Swedish Stocks That May Be Trading Below Estimated Value In October 2024

As European markets show optimism with the pan-European STOXX Europe 600 Index rising amid expectations of quicker interest rate cuts, investors are keenly observing opportunities in various regions, including Sweden. In this environment, identifying stocks that may be trading below their estimated value can be crucial for investors looking to capitalize on potential undervaluations while navigating current economic conditions.

Top 10 Undervalued Stocks Based On Cash Flows In Sweden

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Truecaller (OM:TRUE B) | SEK44.56 | SEK86.61 | 48.6% |

| Concentric (OM:COIC) | SEK212.00 | SEK404.37 | 47.6% |

| Biotage (OM:BIOT) | SEK183.60 | SEK365.08 | 49.7% |

| Lindab International (OM:LIAB) | SEK277.40 | SEK528.45 | 47.5% |

| Nolato (OM:NOLA B) | SEK51.65 | SEK103.13 | 49.9% |

| Wall to Wall Group (OM:WTW A) | SEK57.40 | SEK105.82 | 45.8% |

| Securitas (OM:SECU B) | SEK129.70 | SEK258.62 | 49.9% |

| Nexam Chemical Holding (OM:NEXAM) | SEK3.98 | SEK7.91 | 49.7% |

| BHG Group (OM:BHG) | SEK13.98 | SEK26.45 | 47.1% |

| Bactiguard Holding (OM:BACTI B) | SEK45.90 | SEK86.06 | 46.7% |

Here's a peek at a few of the choices from the screener.

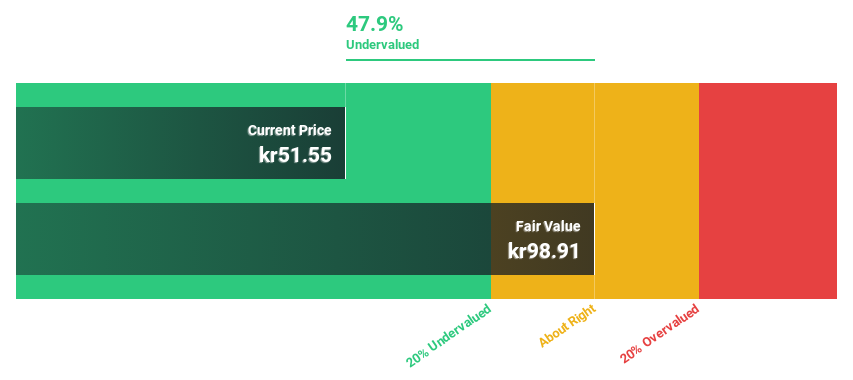

Nolato (OM:NOLA B)

Overview: Nolato AB (publ) develops, manufactures, and sells plastic, silicone, and thermoplastic elastomer products for various sectors including medical technology, pharmaceutical, consumer electronics, telecom, automotive, hygiene, and other industries across Sweden and globally; it has a market cap of SEK13.91 billion.

Operations: The company's revenue segments include Medical Solutions, which generated SEK5.34 billion.

Estimated Discount To Fair Value: 49.9%

Nolato is trading at SEK51.65, significantly below its estimated fair value of SEK103.13, suggesting it may be undervalued based on cash flows. Despite a forecasted low return on equity and slower revenue growth compared to high-growth benchmarks, Nolato's earnings are expected to grow significantly at 23.1% annually, outpacing the Swedish market's 15.6%. Recent earnings reports show steady performance with net income rising year-over-year despite slightly lower sales figures.

- Insights from our recent growth report point to a promising forecast for Nolato's business outlook.

- Get an in-depth perspective on Nolato's balance sheet by reading our health report here.

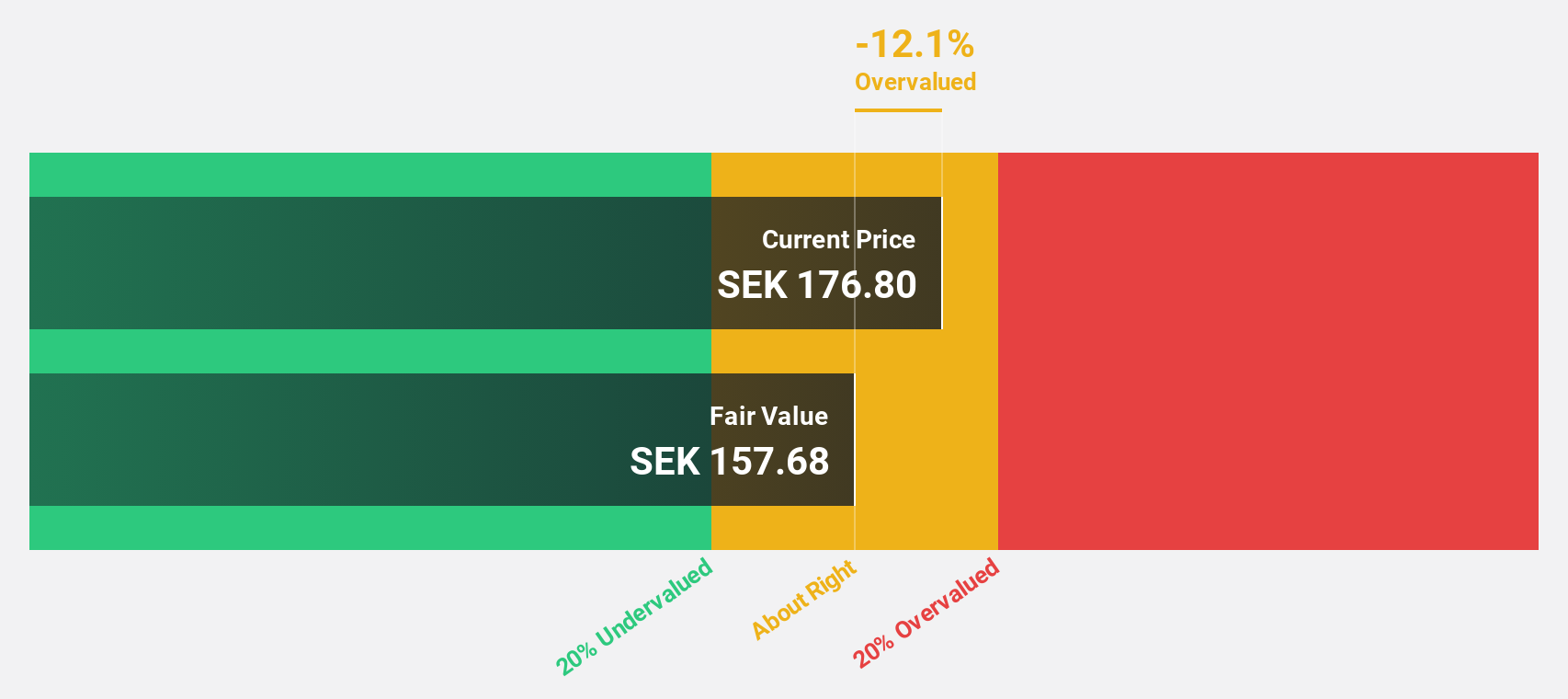

NOTE (OM:NOTE)

Overview: NOTE AB (publ) is a company that offers electronics manufacturing services across Sweden, Finland, the United Kingdom, Bulgaria, Estonia, China, and other international markets with a market cap of SEK3.81 billion.

Operations: The company generates revenue through its electronics manufacturing services operations in Sweden, Finland, the United Kingdom, Bulgaria, Estonia, China, and other international markets.

Estimated Discount To Fair Value: 27.3%

NOTE is trading at SEK131.3, below its estimated fair value of SEK180.53, indicating potential undervaluation based on cash flows. Despite significant insider selling and a forecasted low return on equity of 17.8%, earnings are expected to grow significantly at 20.1% annually, surpassing the Swedish market's growth rate. Recent earnings reports show declines in sales and net income for Q3 and the first nine months of 2024 compared to last year, with basic EPS also decreasing.

- The analysis detailed in our NOTE growth report hints at robust future financial performance.

- Click here and access our complete balance sheet health report to understand the dynamics of NOTE.

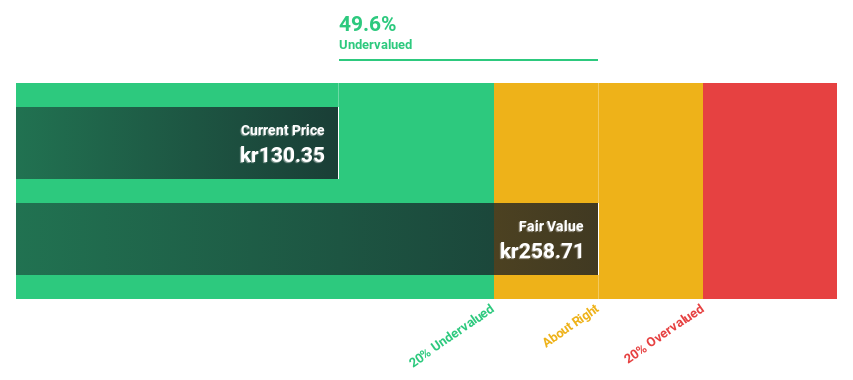

Securitas (OM:SECU B)

Overview: Securitas AB (publ) offers security services across North America, Europe, Latin America, Africa, the Middle East, Asia, and Australia with a market cap of approximately SEK74.31 billion.

Operations: The company's revenue segments include Securitas North America with SEK63.72 billion, Security Services Europe (including Mobile & Monitoring) at SEK68.62 billion, and Securitas Ibero-America generating SEK14.67 billion.

Estimated Discount To Fair Value: 49.9%

Securitas is trading at SEK129.7, substantially below its estimated fair value of SEK258.62, highlighting potential undervaluation based on cash flows. Despite a low profit margin of 1% and debt not well covered by operating cash flow, earnings are forecast to grow significantly at 41.3% annually, outpacing the Swedish market's growth rate. Recent Q2 results show modest revenue growth to SEK40.64 billion and improved net income to SEK1.31 billion year-over-year, despite large one-off items affecting quality earnings.

- Our expertly prepared growth report on Securitas implies its future financial outlook may be stronger than recent results.

- Click here to discover the nuances of Securitas with our detailed financial health report.

Seize The Opportunity

- Delve into our full catalog of 43 Undervalued Swedish Stocks Based On Cash Flows here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal