Atlas Honda And 3 Hidden Gems From None With Promising Potential

As global markets reach new highs, driven by robust earnings reports and a dynamic economic landscape, the spotlight is shifting towards small-cap stocks that may hold untapped potential. In this environment of cautious optimism, identifying stocks with strong fundamentals and growth opportunities becomes crucial for investors seeking to uncover hidden gems in an evolving market.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Thai Steel Cable | NA | 1.27% | 13.99% | ★★★★★★ |

| PSC | 17.90% | 2.07% | 13.38% | ★★★★★★ |

| Otec | 9.81% | 2.32% | -1.39% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Thai Energy Storage Technology | 11.21% | -1.12% | 0.18% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Invest Bank | 136.48% | 9.65% | 16.63% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Atlas Honda (KASE:ATLH)

Simply Wall St Value Rating: ★★★★★★

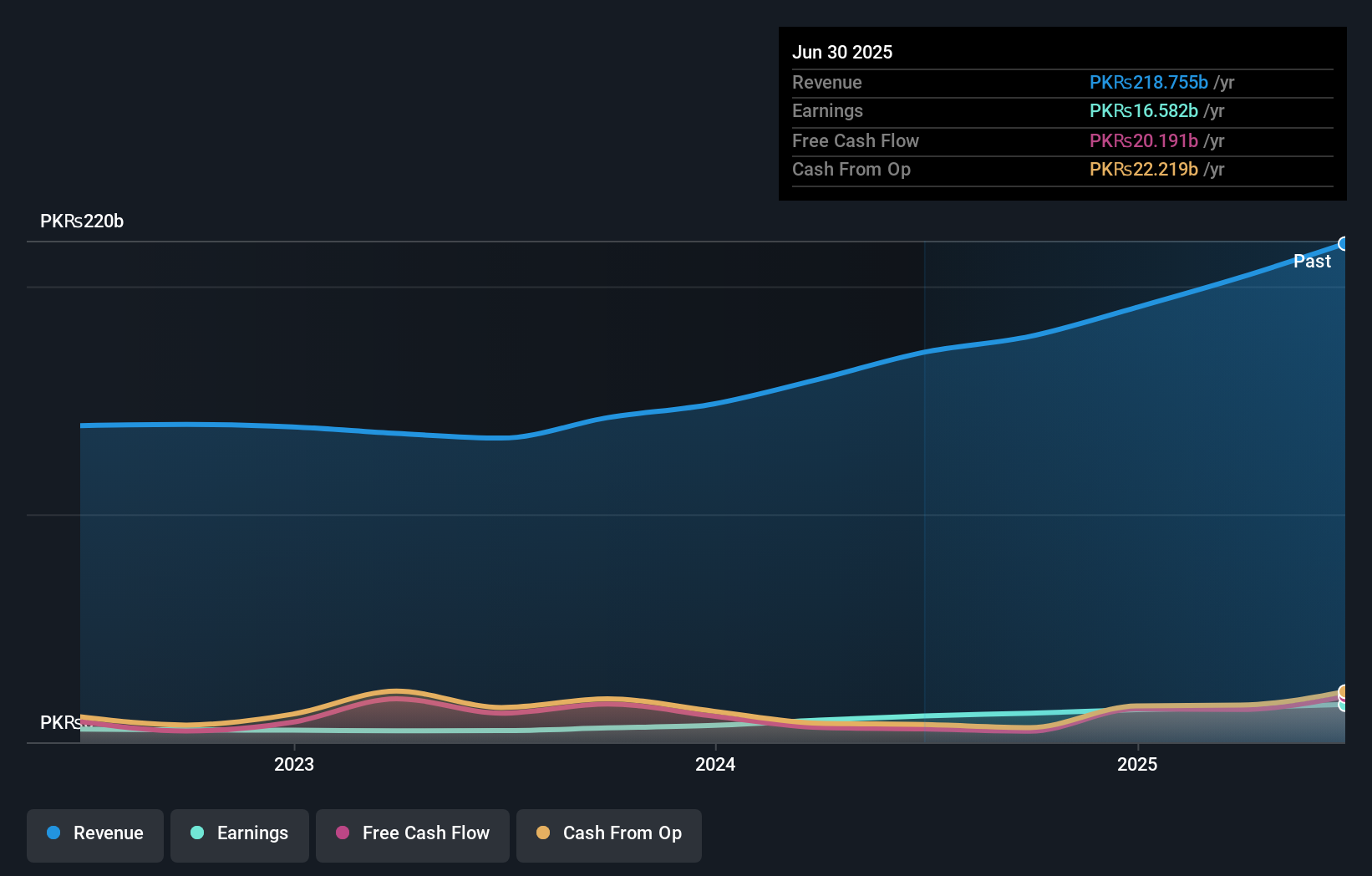

Overview: Atlas Honda Limited is a company that manufactures and markets motorcycles, spare parts, and engine oil primarily in Pakistan with a market capitalization of PKR101.05 billion.

Operations: Atlas Honda Limited generates revenue primarily from its auto manufacturing segment, with reported earnings of PKR148.42 billion.

Atlas Honda, a nimble player in the auto industry, has shown impressive earnings growth of 39% over the past year, outpacing the industry average of 29.2%. With a price-to-earnings ratio of 13.7x below the sector's average and no debt on its books for five years, it presents an attractive value proposition. The recent quarter saw sales jump to PKR 47.42 billion from PKR 35.62 billion last year, with net income reaching PKR 3.48 billion compared to PKR 1.60 billion previously.

CIEL (MUSE:CIEL.N0000)

Simply Wall St Value Rating: ★★★★☆☆

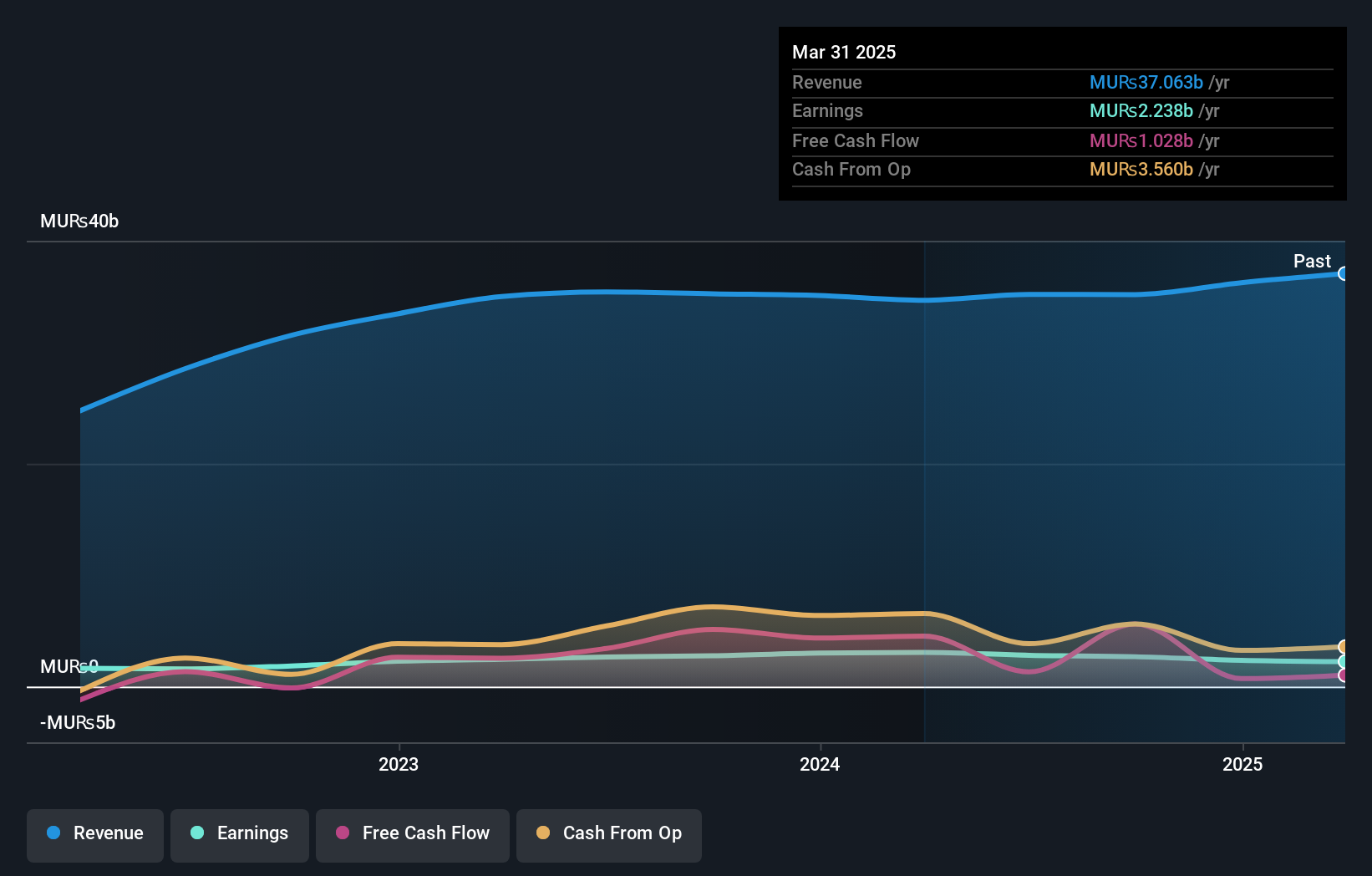

Overview: CIEL Limited is an investment holding company with operations across various sectors including finance, textile, healthcare, properties, and hotels and resorts in Mauritius, Madagascar, Asia, South Africa, and internationally; it has a market capitalization of MUR17.74 billion.

Operations: CIEL generates revenue from multiple sectors, with the textile segment contributing MUR15.67 billion and hotels and resorts adding MUR8.72 billion.

CIEL, a smaller player in the market, trades at 54.8% below its estimated fair value and boasts high-quality earnings. Over the past five years, its debt to equity ratio has impressively decreased from 79.7% to 45.7%, indicating improved financial stability. Although recent earnings growth of 5.8% lags behind the luxury industry's 28.2%, CIEL's net income rose to MUR 2,807 million this year from MUR 2,653 million last year, with basic EPS climbing to MUR 1.66 from MUR 1.57.

- Click here to discover the nuances of CIEL with our detailed analytical health report.

Examine CIEL's past performance report to understand how it has performed in the past.

Medeze Group (SET:MEDEZE)

Simply Wall St Value Rating: ★★★★★★

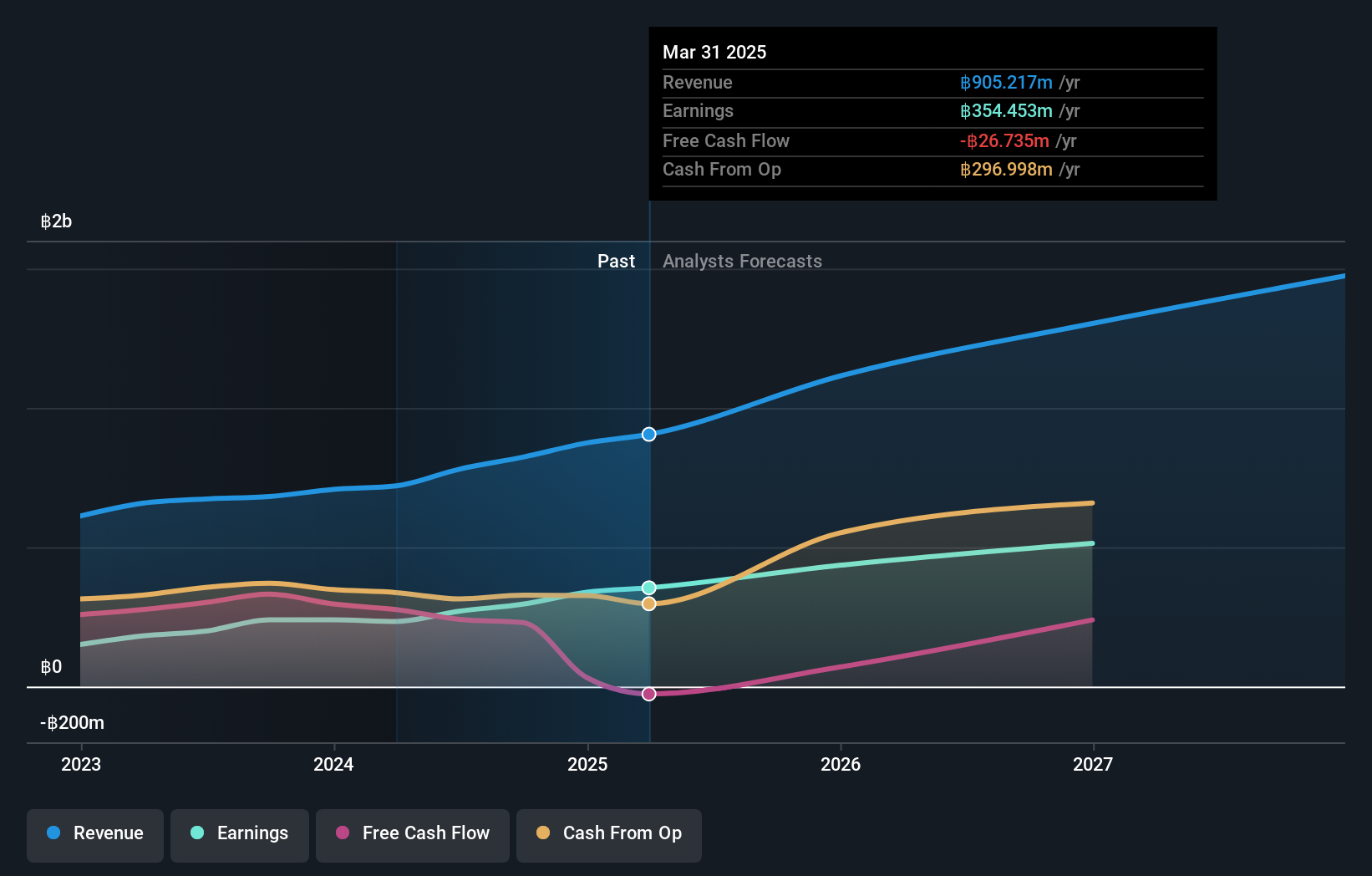

Overview: Medeze Group Public Company Limited provides stem cell, NK cell, and follicle hair banking services in Thailand, with a market cap of THB9.61 billion.

Operations: Medeze Group generates revenue primarily from services related to stem cell, NK cell, and follicle hair banking. The company's financials reveal a focus on these specialized healthcare services without additional revenue segment details provided.

Medeze Group, a small player in the healthcare sector, has shown impressive growth with earnings surging by 38.8% over the past year, outpacing the industry average of 16.1%. The company remains debt-free and boasts high-quality non-cash earnings. Recent reports highlight a revenue increase to THB 221.7 million from THB 161.26 million year-over-year for Q2, while net income rose to THB 86.87 million from THB 50.25 million in the same period last year, reflecting its robust financial health despite highly illiquid shares.

- Dive into the specifics of Medeze Group here with our thorough health report.

Gain insights into Medeze Group's past trends and performance with our Past report.

Next Steps

- Gain an insight into the universe of 4780 Undiscovered Gems With Strong Fundamentals by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal