Optimistic Investors Push Daiichi Kigenso Kagaku Kogyo Co., Ltd. (TSE:4082) Shares Up 46% But Growth Is Lacking

Despite an already strong run, Daiichi Kigenso Kagaku Kogyo Co., Ltd. (TSE:4082) shares have been powering on, with a gain of 46% in the last thirty days. The last month tops off a massive increase of 151% in the last year.

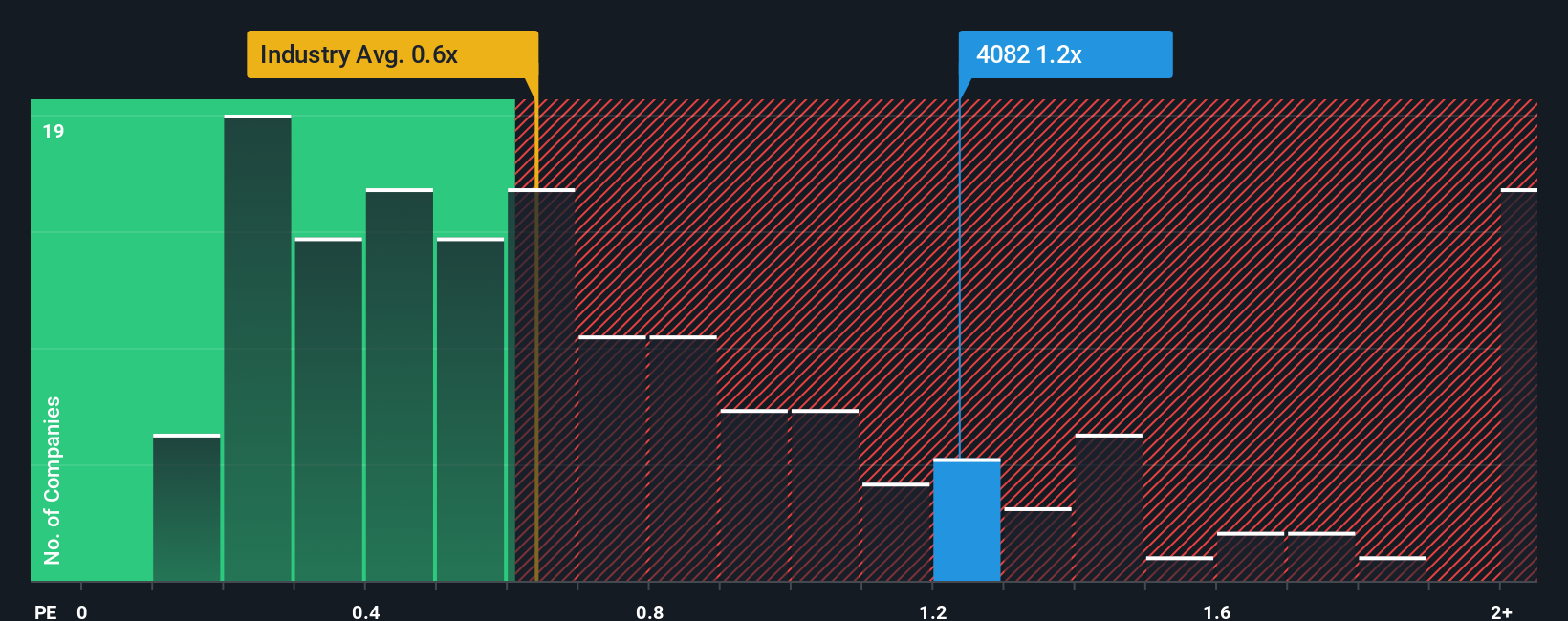

Following the firm bounce in price, you could be forgiven for thinking Daiichi Kigenso Kagaku Kogyo is a stock not worth researching with a price-to-sales ratios (or "P/S") of 1.2x, considering almost half the companies in Japan's Chemicals industry have P/S ratios below 0.6x. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Daiichi Kigenso Kagaku Kogyo

What Does Daiichi Kigenso Kagaku Kogyo's P/S Mean For Shareholders?

Daiichi Kigenso Kagaku Kogyo hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. One possibility is that the P/S ratio is high because investors think this poor revenue performance will turn the corner. If not, then existing shareholders may be extremely nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Daiichi Kigenso Kagaku Kogyo will help you uncover what's on the horizon.Is There Enough Revenue Growth Forecasted For Daiichi Kigenso Kagaku Kogyo?

In order to justify its P/S ratio, Daiichi Kigenso Kagaku Kogyo would need to produce impressive growth in excess of the industry.

Retrospectively, the last year delivered a frustrating 2.6% decrease to the company's top line. Regardless, revenue has managed to lift by a handy 7.2% in aggregate from three years ago, thanks to the earlier period of growth. So we can start by confirming that the company has generally done a good job of growing revenue over that time, even though it had some hiccups along the way.

Turning to the outlook, the next year should generate growth of 5.3% as estimated by the sole analyst watching the company. Meanwhile, the rest of the industry is forecast to expand by 3.5%, which is not materially different.

With this in consideration, we find it intriguing that Daiichi Kigenso Kagaku Kogyo's P/S is higher than its industry peers. It seems most investors are ignoring the fairly average growth expectations and are willing to pay up for exposure to the stock. Although, additional gains will be difficult to achieve as this level of revenue growth is likely to weigh down the share price eventually.

The Key Takeaway

Daiichi Kigenso Kagaku Kogyo's P/S is on the rise since its shares have risen strongly. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Given Daiichi Kigenso Kagaku Kogyo's future revenue forecasts are in line with the wider industry, the fact that it trades at an elevated P/S is somewhat surprising. When we see revenue growth that just matches the industry, we don't expect elevates P/S figures to remain inflated for the long-term. A positive change is needed in order to justify the current price-to-sales ratio.

You should always think about risks. Case in point, we've spotted 2 warning signs for Daiichi Kigenso Kagaku Kogyo you should be aware of, and 1 of them shouldn't be ignored.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal