IPO News | Xizi Health Reports Hong Kong Stock Exchange's 2024 retail sales rank third among sports nutrition brand operators in China

The Zhitong Finance App learned that according to the Hong Kong Stock Exchange's disclosure on January 8, Hunan Xizi Health Group Co., Ltd. (Xizi Health for short) submitted a listing application to the main board of the Hong Kong Stock Exchange, and CITIC Securities is the sole sponsor.

Company profile

According to the prospectus, Xizi Health is a sports nutrition and functional food company dedicated to providing consumers with high-quality nutritional and health products and leading a healthy lifestyle. The company's main products include protein powder, whey protein compound, creatine, functional gummies, coffee, etc. The company has created a brand matrix covering professional training, health and wellness, weight management and daily nutritional needs. The brand matrix includes four of its own brands FOYes, Fiboo, Tanimoto Diary, and HotRule. Among them, Fiboo, Tanimoto Diary, and FoYes achieved cumulative sales of over RMB 500 million within 31, 20, and 15 months of product launch, respectively. HotRule was launched in April 2025. As of the last practical date, the cumulative GMV has exceeded RMB 60 million.

Specifically: Launched in 2024, FOYES is the company's core sports nutrition brand, specially designed for targeted trainers to meet their needs for significant gains in strength and muscle development. The brand focuses on major sports nutrition categories, covering high quality protein powder, whey protein complex, creatine and branched chain amino acids (BCAAs). For 11 months ended November 30, 2025, Foyes topped Douyin's GMV ranking in the whey protein product category.

Launched in 2021, fiboo is a nutritional health food brand for women, providing full-scene scientific nutritional supplements around women's sports lifestyle. The brand provides scientifically proven daily nutrition products, suitable for various life scenarios, and is steadily expanding its layout in the sports nutrition and functional food market. With nutritional science and sophisticated sensory design, fiboo has established a diverse product line covering sports protein products, functional gummies, and functional drinks. Each product is specially designed for natural integration into everyday work, travel, and light training. For 11 months ended November 30, 2025, Fiboo topped Douyin's GMV ranking in the multi-vitamin and mineral product category.

Tanimoto Diary was founded in 2022, focusing on natural healthy light food and nourishing meal replacement, focusing on the combination of natural grains and modern nutritional science. The product line covers products such as meal replacement milkshakes, protein bars, nutritious meal replacement powder, baked oatmeal, light truck snacks, etc., which accurately meet the three basic needs of consumers for “light weight management,” “daily nutrition,” and “convenient life,” making it the first choice for consumers seeking a balanced and lightweight lifestyle.

HotRule was founded in April 2025. With its unique position of “trend and deliciousness,” HotRule attracts Gen Z consumers with its fun flavors. The products include sports nutrition products such as protein powder, whey protein compound, and creatine, and are characterized by innovative flavors and bold, trend-driven designs. HotRule is appealing to younger consumers, who want fitness products to match a social and modern lifestyle. As of the last practical date, GMV has surpassed RMB 60 million.

The breakdown of revenue by brand type is as follows:

According to Frost & Sullivan's data, in terms of retail sales of sports nutrition food in 2024, the company ranked third among sports nutrition brand operators in China, and has become the sports nutrition food leader in China. The company is also the fastest growing sports nutrition brand operator in China from 2022 to 2024.

Financial data

Revenue:

In 2023, 2024, 2024, and 2025 for the nine months ended September 30, Xizi Health achieved revenue of approximately RMB 1,447 billion, RMB 1,692 billion, RMB 1,308 billion, and RMB 1,609 billion, respectively.

Gross profit:

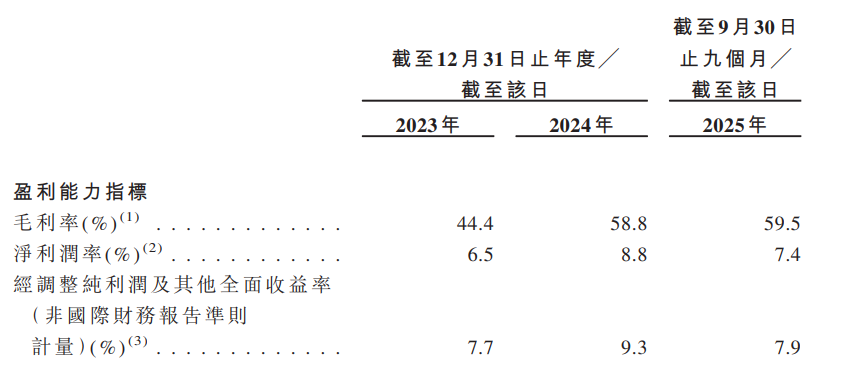

In 2023, 2024, 2024, and 2025 for the nine months ended September 30, Xizi Health achieved gross profit of 642 million yuan, 995 million yuan, 760 million yuan, and 958 million yuan respectively. Through direct control of product design, pricing strategies, and marketing promotion, large-scale development of private brands has driven the company's gross margin from 44.4% in 2023 to 58.8% in 2024, and further increased to 59.5% for the nine months ended September 30, 2025.

Industry Overview

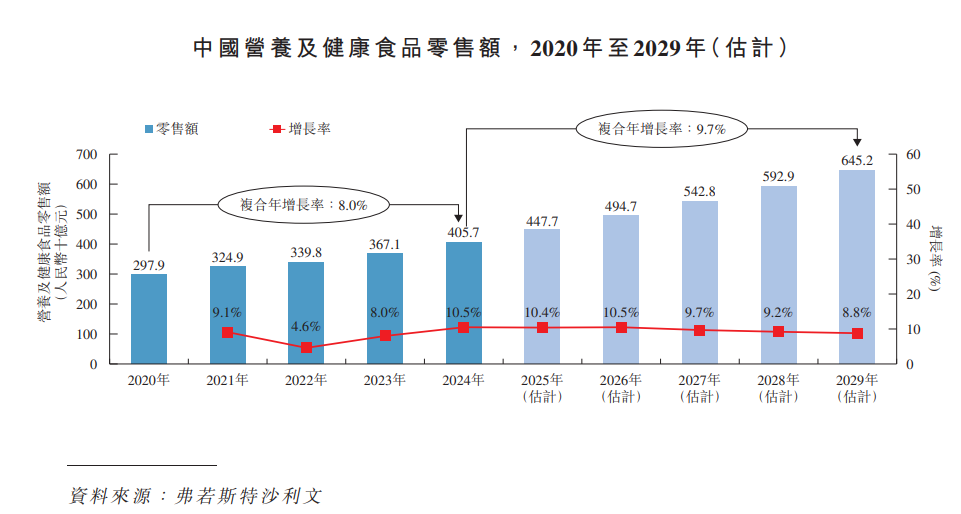

Retail sales of nutritional and health food products in China increased from RMB 297.9 billion in 2020 to RMB 405.7 billion in 2024, with a compound annual growth rate of 8.0% since 2020. As the market is expected to show market trends such as product diversification, scene segmentation, and cross-border integration, nutritional and health foods are expected to provide richer products and be more closely integrated with consumer needs. Retail sales of nutritional and health food products in China are expected to continue to grow from 2024 to 2029, reaching RMB 645.2 billion in 2029, with a compound annual growth rate of 9.7% from 2024.

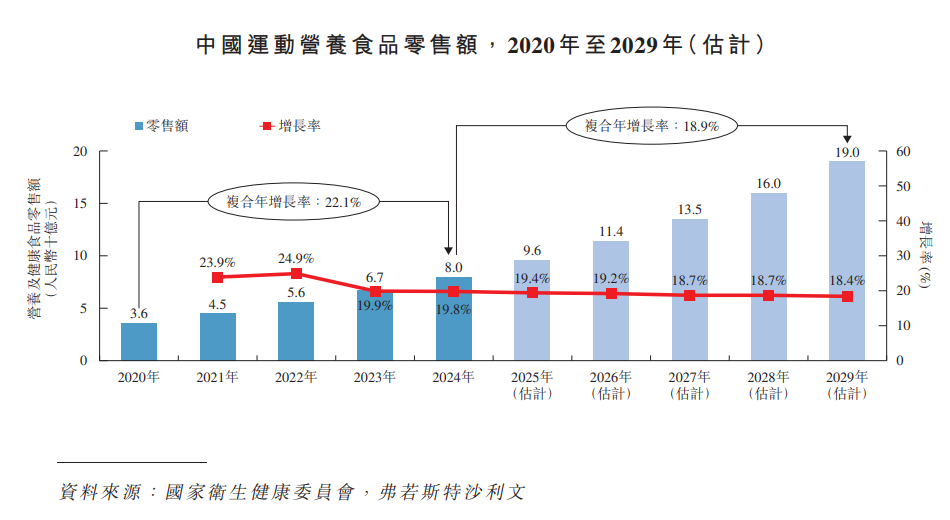

The retail sales of sports nutrition food in China increased from RMB 3.6 billion in 2020 to RMB 8 billion in 2024, with a compound annual growth rate of 22.1% since 2020. Driven by increasing participation in sports and the gradual expansion of daily consumption scenarios, retail sales of sports nutrition food in China are expected to reach RMB 19 billion in 2029, growing at a CAGR of 18.9% from 2024.

Board Information

The board of directors will be composed of nine directors, including four executive directors, two non-executive directors and three independent non-executive directors.

Shareholding structure

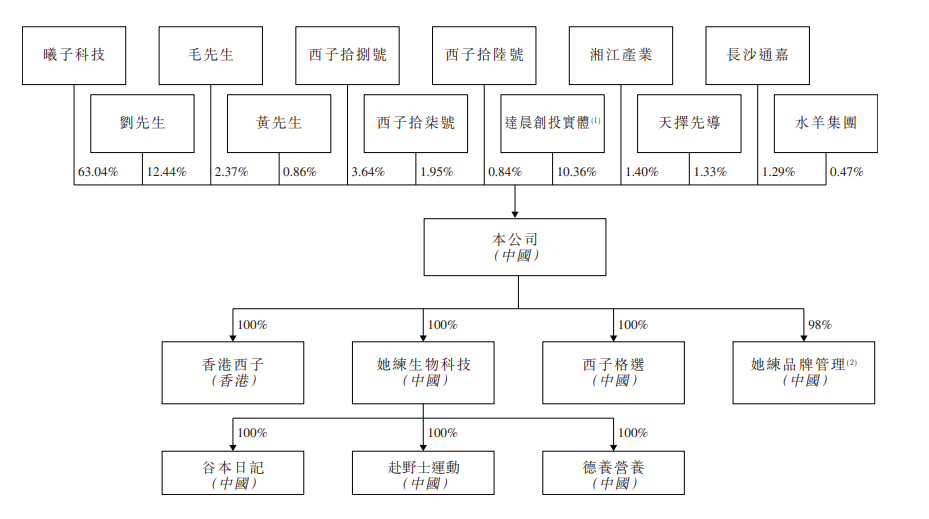

Xizi Technology holds 63.04% of the company's shares, Mr. Liu holds 12.44% of the company's shares; Mr. Mao holds 2.37% of the company's shares; and Dachen Venture Capital holds 10.36% of the company's shares.

Intermediary team

Sole sponsor: CITIC Securities (Hong Kong) Limited

The company's legal advisors: relating to Hong Kong and US law: Clyde Hong Kong law; relating to Chinese law: Hunan Qiyuan Law Firm

Sole sponsor's legal adviser: Law relating to Hong Kong and the United States: Haiwen Law Firm Limited Liability Partnership; relating to Chinese law: King & Wood Mallesons

Reporting Accountants and Independent Auditors: KPMG

Industry Advisor: Frost & Sullivan (Beijing) Consulting Co., Ltd. Shanghai Branch

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal