KRX Value Stock Estimates For October 2024

In the last week, the South Korean market has stayed flat but has shown a 3.8% increase over the past year, with earnings forecasted to grow by 30% annually. In such a landscape, identifying undervalued stocks can be crucial for investors looking to capitalize on potential growth opportunities while maintaining a focus on intrinsic value.

Top 10 Undervalued Stocks Based On Cash Flows In South Korea

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Samwha ElectricLtd (KOSE:A009470) | ₩48850.00 | ₩92421.92 | 47.1% |

| PharmaResearch (KOSDAQ:A214450) | ₩215000.00 | ₩424407.22 | 49.3% |

| T'Way Air (KOSE:A091810) | ₩3165.00 | ₩5637.57 | 43.9% |

| Cosmecca Korea (KOSDAQ:A241710) | ₩76100.00 | ₩147557.34 | 48.4% |

| TSE (KOSDAQ:A131290) | ₩53300.00 | ₩99841.16 | 46.6% |

| Lutronic (KOSDAQ:A085370) | ₩36700.00 | ₩63217.94 | 41.9% |

| Oscotec (KOSDAQ:A039200) | ₩38700.00 | ₩65156.22 | 40.6% |

| Shinsung E&GLtd (KOSE:A011930) | ₩1605.00 | ₩2943.91 | 45.5% |

| Global Tax Free (KOSDAQ:A204620) | ₩3725.00 | ₩6410.22 | 41.9% |

| Kakao Games (KOSDAQ:A293490) | ₩16740.00 | ₩29396.88 | 43.1% |

Let's review some notable picks from our screened stocks.

Hd Hyundai MipoLtd (KOSE:A010620)

Overview: Hd Hyundai Mipo Co., Ltd. is a South Korean company that specializes in the manufacturing, repair, and remodeling of ships, with a market cap of ₩4.01 trillion.

Operations: The company's revenue is primarily derived from its shipbuilding segment, totaling ₩5.10 trillion, with a connection adjustment of -₩870.77 million.

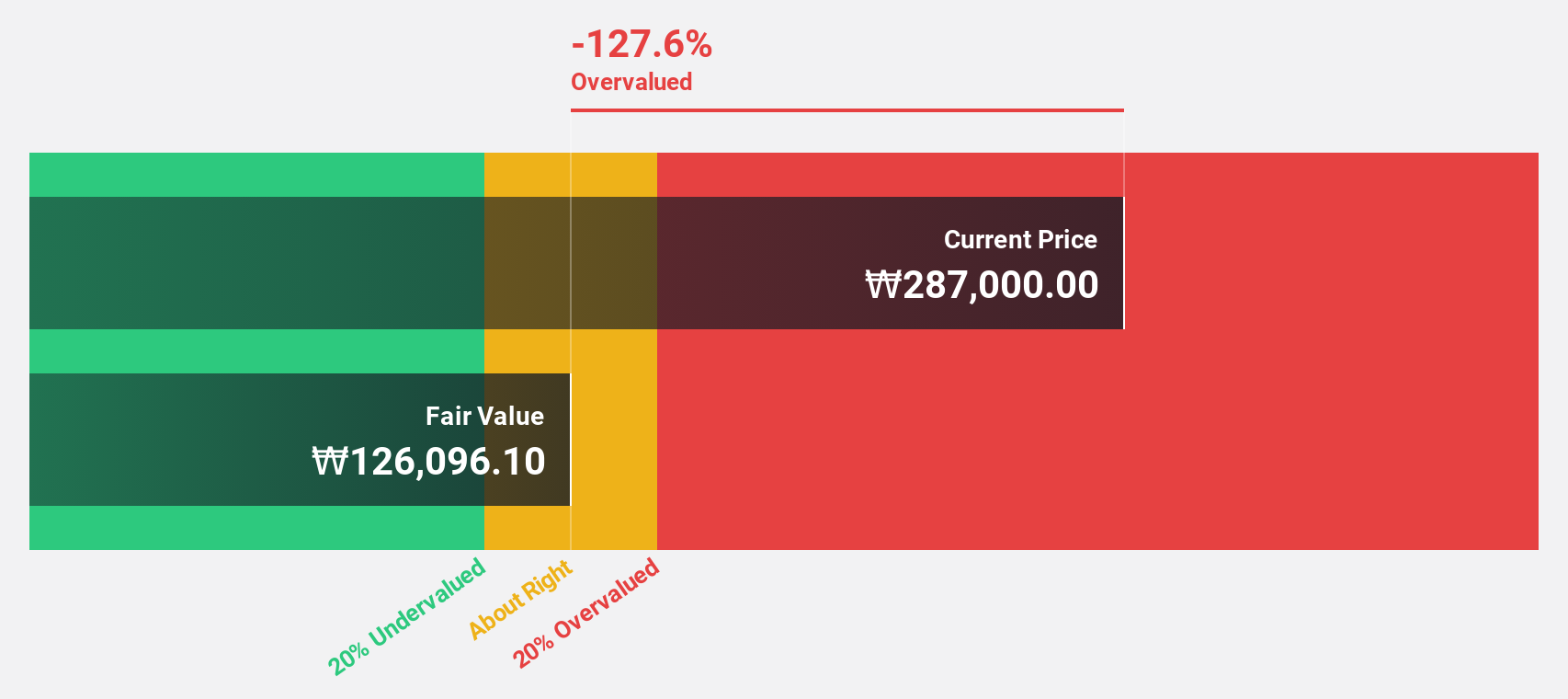

Estimated Discount To Fair Value: 37%

Hd Hyundai Mipo Ltd. is trading 37% below its estimated fair value of ₩159,785.16, highlighting potential undervaluation based on cash flows. Earnings are forecast to grow significantly at 92.48% annually, although revenue growth is slower than 20%, yet still outpaces the South Korean market average of 10.4%. The company is expected to become profitable within three years, with a forecasted return on equity of 13%, which remains relatively low.

- In light of our recent growth report, it seems possible that Hd Hyundai MipoLtd's financial performance will exceed current levels.

- Get an in-depth perspective on Hd Hyundai MipoLtd's balance sheet by reading our health report here.

SK Biopharmaceuticals (KOSE:A326030)

Overview: SK Biopharmaceuticals Co., Ltd. is a pharmaceutical company focused on the research and development of drugs for central nervous system disorders, with a market cap of ₩9.33 trillion.

Operations: The company generates revenue from its New Drug Development segment, amounting to ₩465.06 million.

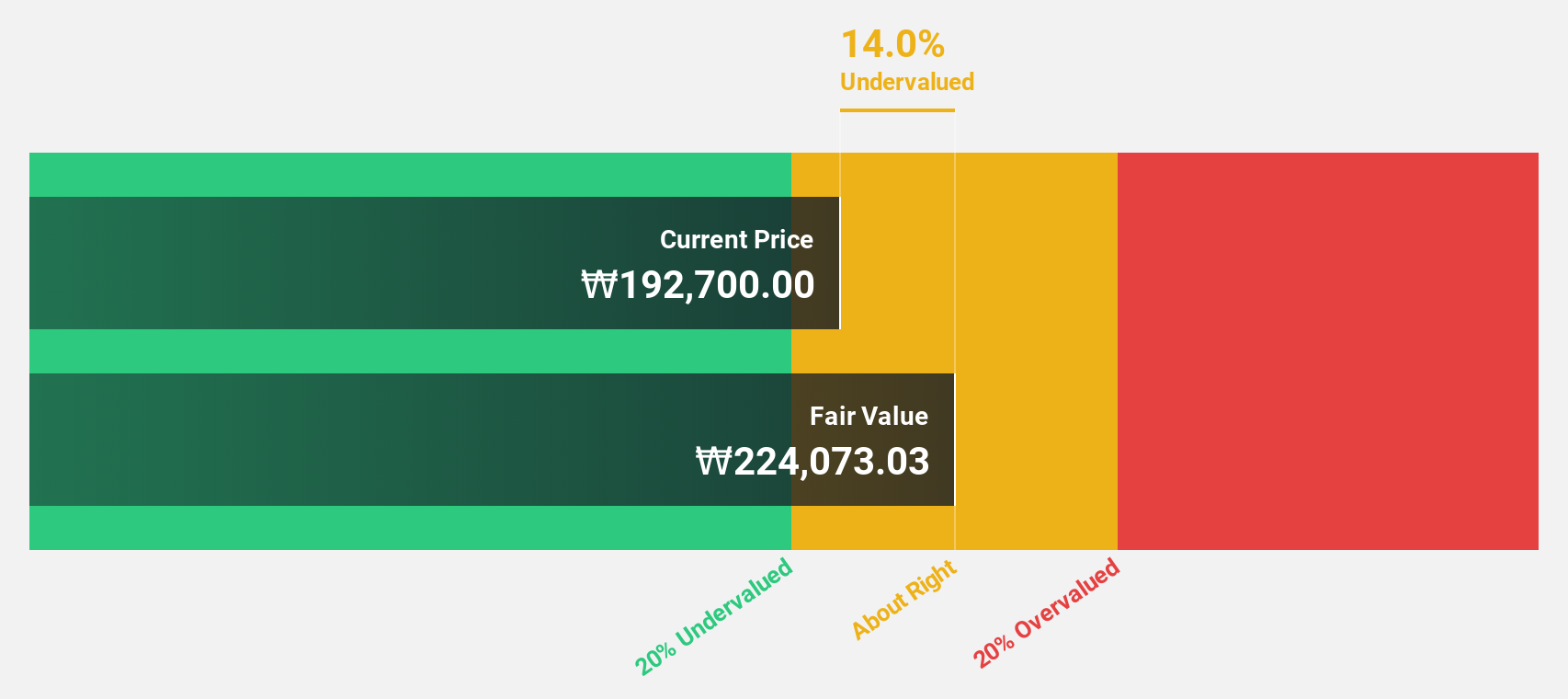

Estimated Discount To Fair Value: 33.8%

SK Biopharmaceuticals is trading 33.8% below its estimated fair value of ₩179,969.09, suggesting potential undervaluation based on cash flows. The company recently became profitable and is expected to see significant earnings growth at 70.6% annually over the next three years, outpacing the South Korean market's average growth rate of 30.3%. Revenue is projected to grow at 22.4% per year, surpassing the market's average of 10.4%.

- The growth report we've compiled suggests that SK Biopharmaceuticals' future prospects could be on the up.

- Click here and access our complete balance sheet health report to understand the dynamics of SK Biopharmaceuticals.

HYBE (KOSE:A352820)

Overview: HYBE Co., Ltd. operates in music production, publishing, and artist development and management, with a market cap of ₩7.68 trillion.

Operations: The company's revenue is derived from three primary segments: Label (₩1.28 trillion), Platform (₩361.12 billion), and Solution (₩1.24 trillion).

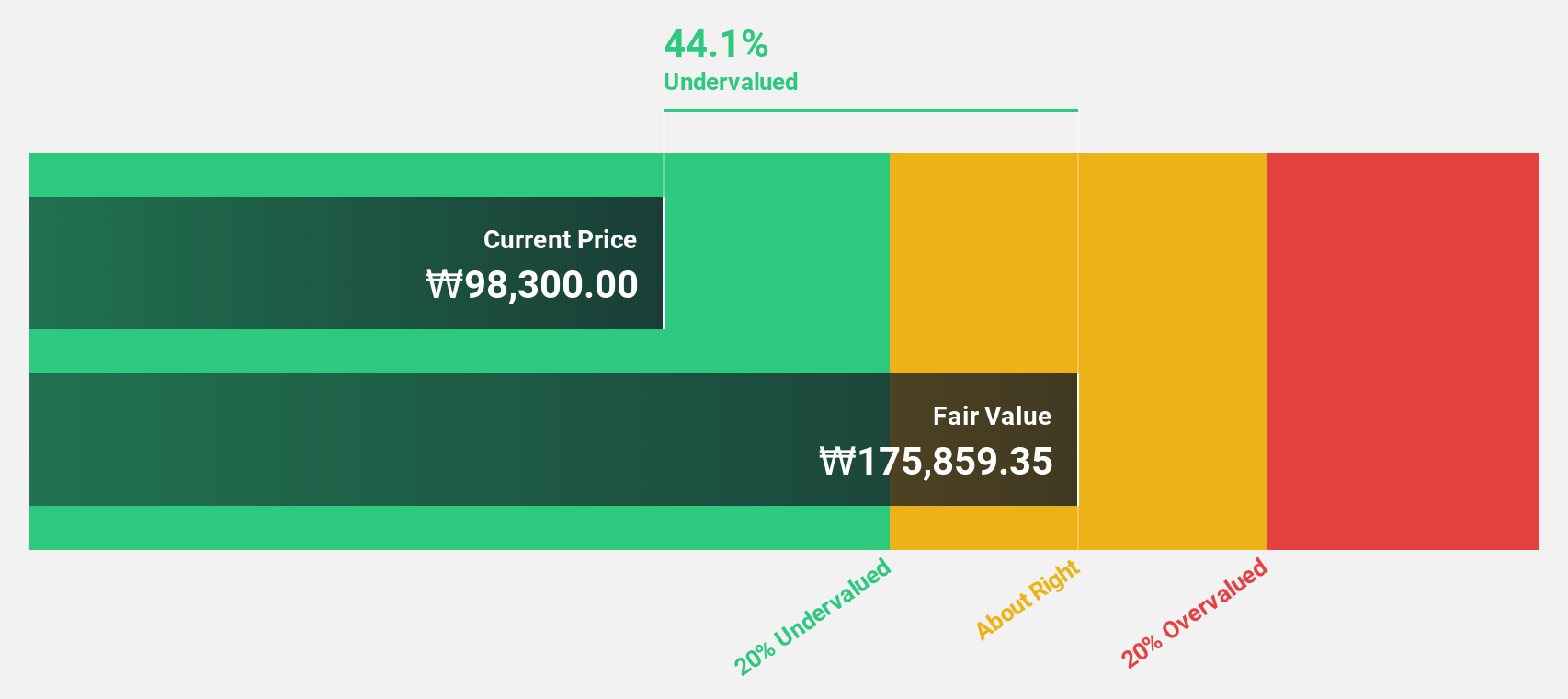

Estimated Discount To Fair Value: 22%

HYBE is trading 22% below its estimated fair value of ₩236,144.49, indicating potential undervaluation based on cash flows. Despite recent earnings challenges, with net income dropping significantly year-over-year, earnings are forecast to grow at 42.6% annually over the next three years, surpassing the South Korean market's average growth rate. The recent share buyback program demonstrates management's confidence in stabilizing stock prices amidst these fluctuations.

- The analysis detailed in our HYBE growth report hints at robust future financial performance.

- Dive into the specifics of HYBE here with our thorough financial health report.

Make It Happen

- Gain an insight into the universe of 34 Undervalued KRX Stocks Based On Cash Flows by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal