Will the “frenzy” of US stocks finally cool down? Agency warns: it could plummet 26% next year

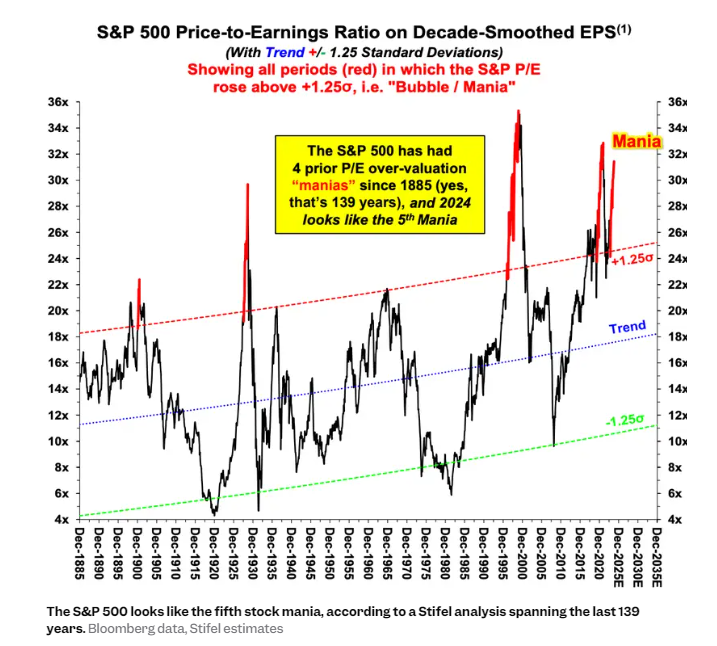

Stifel said the S&P 500 appears to be in the midst of another “frenzy,” and investors may see the benchmark index fall sharply sometime next year.

The investment company's strategist pointed out that against the backdrop of improved economic prospects, expectations of interest rate cuts by the Federal Reserve, and artificial intelligence speculation, the S&P 500 index broke through a series of record highs this year.

However, the company said that the current state of the benchmark index looks similar to the four “frenzy” that occurred in the past, and compared the current investment environment to the stock market boom of the 1920s and the internet bubble of the late 19th century.

The company added that the “overvalued” growth returns in the market today look “almost exactly the same” as they were before the 1929 stock market crash.

“We took a close look at the stock market and felt that the situation was not good.” The strategists said in a report on Tuesday: “Despite optimism surrounding a soft landing and the Fed's interest rate cut, the S&P 500 index's rise of nearly 40% year over year is already too high.”

The strategist said that if the S&P 500 follows the “classic frenzy” path, this means that the benchmark index will rebound to around 6,400 points and then fall back to 4,750 points next year.

“Of course, we can pick the best examples and adjust the valuation level by applying the most severely overestimated cycle of the past 35 years. The results showed room for further growth of about 10%. But the same analysis of the “frenzy” of the past century shows that in 2025 the S&P 500 index will also return to where it began in 2024 (down 26% from the expected peak),” the report added.

The strategists said that the stock market may face challenges next year due to uncertain prospects for the Fed to cut interest rates. Although the Federal Reserve has hinted that it will cut interest rates even more, if it cuts interest rates too soon, it may damage its inflation target.

“The conclusion is... If the Federal Reserve cuts interest rates next year without a recession (not counting the two 25 basis points for the rest of the year), then this would be a mistake, and according to historical precedents, investors will pay the price in the second half of 2025/2026,” the strategist wrote.

They added that investors may be affected in the long term, and pointed out that past “carnivals” usually lead to weak returns in the stock market over the next 10 years.

“Or let's say it's been like this for at least the past three generations. This' carnival 'is no less destructive when the capital market falls than it boosts when it rises,” they said.

Other Wall Street forecasters also said that the stock market is overvalued, but investors are generally optimistic about the outlook for the stock market, especially when they expect the Federal Reserve to cut interest rates even more in 2025.

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal