Assessing South32’s Valuation After Copper Price Rally And Mozal Power Setback

Why South32’s recent price move is on investors’ radar

South32 (ASX:S32) has drawn fresh attention after its shares outperformed the broader market on Tuesday, coinciding with record-high copper prices linked to supply disruptions and renewed focus on its upcoming earnings updates.

See our latest analysis for South32.

That copper driven surge sits on top of a 21.34% 90 day share price return and a 13.06% 30 day share price return. The 1 year total shareholder return of 16.22% and 5 year total shareholder return of 70.40% point to momentum that has built over time, despite a weaker 3 year total shareholder return of 9.40%.

If South32’s recent move has you scanning the resource space, it can be useful to contrast it with other parts of the market. For a different angle on opportunity, take a look at fast growing stocks with high insider ownership.

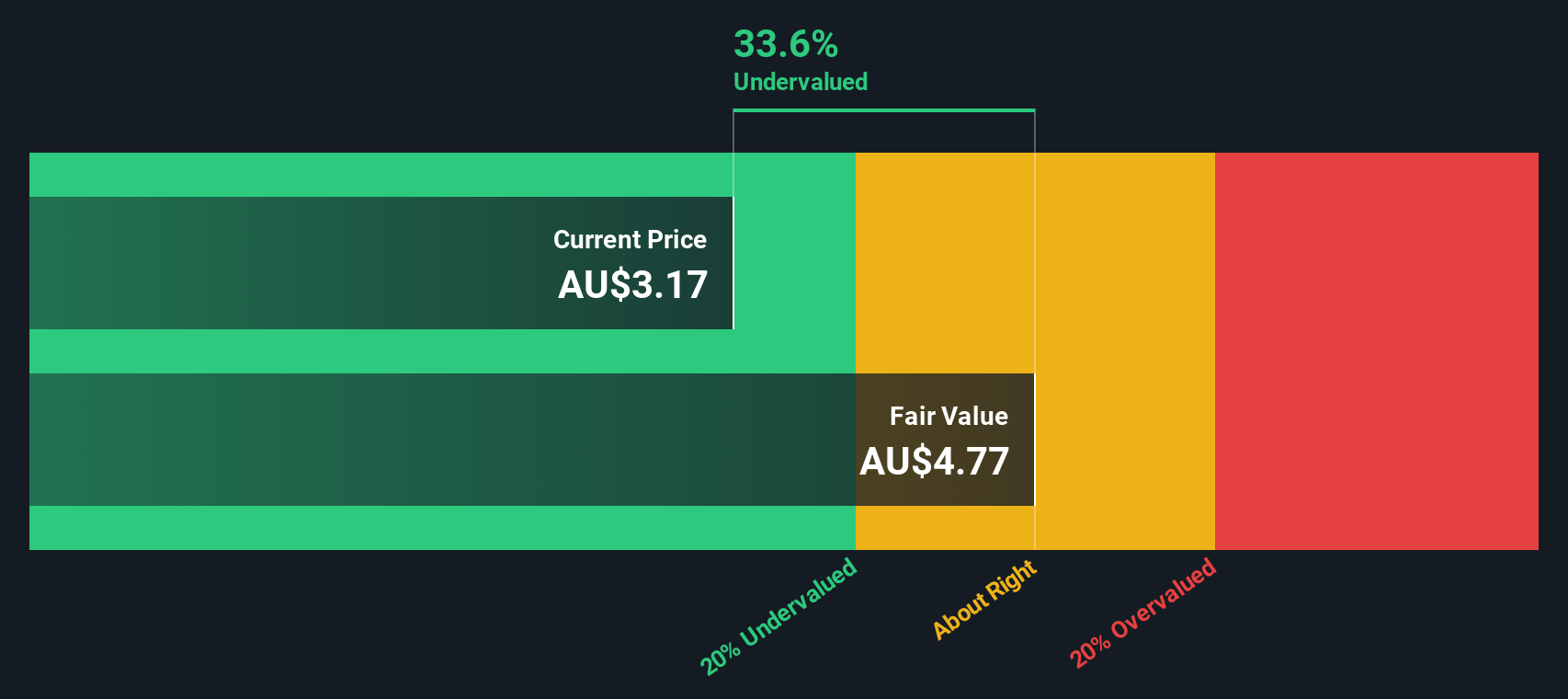

With South32 trading at A$3.81 and sitting on mixed multi year returns, attention turns to what is already reflected in the price. Is the market offering a value gap here, or is it assuming strong future growth?

Most Popular Narrative: 9% Overvalued

At A$3.81, South32 sits above the most followed fair value estimate of A$3.50, which is built on detailed revenue, margin and earnings projections.

Large-scale investment and progress in copper and base metals growth projects (Hermosa, expanded Sierra Gorda capacity) position South32 to benefit from rising demand for metals critical in renewables, electric vehicles, and global decarbonization, supporting revenue and future earnings growth.

Realized portfolio simplification and divestiture of lower margin, higher-risk coal assets refocus South32 on higher-return and future-facing commodities, increasing long-term net margins and improving the company's risk profile in line with energy transition trends.

Curious what kind of revenue pacing and margin reset underpin that A$3.50 mark, and how future earnings multiples are wired into the story? The full narrative lays out the cash flow and profitability path that needs to show up on South32’s income statement for today’s price to make sense.

Result: Fair Value of A$3.50 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, there are clear watchpoints here, including power supply uncertainty at Mozal and execution or cost risks on big projects such as Taylor and Sierra Gorda.

Find out about the key risks to this South32 narrative.

Another lens on value

That A$3.50 fair value narrative sits awkwardly beside our SWS DCF model, which points to a fair value of A$14.12. On that view, South32 at A$3.81 screens as deeply undervalued, not modestly overvalued. Which picture do you think better reflects the risks around Mozal, Cannington and growth projects?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out South32 for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 881 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own South32 Narrative

If you see the numbers differently or prefer to stress test the assumptions yourself, you can spin up your own South32 narrative in minutes: Do it your way.

A great starting point for your South32 research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If South32 has caught your eye, do not stop here. Broader opportunities across sectors could fit your goals just as well or even better.

- Spot potential mispricings by scanning these 881 undervalued stocks based on cash flows, which ties current prices closely to underlying cash flows and business fundamentals.

- Ride emerging themes in automation and machine learning by checking out these 28 AI penny stocks, which focuses on companies tied to real world AI adoption.

- Target income focused opportunities by screening these 11 dividend stocks with yields > 3%, which combines yield with a focus on underlying business quality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal