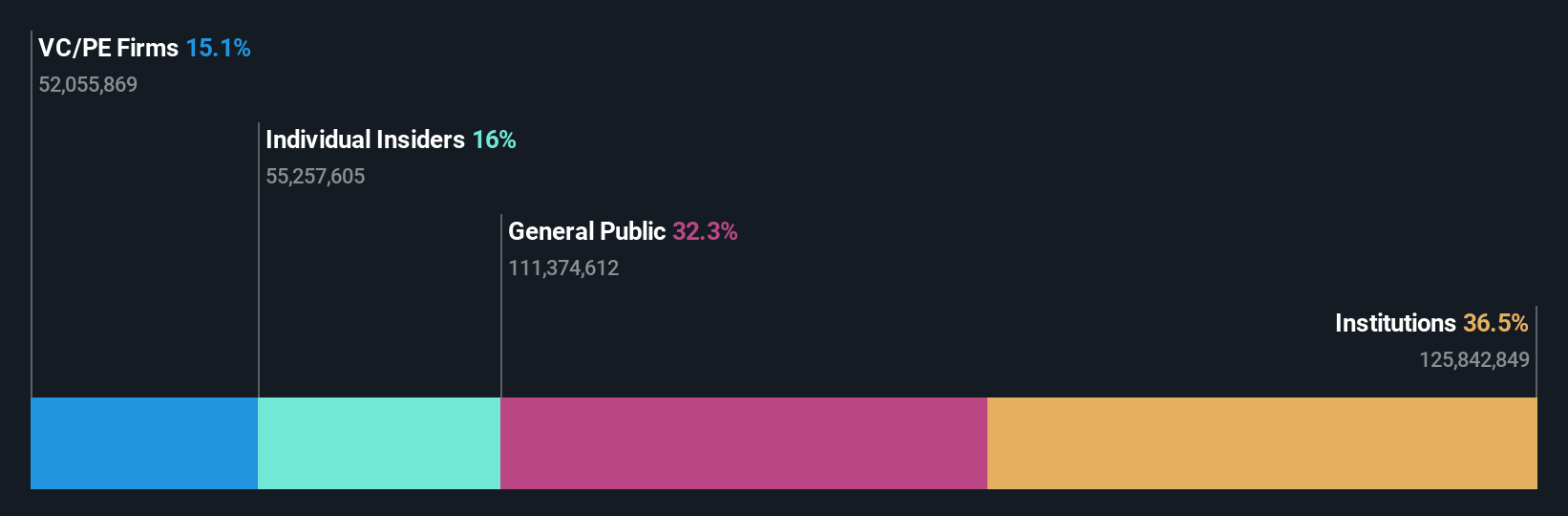

Insider Ownership: 30.3%

Earnings Growth Forecast: 21.2% p.a.

Sectra exhibits strong growth potential, with earnings forecasted to grow 21.2% annually, outpacing the Swedish market's 15.3%. Recent earnings results show revenue of SEK 739.48 million and net income of SEK 80.4 million for Q1 2024, reflecting positive momentum. Despite limited insider buying recently, Sectra's strategic expansion into cloud services with MaineGeneral Health highlights its innovative approach in healthcare IT solutions, potentially enhancing its competitive edge and scalability in the industry.

- Delve into the full analysis future growth report here for a deeper understanding of Sectra.

- Our valuation report here indicates Sectra may be overvalued.

Truecaller (OM:TRUE B)

Simply Wall St Growth Rating: ★★★★★★

Overview: Truecaller AB (publ) develops and publishes mobile caller ID applications for individuals and businesses across India, the Middle East, Africa, and internationally, with a market cap of approximately SEK15.63 billion.

Operations: The company generates revenue primarily from its Communications Software segment, amounting to SEK1.72 billion.

Insider Ownership: 29.7%

Earnings Growth Forecast: 21.7% p.a.

Truecaller demonstrates significant growth potential, with earnings projected to rise 21.7% annually, surpassing the Swedish market's average. Despite a decline in recent quarterly earnings to SEK 123.01 million from SEK 205.95 million last year, the company is trading at a substantial discount to its estimated fair value and has seen more insider buying than selling recently. The strategic partnership with Halan enhances Truecaller's position in secure communication solutions, potentially driving future revenue growth of over 20% annually.

- Take a closer look at Truecaller's potential here in our earnings growth report.

- In light of our recent valuation report, it seems possible that Truecaller is trading behind its estimated value.

Turning Ideas Into Actions

- Navigate through the entire inventory of 80 Fast Growing Swedish Companies With High Insider Ownership here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal