Should MTU Aero Engines’ Zero‑Coupon 2033 Convertible Refinancing Reshape Dilution Risks for (XTRA:MTX) Investors?

- Earlier this week, MTU Aero Engines AG issued new senior unsecured convertible bonds with a principal amount of €600 million, maturing in July 2033, bearing no interest, a 47.5% conversion premium and an accreted redemption price of 105%, to refinance its 2027 convertible bonds and support general corporate purposes.

- By using the new zero‑coupon 2033 convertible bonds to repurchase up to €500 million of 2027 bonds, MTU is reshaping its capital structure, extending debt maturities and actively managing future equity dilution linked to its existing convertible instruments.

- Next, we’ll examine how this zero‑coupon 2033 convertible refinancing and dilution management effort affects MTU Aero Engines’ investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

MTU Aero Engines Investment Narrative Recap

To own MTU Aero Engines, you need to believe in long term demand for its engine programs and high margin aftermarket services, while accepting exposure to GTF program concentration and supply chain fragility. The new zero coupon 2033 convertible bonds mainly tweak the balance sheet and timing of potential dilution rather than shifting the near term earnings catalyst or the key operational risks in a material way.

The recent expansion of GTF overhaul capacity, which could add up to 600 extra shop visits a year, ties directly into MTU’s reliance on next generation engine programs and aftermarket work as core earnings drivers. In that context, the 2033 convertible refinancing looks more like financial housekeeping alongside a business that still depends heavily on smooth GTF execution and stable geopolitical and tariff conditions.

Yet while refinancing reduces near term funding pressure, investors should still be aware that concentrated exposure to GTF program risks could...

Read the full narrative on MTU Aero Engines (it's free!)

MTU Aero Engines' narrative projects €10.9 billion revenue and €1.1 billion earnings by 2028. This requires 9.9% yearly revenue growth and about a €248 million earnings increase from €852.0 million.

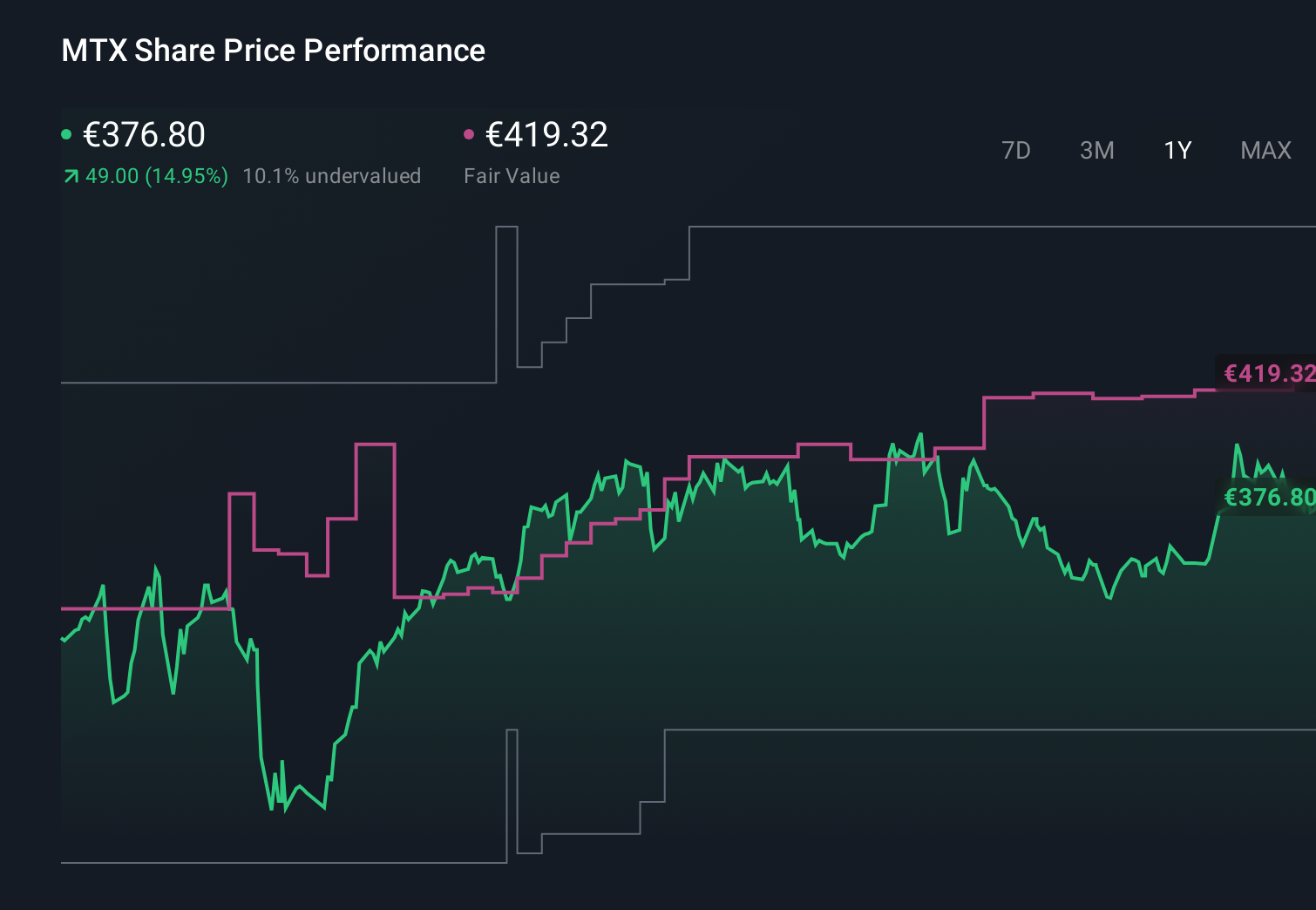

Uncover how MTU Aero Engines' forecasts yield a €413.50 fair value, a 8% upside to its current price.

Exploring Other Perspectives

Seven fair value estimates from the Simply Wall St Community range widely, from about €296 to over €582 per share, underscoring how far apart individual views can be. When you set those against MTU’s heavy reliance on next generation GTF engines and associated aftermarket work, it becomes clear why many investors may want to compare several different scenarios before forming a view on the company’s long term performance.

Explore 7 other fair value estimates on MTU Aero Engines - why the stock might be worth as much as 52% more than the current price!

Build Your Own MTU Aero Engines Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your MTU Aero Engines research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free MTU Aero Engines research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate MTU Aero Engines' overall financial health at a glance.

No Opportunity In MTU Aero Engines?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Explore 29 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Outshine the giants: these 28 early-stage AI stocks could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal