Mueller Water Products (MWA) Valuation Check After Defense And Infrastructure Spending News

Mueller Water Products (MWA) moved higher as investors rotated into defensive names following news of a large proposed government infrastructure and defense spending plan, with the stock gaining 3.5% in the afternoon session.

See our latest analysis for Mueller Water Products.

That 3.5% intraday move sits on top of a 4.95% 7 day share price return and a 4.43% year to date share price return, while the 1 year total shareholder return of 14.34% and 3 year total shareholder return of 115.64% suggest that momentum has been building over time.

If this kind of infrastructure driven interest has your attention, it may be a suitable moment to broaden your watchlist with aerospace and defense stocks.

So with the shares up 3.5% today, backed by a 14.34% 1 year total return and analysts seeing around 10.7% upside to a US$27.67 target, is there still a buying opportunity here, or is the market already pricing in more growth?

Most Popular Narrative: 9.6% Undervalued

With Mueller Water Products last closing at US$25.00 against a narrative fair value of about US$27.67, the current setup hinges on how durable earnings and margins can be.

Operational efficiency initiatives, including legacy foundry closures and modernization of iron foundries, are expected to further lower production costs and enable scalable capacity. This is anticipated to result in sustainable improvements to net margins and increased free cash flow generation over the coming years.

Curious what sits behind that confidence in higher margins and cash generation? Revenue growth expectations, a step change in profitability and a lower future P/E are all baked into this fair value story, but the exact mix of those levers might surprise you.

Result: Fair Value of $27.67 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, you should keep an eye on two pressure points: any prolonged delays in federal infrastructure funding and ongoing cost or tariff swings that could squeeze margins.

Find out about the key risks to this Mueller Water Products narrative.

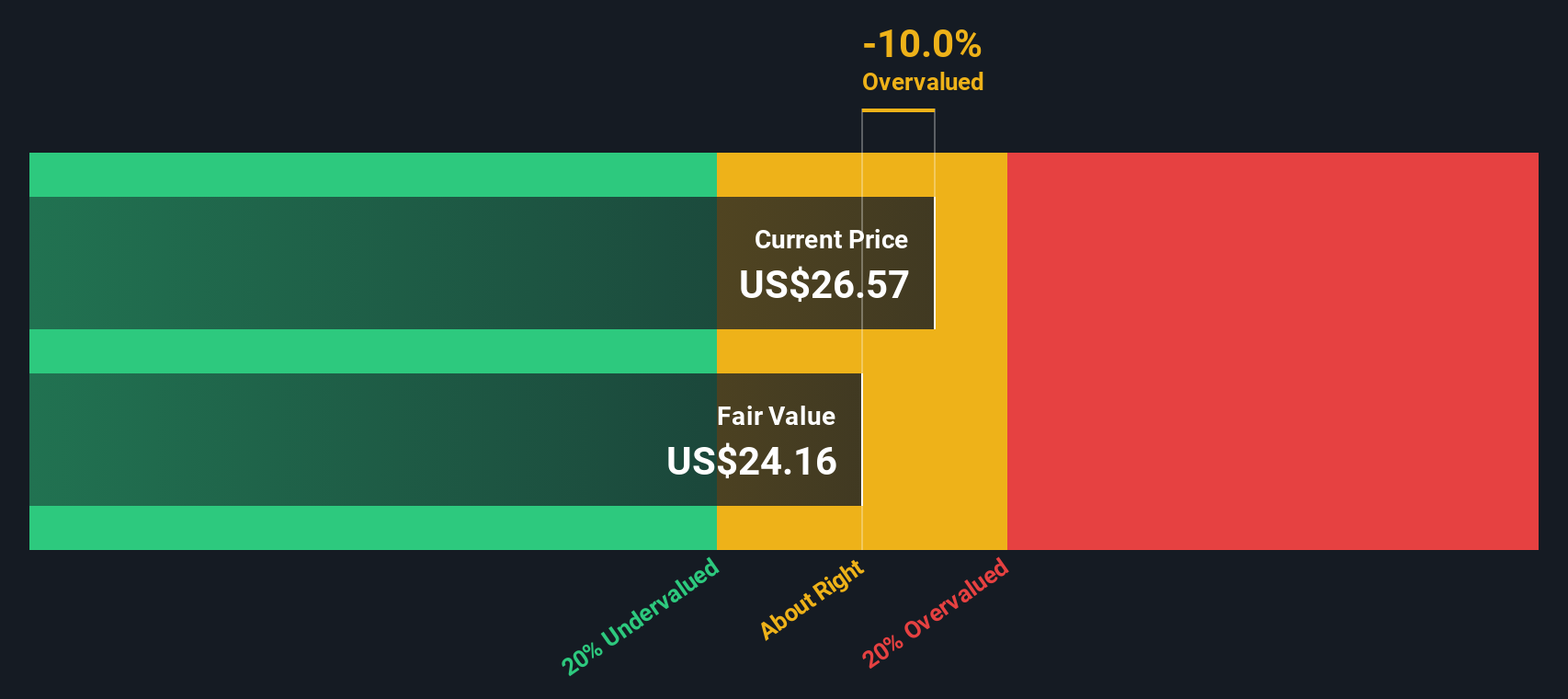

Another View: SWS DCF Says Slightly Overvalued

While the narrative fair value points to roughly 9.6% undervaluation at US$27.67, the SWS DCF model comes out differently. On that framework, Mueller Water Products looks slightly overvalued, with a fair value estimate of about US$24.05 versus the current US$25 share price. So which story do you find more convincing: cash flows or earnings multiples?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Mueller Water Products for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 881 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Mueller Water Products Narrative

If parts of this story do not line up with your own view, or you prefer to test the assumptions yourself, you can use the same data, adjust the inputs and build a custom Mueller Water Products thesis in just a few minutes, all set up for you with Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Mueller Water Products.

Ready For More Investment Ideas?

If Mueller Water Products has sparked your interest, do not stop here. The real edge comes from lining up a few more well chosen ideas beside it.

- Spot potential mispricings early by checking out these 881 undervalued stocks based on cash flows that might not yet be on everyone else’s radar.

- Ride powerful sector trends by scanning these 29 healthcare AI stocks shaping how data, diagnostics and treatment come together in real businesses.

- Add a higher risk, higher potential corner to your watchlist by reviewing these 79 cryptocurrency and blockchain stocks tied to blockchain, payments and digital infrastructure themes.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal