Koshidaka Holdings And 2 Other Undiscovered Gems With Strong Fundamentals

As Japan's stock markets experience a rise, with the Nikkei 225 Index gaining 2.45% and the TOPIX Index up 0.45%, investors are increasingly drawn to small-cap companies that may offer unique opportunities amid yen weakness and shifting economic conditions. In this context, identifying stocks with strong fundamentals becomes crucial, as they can potentially provide stability and growth even amidst broader market fluctuations.

Top 10 Undiscovered Gems With Strong Fundamentals In Japan

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| AOKI Holdings | 28.27% | 0.91% | 37.15% | ★★★★★★ |

| Kanda HoldingsLtd | 30.47% | 4.35% | 18.02% | ★★★★★★ |

| Toukei Computer | NA | 5.46% | 12.14% | ★★★★★★ |

| Uoriki | NA | 3.90% | 6.15% | ★★★★★★ |

| Innotech | 38.96% | 7.08% | 6.36% | ★★★★★☆ |

| Kappa Create | 74.42% | -0.45% | 3.62% | ★★★★★☆ |

| MIRARTH HOLDINGSInc | 266.33% | 3.00% | -2.40% | ★★★★☆☆ |

| Ogaki Kyoritsu Bank | 139.93% | 2.20% | -0.27% | ★★★★☆☆ |

| Nippon Sharyo | 61.34% | -1.68% | -17.07% | ★★★★☆☆ |

| Hakuto | 56.93% | 8.02% | 27.72% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Koshidaka Holdings (TSE:2157)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Koshidaka Holdings Co., Ltd. is a company that operates karaoke and bath house businesses both in Japan and internationally, with a market cap of approximately ¥91.71 billion.

Operations: Koshidaka Holdings generates revenue primarily from its karaoke business, which accounts for ¥61.25 billion, and real estate management contributing ¥1.59 billion.

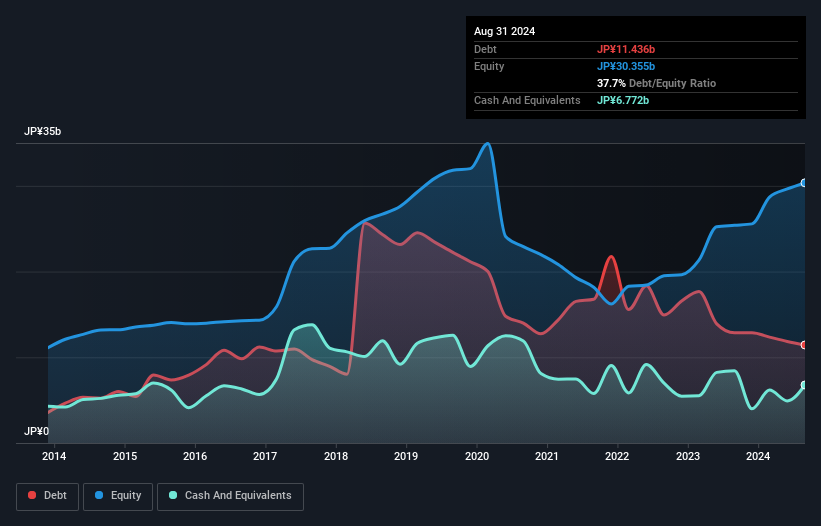

Koshidaka Holdings, a notable player in Japan's hospitality sector, shows promise with a debt-to-equity ratio reduced from 69.9% to 37.7% over five years and satisfactory net debt levels at 15.4%. Trading at a price-to-earnings ratio of 13.6x, it offers good value against an industry average of 21.9x. Despite recent negative earnings growth of -5.2%, its forecasted annual growth rate is pegged at 6.5%, suggesting potential recovery and expansion ahead.

- Click to explore a detailed breakdown of our findings in Koshidaka Holdings' health report.

Understand Koshidaka Holdings' track record by examining our Past report.

PAL GROUP Holdings (TSE:2726)

Simply Wall St Value Rating: ★★★★★★

Overview: PAL GROUP Holdings CO., LTD. operates in Japan, focusing on the planning, manufacture, wholesale, and retail of clothing and accessories for men and women, with a market capitalization of ¥223.31 billion.

Operations: PAL GROUP Holdings generates revenue primarily from its clothing business, which accounts for ¥121.28 billion, and its miscellaneous goods/accessories segment contributing ¥75.51 billion.

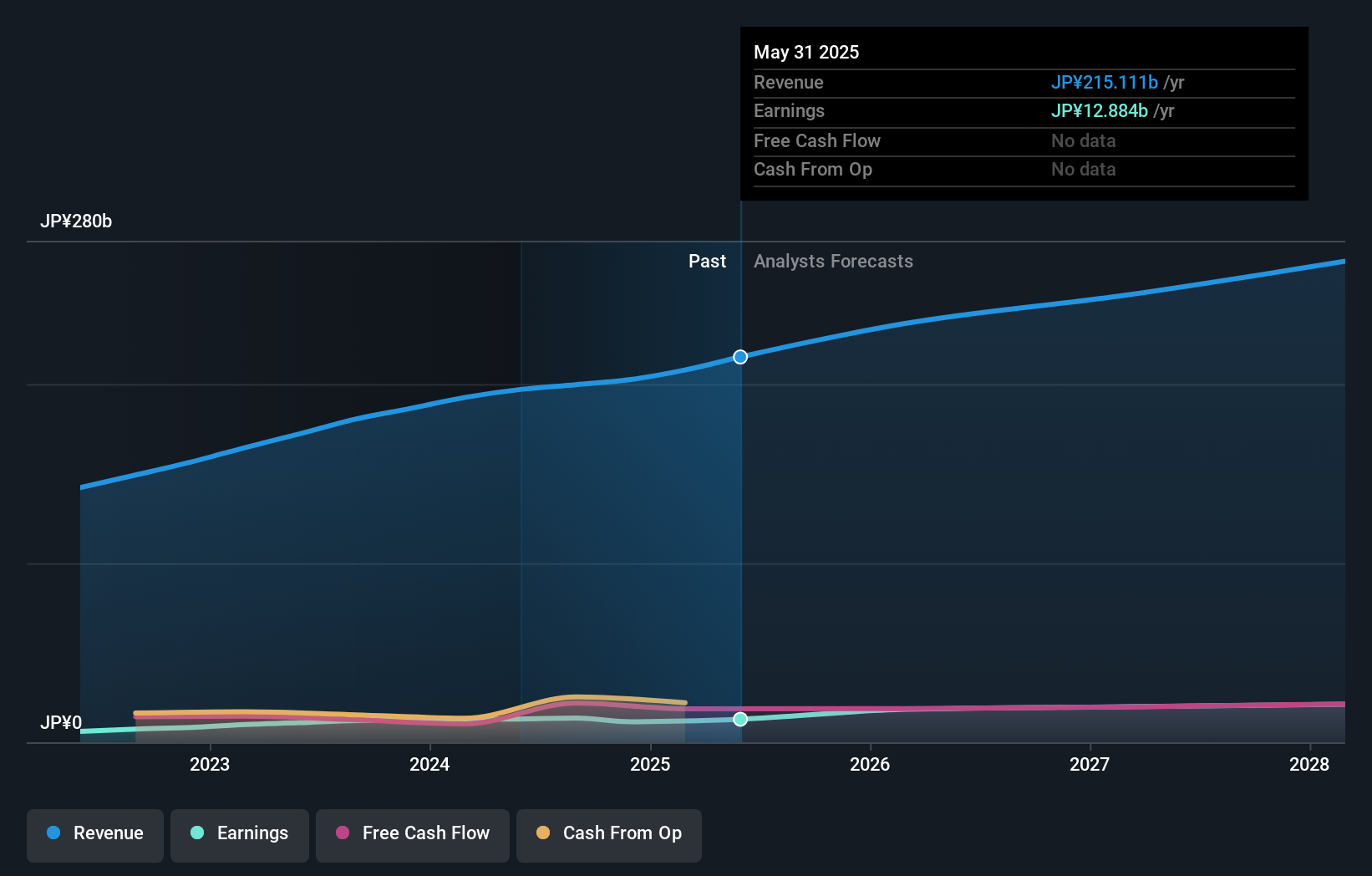

PAL GROUP Holdings, a nimble player in Japan's market, trades at 43.1% below its estimated fair value, suggesting potential undervaluation. The company has shown robust earnings growth of 18.8% over the past year, outpacing the Specialty Retail industry average of 5.3%. Its debt-to-equity ratio has impressively decreased from 41.2% to 18.9% over five years, reflecting prudent financial management. With interest payments covered by EBIT at an impressive 215 times, PAL appears financially sound and poised for continued growth with forecasted earnings increases of about 10.69% annually.

- Get an in-depth perspective on PAL GROUP Holdings' performance by reading our health report here.

Assess PAL GROUP Holdings' past performance with our detailed historical performance reports.

Nojima (TSE:7419)

Simply Wall St Value Rating: ★★★★★★

Overview: Nojima Corporation operates digital home electronics retail stores in Japan and internationally, with a market cap of approximately ¥201.52 billion.

Operations: Nojima's primary revenue streams include its Digital Home Electronics Specialty Store Operation Business, generating ¥273.98 billion, and the Career Show Management Business, contributing ¥350.30 billion. The Internet Business and Foreign Operations add ¥66.93 billion and ¥75.74 billion respectively to the overall revenue mix.

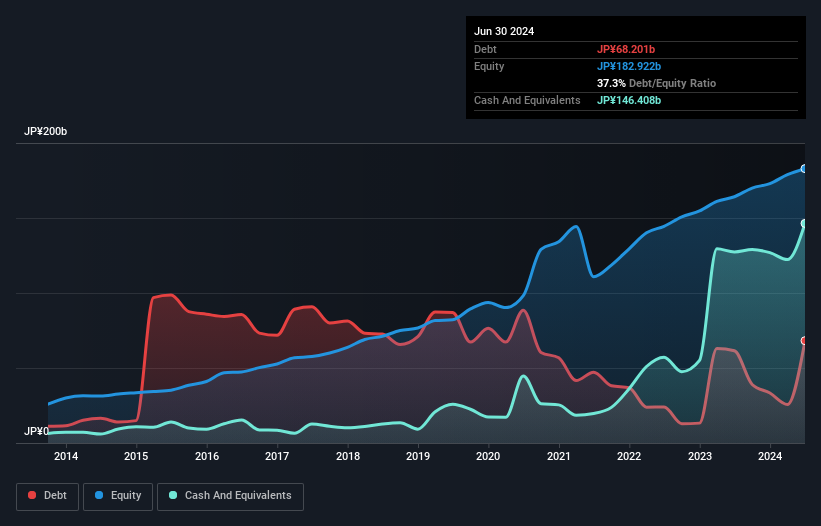

Nojima, a smaller player in Japan's retail scene, shows promising financial health with earnings growing 8% last year and a debt-to-equity ratio dropping from 105.8% to 37.3% over five years. The company repurchased 1.79 million shares for ¥2.98 billion recently, indicating confidence in its valuation, which trades at nearly 78% below estimated fair value. Looking ahead, Nojima forecasts net sales of ¥765 billion and operating income of ¥31 billion for the fiscal year ending March 2025.

- Unlock comprehensive insights into our analysis of Nojima stock in this health report.

Gain insights into Nojima's past trends and performance with our Past report.

Taking Advantage

- Click here to access our complete index of 731 Japanese Undiscovered Gems With Strong Fundamentals.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal