Trigon Metals Inc. (CVE:TM) Stock Rockets 51% But Many Are Still Ignoring The Company

Those holding Trigon Metals Inc. (CVE:TM) shares would be relieved that the share price has rebounded 51% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Taking a wider view, although not as strong as the last month, the full year gain of 19% is also fairly reasonable.

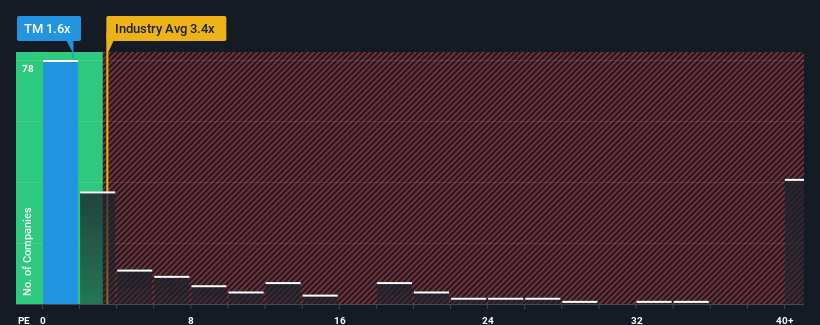

Although its price has surged higher, Trigon Metals may still be sending buy signals at present with its price-to-sales (or "P/S") ratio of 1.6x, considering almost half of all companies in the Metals and Mining industry in Canada have P/S ratios greater than 3.4x and even P/S higher than 21x aren't out of the ordinary. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Trigon Metals

How Has Trigon Metals Performed Recently?

Recent times have been advantageous for Trigon Metals as its revenues have been rising faster than most other companies. Perhaps the market is expecting future revenue performance to dive, which has kept the P/S suppressed. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Trigon Metals.Do Revenue Forecasts Match The Low P/S Ratio?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Trigon Metals' to be considered reasonable.

Taking a look back first, we see that the company's revenues underwent some rampant growth over the last 12 months. Still, revenue has barely risen at all from three years ago in total, which is not ideal. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Turning to the outlook, the next year should generate growth of 164% as estimated by the dual analysts watching the company. Meanwhile, the rest of the industry is forecast to only expand by 20%, which is noticeably less attractive.

With this information, we find it odd that Trigon Metals is trading at a P/S lower than the industry. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Final Word

The latest share price surge wasn't enough to lift Trigon Metals' P/S close to the industry median. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Trigon Metals' analyst forecasts revealed that its superior revenue outlook isn't contributing to its P/S anywhere near as much as we would have predicted. There could be some major risk factors that are placing downward pressure on the P/S ratio. It appears the market could be anticipating revenue instability, because these conditions should normally provide a boost to the share price.

Before you settle on your opinion, we've discovered 4 warning signs for Trigon Metals (1 is potentially serious!) that you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal