Almonty Industries (TSX:AII) Valuation Check As New Chief Development Officer Takes Charge

Almonty Industries (TSX:AII) has appointed Guillaume Wiesenbach de Lamaziere, CFA, as Chief Development Officer. He has been tasked with leading corporate development as the company progresses its tungsten focused mining portfolio across Spain, Portugal, and South Korea.

See our latest analysis for Almonty Industries.

The appointment of a seasoned capital markets executive comes after a strong run in the share price, with a 31.43% 1 month share price return and an 18.60% 3 month share price return. The 1 year total shareholder return is very large, suggesting momentum that investors will be weighing against risks and valuation.

If this kind of move has you looking at materials and energy exposure, it could be a good time to broaden your watchlist with fast growing stocks with high insider ownership.

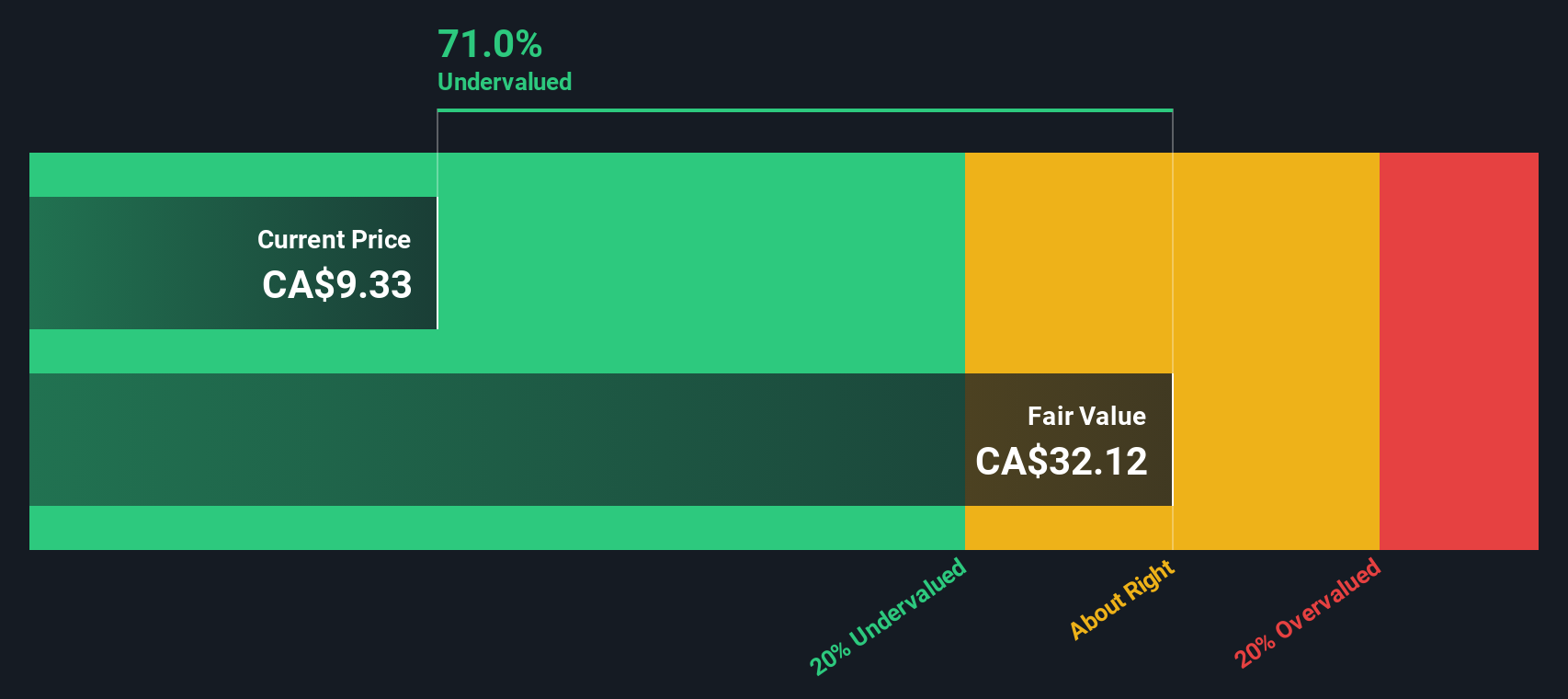

With Almonty reporting a very large 1 year total shareholder return, an indicated intrinsic discount of around 45%, and new leadership focused on corporate development, the key question for investors is whether this represents a genuine opportunity or whether the market has already priced in future growth.

Price to Book of 20.1x: Is it justified?

Almonty’s shares last closed at CA$12.88, and on a P/B basis the stock screens as expensive, with investors paying 20.1x its book value.

P/B compares the share price to the company’s net assets on the balance sheet. This is a common reference point for asset heavy sectors like metals and mining. A higher P/B usually signals that the market is assigning a premium to those assets, often tied to expectations about future profitability, project quality, or both.

For Almonty, the current 20.1x P/B stands well above the Canadian Metals and Mining industry average of 3.1x and above the peer average of 16x. That is a substantial premium, suggesting the market is pricing in stronger outcomes than the typical miner, despite the company being currently unprofitable and reporting a loss of CA$65.044m on revenue of CA$30.075m.

At the same time, our DCF model points to a different signal, with Almonty trading at an indicated 44.2% discount to an estimated fair value of CA$23.57 per share. The SWS DCF model projects future cash flows and discounts them back to today using an appropriate rate. This can produce a very different view compared to simple balance sheet multiples, especially for companies where investors are focused on future projects and forecast growth.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price to Book of 20.1x (OVERVALUED)

However, you also have to weigh the recent share price run against the ongoing CA$65.044m loss and the premium to the CA$10.45 analyst price target.

Find out about the key risks to this Almonty Industries narrative.

Another View: What The DCF Is Saying

While the 20.1x P/B suggests Almonty looks expensive against the industry, our DCF model points the other way. On those cash flow assumptions, the shares are trading at about a 44.2% discount to an estimated fair value of CA$23.57 per share. This frames the current price as potentially conservative rather than stretched.

Look into how the SWS DCF model arrives at its fair value.

If the P/B and SWS DCF model are sending such different messages, which one do you treat as your anchor, and how much conviction do you have in the inputs behind it?

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Almonty Industries for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 877 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Almonty Industries Narrative

If you see the numbers differently or prefer to work from your own assumptions, you can build a full view of Almonty in just a few minutes with Do it your way.

A great starting point for your Almonty Industries research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If you are serious about building a stronger portfolio, do not stop at one company. Use targeted stock ideas to spot opportunities before everyone else catches on.

- Target potential value with these 877 undervalued stocks based on cash flows, built to surface companies that may be trading below what their cash flows imply.

- Spot income ideas through these 12 dividend stocks with yields > 3%, focusing on businesses offering dividend yields above 3%.

- Get ahead of emerging themes with these 79 cryptocurrency and blockchain stocks, pointing you to stocks tied to cryptocurrency and blockchain trends.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal