Insider Buying Highlights 3 Undervalued Small Caps In Canada

The Canadian market has shown a positive trajectory, climbing by 1.4% over the past week and achieving a 22% increase over the last year, with earnings forecasted to grow by 15% annually. In this optimistic environment, identifying stocks that are potentially undervalued can be crucial for investors looking to capitalize on growth opportunities, particularly when insider buying suggests confidence in these small-cap companies.

Top 10 Undervalued Small Caps With Insider Buying In Canada

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Trican Well Service | 7.1x | 0.9x | 20.00% | ★★★★★★ |

| First National Financial | 10.4x | 3.3x | 49.90% | ★★★★★☆ |

| Spartan Delta | 4.3x | 2.2x | 38.27% | ★★★★★☆ |

| AutoCanada | NA | 0.1x | 39.73% | ★★★★★☆ |

| Nexus Industrial REIT | 3.7x | 3.7x | 17.05% | ★★★★☆☆ |

| Rogers Sugar | 15.6x | 0.6x | 47.63% | ★★★★☆☆ |

| Primaris Real Estate Investment Trust | 12.9x | 3.4x | 44.44% | ★★★★☆☆ |

| Sagicor Financial | 1.3x | 0.3x | -43.45% | ★★★★☆☆ |

| Calfrac Well Services | 2.5x | 0.2x | 18.51% | ★★★★☆☆ |

| Vermilion Energy | NA | 1.1x | -3.98% | ★★★☆☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

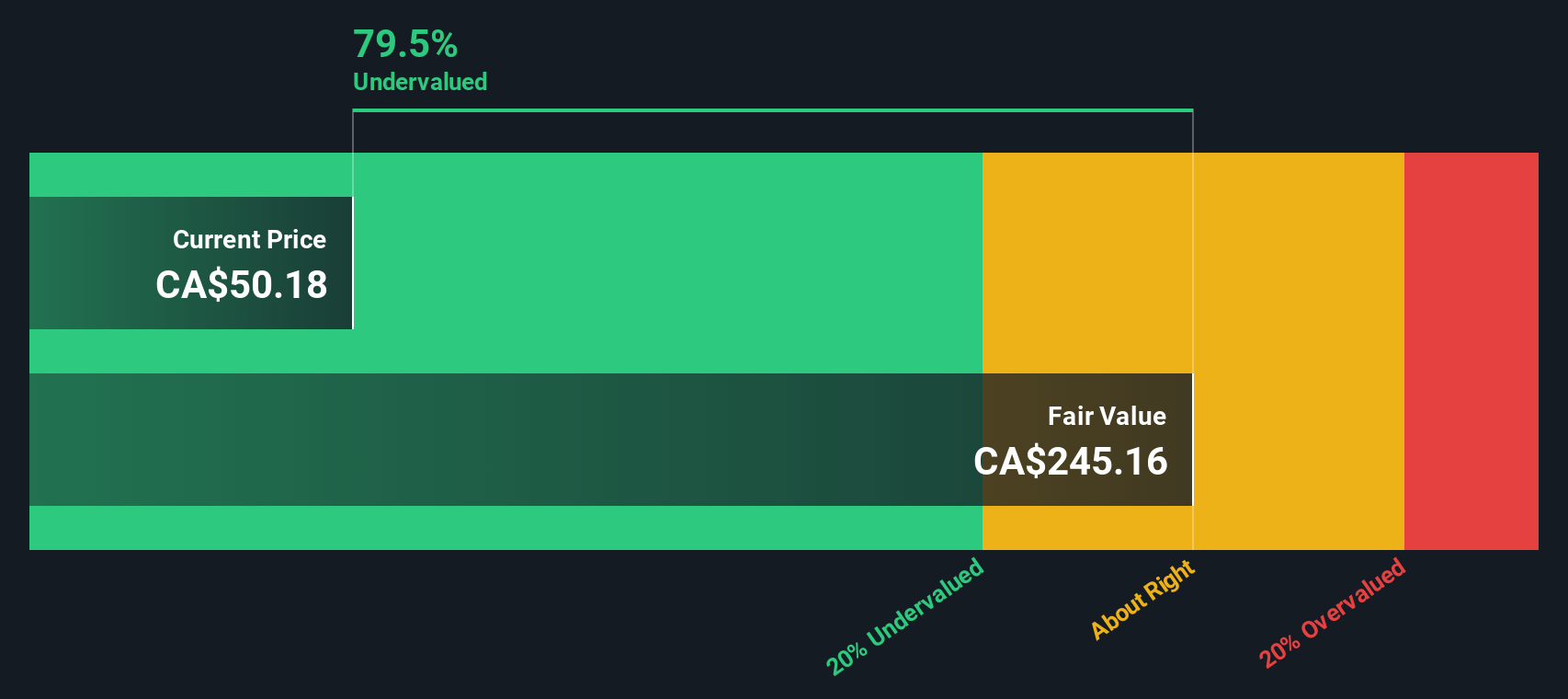

Badger Infrastructure Solutions (TSX:BDGI)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Badger Infrastructure Solutions provides non-destructive excavating services and has a market cap of approximately CA$1.27 billion.

Operations: Badger Infrastructure Solutions generates revenue primarily from its non-destructive excavating services, with a recent gross profit margin of 28.29%. The company's cost structure includes significant components such as operating expenses and depreciation & amortization, which have been consistently impacting its net income margins.

PE: 24.6x

Badger Infrastructure Solutions, a Canadian small-cap company, recently reported increased sales of US$186.84 million for Q2 2024, up from US$171.89 million the previous year, with net income rising to US$11.91 million. Despite its high debt levels and reliance on external borrowing—considered riskier than customer deposits—the company's earnings are projected to grow at an annual rate of 36%. Insider confidence is evident through recent share purchases in July 2024, suggesting potential growth opportunities ahead.

Calian Group (TSX:CGY)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Calian Group is a diversified company operating in IT and cyber solutions, health services, learning systems, and advanced technologies with a market cap of CA$0.84 billion.

Operations: The company generates revenue across four primary segments: ITCS, Health, Learning, and Advanced Technologies. Over recent periods, the gross profit margin has shown an upward trend, reaching 33.17% in June 2024. Operating expenses are a significant component of costs and have been increasing alongside revenue growth.

PE: 35.4x

Calian Group, a Canadian company with a market cap under C$1 billion, is gaining traction through strategic partnerships and innovative projects. Their collaboration with Walmart Canada to enhance pharmacy capabilities via the Nexi platform and an alliance with Microsoft for cybersecurity services underscore their growth potential. Despite a dip in net income to C$1.3 million for Q3 2024 from C$4.67 million the previous year, insider confidence remains strong as evidenced by share repurchase plans targeting nearly 8% of outstanding shares by August 2025. These initiatives position Calian well in healthcare and cybersecurity sectors while addressing funding risks associated with external borrowing.

- Unlock comprehensive insights into our analysis of Calian Group stock in this valuation report.

Assess Calian Group's past performance with our detailed historical performance reports.

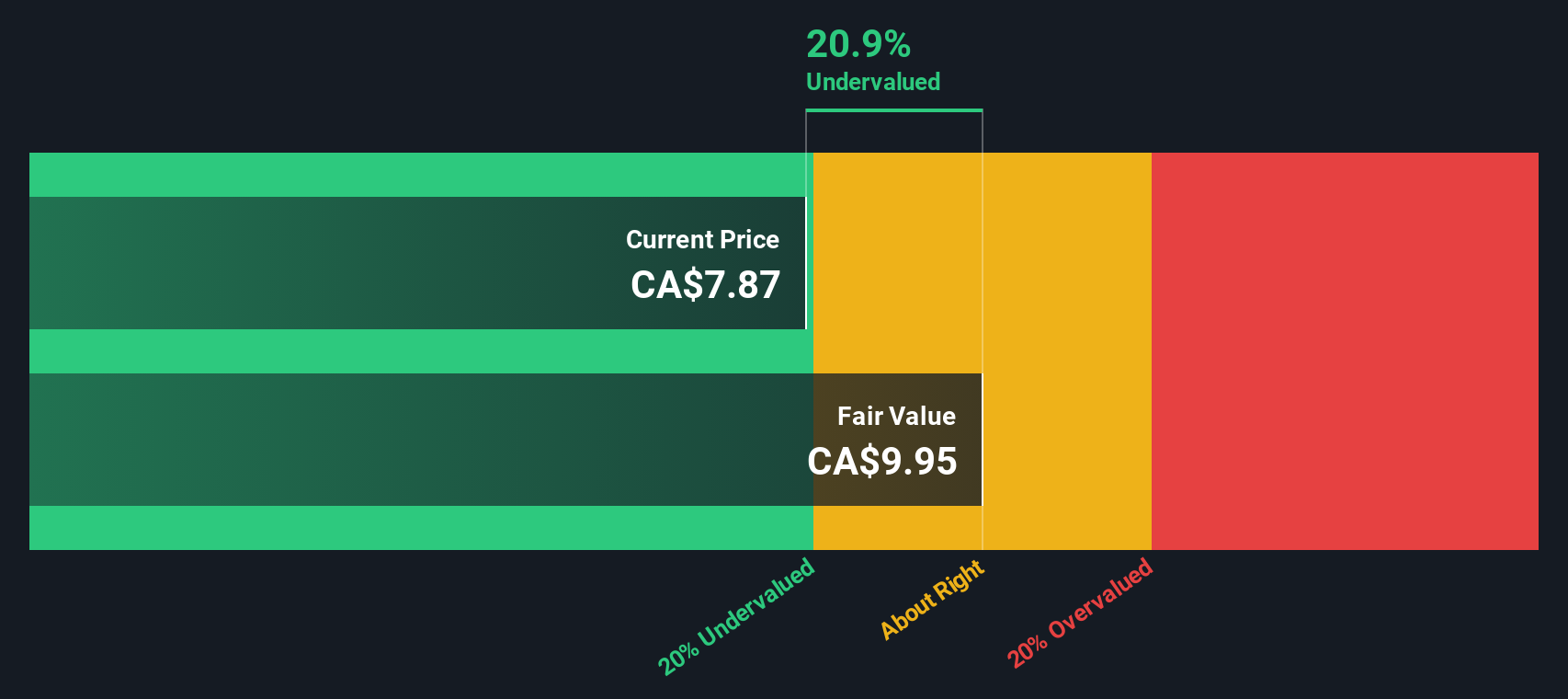

Nexus Industrial REIT (TSX:NXR.UN)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Nexus Industrial REIT focuses on owning and managing a diversified portfolio of industrial properties, with a market capitalization of approximately CA$1.21 billion.

Operations: Nexus Industrial REIT's revenue primarily comes from investment properties, with a recent figure of CA$167.21 million. The cost of goods sold (COGS) is reported at CA$47.55 million, leading to a gross profit of CA$119.66 million and a gross profit margin of 71.56%. Operating expenses are noted at CA$8.65 million, while non-operating expenses stand at -CA$55.27 million, contributing to net income figures that occasionally exceed the revenue due to substantial non-operating gains or adjustments in certain periods.

PE: 3.7x

Nexus Industrial REIT, a Canadian small-cap stock, recently appointed Mary Vitug to its Board of Trustees, bringing over 30 years of capital markets expertise. Despite earnings forecasted to decline by 41.1% annually over the next three years, Nexus has maintained consistent cash distributions at C$0.05333 per unit monthly. While interest payments aren't well-covered by earnings and funding relies solely on external borrowing, insider confidence remains high with recent share purchases indicating potential value recognition in the industrial real estate sector.

Seize The Opportunity

- Click through to start exploring the rest of the 18 Undervalued TSX Small Caps With Insider Buying now.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal