Investors Appear Satisfied With Puya Semiconductor (Shanghai) Co., Ltd.'s (SHSE:688766) Prospects As Shares Rocket 36%

Those holding Puya Semiconductor (Shanghai) Co., Ltd. (SHSE:688766) shares would be relieved that the share price has rebounded 36% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Unfortunately, despite the strong performance over the last month, the full year gain of 7.7% isn't as attractive.

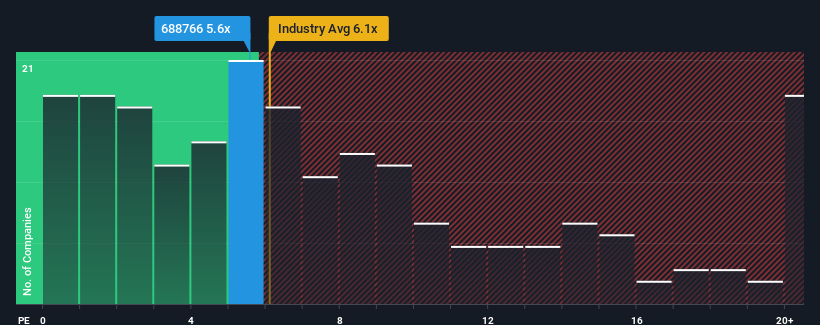

Even after such a large jump in price, there still wouldn't be many who think Puya Semiconductor (Shanghai)'s price-to-sales (or "P/S") ratio of 5.6x is worth a mention when the median P/S in China's Semiconductor industry is similar at about 6.1x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

View our latest analysis for Puya Semiconductor (Shanghai)

What Does Puya Semiconductor (Shanghai)'s Recent Performance Look Like?

Puya Semiconductor (Shanghai) certainly has been doing a good job lately as it's been growing revenue more than most other companies. Perhaps the market is expecting this level of performance to taper off, keeping the P/S from soaring. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Puya Semiconductor (Shanghai).Is There Some Revenue Growth Forecasted For Puya Semiconductor (Shanghai)?

The only time you'd be comfortable seeing a P/S like Puya Semiconductor (Shanghai)'s is when the company's growth is tracking the industry closely.

Retrospectively, the last year delivered an exceptional 89% gain to the company's top line. The latest three year period has also seen an excellent 63% overall rise in revenue, aided by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 38% as estimated by the four analysts watching the company. With the industry predicted to deliver 37% growth , the company is positioned for a comparable revenue result.

With this in mind, it makes sense that Puya Semiconductor (Shanghai)'s P/S is closely matching its industry peers. It seems most investors are expecting to see average future growth and are only willing to pay a moderate amount for the stock.

The Bottom Line On Puya Semiconductor (Shanghai)'s P/S

Its shares have lifted substantially and now Puya Semiconductor (Shanghai)'s P/S is back within range of the industry median. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

A Puya Semiconductor (Shanghai)'s P/S seems about right to us given the knowledge that analysts are forecasting a revenue outlook that is similar to the Semiconductor industry. Right now shareholders are comfortable with the P/S as they are quite confident future revenue won't throw up any surprises. If all things remain constant, the possibility of a drastic share price movement remains fairly remote.

You should always think about risks. Case in point, we've spotted 2 warning signs for Puya Semiconductor (Shanghai) you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal