3 KRX Dividend Stocks Yielding Up To 5.7%

Over the last 7 days, the South Korean market has seen a 1.1% rise, contributing to a 4.9% increase over the past year, with earnings projected to grow by 30% annually. In this context of upward momentum and promising growth forecasts, identifying dividend stocks that offer attractive yields can be an effective strategy for investors seeking steady income streams alongside potential capital appreciation.

Top 10 Dividend Stocks In South Korea

| Name | Dividend Yield | Dividend Rating |

| Kia (KOSE:A000270) | 5.73% | ★★★★★★ |

| Kangwon Land (KOSE:A035250) | 5.56% | ★★★★★☆ |

| Woori Financial Group (KOSE:A316140) | 4.37% | ★★★★★☆ |

| HANYANG ENGLtd (KOSDAQ:A045100) | 3.54% | ★★★★★☆ |

| KT (KOSE:A030200) | 4.68% | ★★★★★☆ |

| JW Holdings (KOSE:A096760) | 3.35% | ★★★★★☆ |

| Industrial Bank of Korea (KOSE:A024110) | 6.78% | ★★★★★☆ |

| Kyung Nong (KOSE:A002100) | 7.10% | ★★★★★☆ |

| ORION Holdings (KOSE:A001800) | 4.70% | ★★★★★☆ |

| Samsung Fire & Marine Insurance (KOSE:A000810) | 4.54% | ★★★★★☆ |

Click here to see the full list of 73 stocks from our Top KRX Dividend Stocks screener.

We'll examine a selection from our screener results.

Asia Paper Manufacturing (KOSE:A002310)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Asia Paper Manufacturing Co., Ltd specializes in the production and sale of specialized industrial paper in South Korea, with a market cap of ₩344.46 billion.

Operations: Asia Paper Manufacturing Co., Ltd generates its revenue through the production and sale of specialized industrial paper in South Korea.

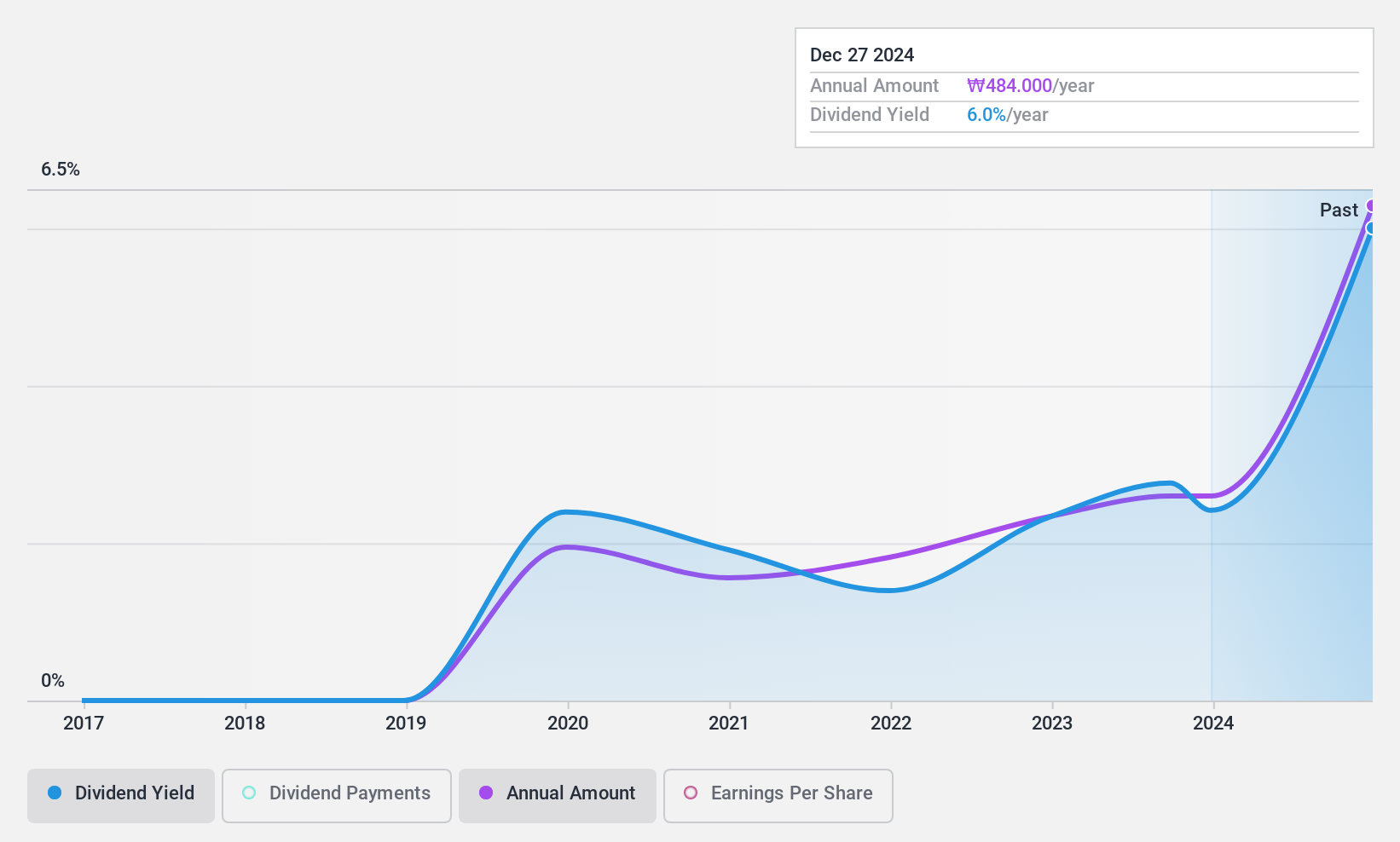

Dividend Yield: 5.7%

Asia Paper Manufacturing faces challenges with a volatile dividend history over the past five years, though its current dividend yield of 5.71% ranks in the top 25% of South Korea's market. Despite this volatility, dividends are covered by earnings and cash flows, with payout ratios at 33.6% and 74.5%, respectively. Recent earnings show decreased net income despite increased sales, highlighting potential pressures on future dividend stability amidst fluctuating profits and basic EPS declines from KRW 562 to KRW 237 year-over-year in Q2.

- Get an in-depth perspective on Asia Paper Manufacturing's performance by reading our dividend report here.

- The valuation report we've compiled suggests that Asia Paper Manufacturing's current price could be inflated.

KT (KOSE:A030200)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: KT Corporation offers integrated telecommunications and platform services both in Korea and internationally, with a market cap of ₩10.50 trillion.

Operations: KT Corporation's revenue segments include ICT services generating ₩18.84 trillion, finance contributing ₩3.66 trillion, real estate bringing in ₩534.64 million, and satellite broadcasting at ₩708.98 million.

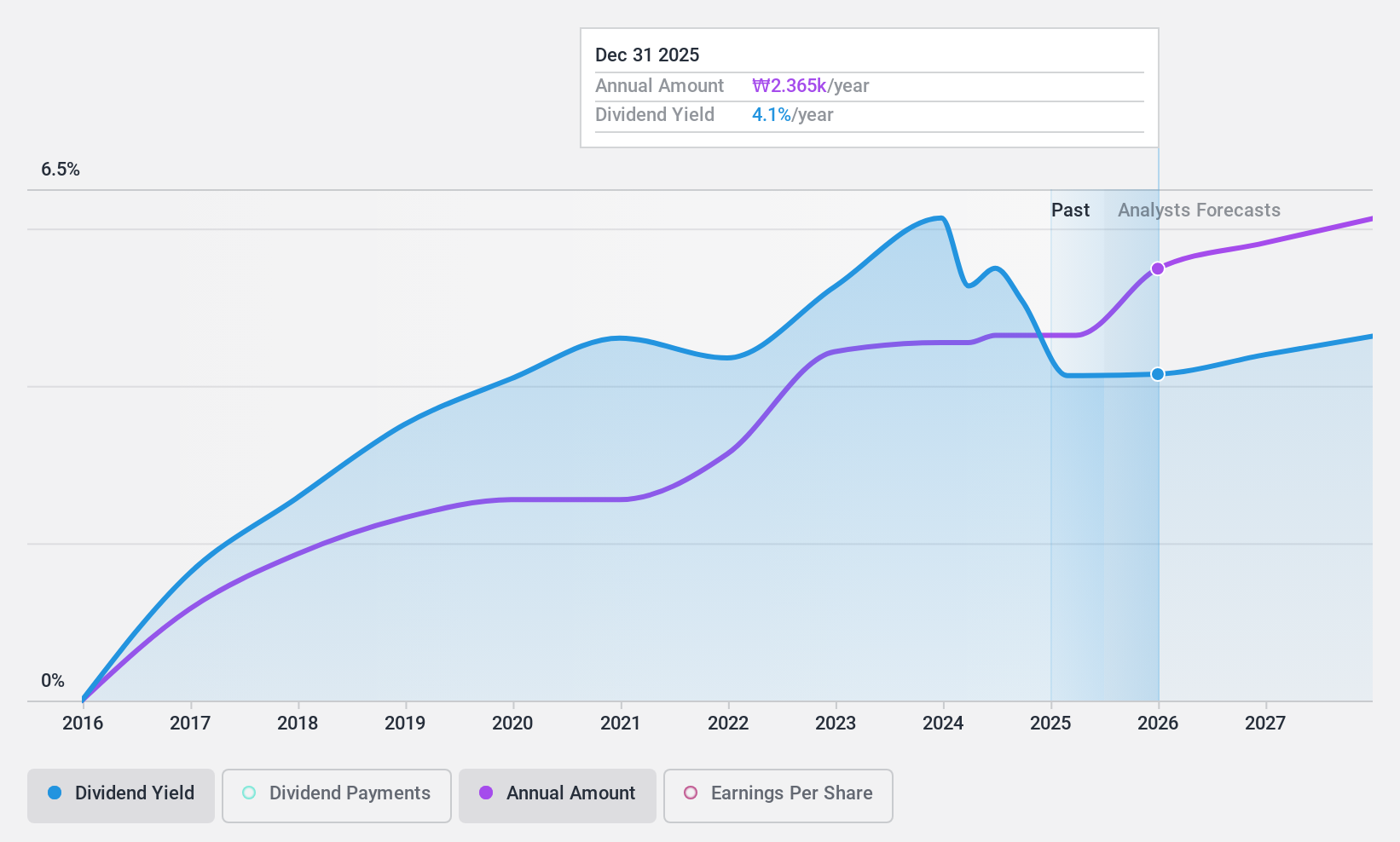

Dividend Yield: 4.7%

KT Corporation's dividend payments have been volatile over the past decade, yet they remain covered by earnings and cash flows, with payout ratios of 68.1% and 19.6%, respectively. Recent affirmations include a KRW 500 per share dividend approved on October 15, 2024. Trading at good value compared to peers, KT's strategic partnership with Microsoft aims to bolster AI and cloud capabilities, potentially supporting future revenue growth amidst a competitive market landscape.

- Click here and access our complete dividend analysis report to understand the dynamics of KT.

- The analysis detailed in our KT valuation report hints at an deflated share price compared to its estimated value.

Samyang (KOSE:A145990)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Samyang Corporation operates in the chemicals and food industries across Korea, China, Japan, the rest of Asia, Europe, and internationally with a market cap of ₩515.05 billion.

Operations: Samyang Corporation's revenue is primarily derived from its Food segment, contributing ₩1.60 trillion, and its Chemicals segment, contributing ₩1.11 trillion.

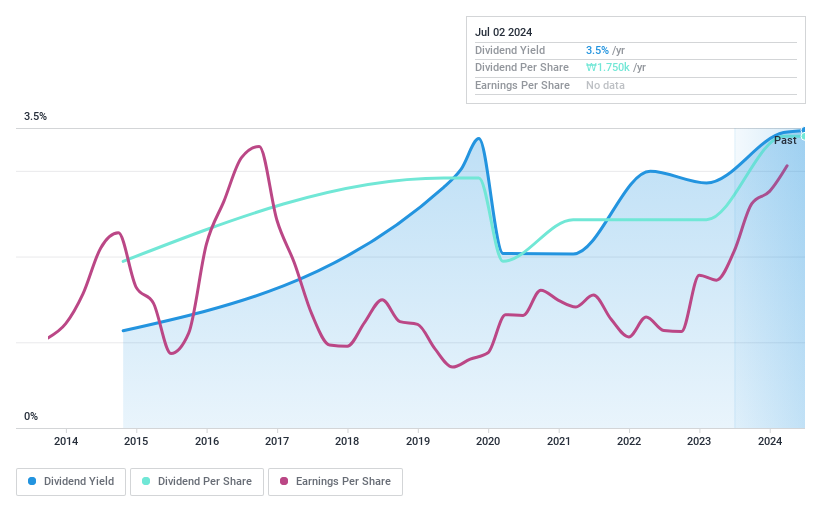

Dividend Yield: 3.4%

Samyang Corporation's dividends are well-covered by earnings and cash flows, with low payout ratios of 14.5% and 18.7%, respectively, although they have been unreliable over the past decade due to volatility. Despite a lower yield of 3.36% compared to top dividend payers in South Korea, recent business expansions like the KRW 140 billion allulose plant could enhance revenue streams and market reach, potentially stabilizing future dividend payments amidst growth in North America and Asia.

- Delve into the full analysis dividend report here for a deeper understanding of Samyang.

- According our valuation report, there's an indication that Samyang's share price might be on the cheaper side.

Next Steps

- Unlock our comprehensive list of 73 Top KRX Dividend Stocks by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal