Assessing Hamilton Lane (HLNE) Valuation After Pluto AI Lending Partnership And Recent Share Price Momentum

Hamilton Lane (HLNE) is back on investors’ radar after emerging as a balance sheet partner in Pluto Financial Technologies’ new AI-powered lending platform for private markets. This move directly connects the firm to private-asset credit growth.

See our latest analysis for Hamilton Lane.

The Pluto partnership lands at a time when momentum in Hamilton Lane's shares has been picking up. The 7 day share price return is 9.22% and the 90 day share price return is 24.05% from a latest share price of $146.7. The 3 year total shareholder return of 113.19% and 5 year total shareholder return of 93.20% point to a strong longer term track record, despite a relatively flat 1 year total shareholder return of 0.68%.

If you are interested in how private markets and AI are shaping other corners of finance, it could be worth scanning high growth tech and AI stocks as a next step.

With the share price already up strongly over the past quarter and Hamilton Lane trading at roughly a 14% discount to the average analyst price target, you have to ask: Is there still a buying opportunity here, or is the market already pricing in future growth?

Most Popular Narrative Narrative: 6.7% Undervalued

With Hamilton Lane closing at $146.70 versus a narrative fair value of $157.17, the current setup hinges on how sustainable future fee growth really is.

Healthy pipeline/backlog in customized separate accounts and perpetual fundraising strategies creates forward visibility into recurring revenue streams and earnings growth, while the high unrealized carry balance (~$1.3 billion) points to potential for strong incentive fee income as more favorable macro conditions enable exits and crystallization of performance fees.

Want to see what underpins that confidence in future earnings power? The narrative leans heavily on expanding recurring fees and richer margins, plus a punchy earnings multiple. Curious which assumptions really move that fair value?

Result: Fair Value of $157.17 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, there are still clear pressure points, including tighter regulation that could lift costs and fee compression, as competition and technology give clients more pricing power.

Find out about the key risks to this Hamilton Lane narrative.

Another Angle: Rich Multiple, Different Message

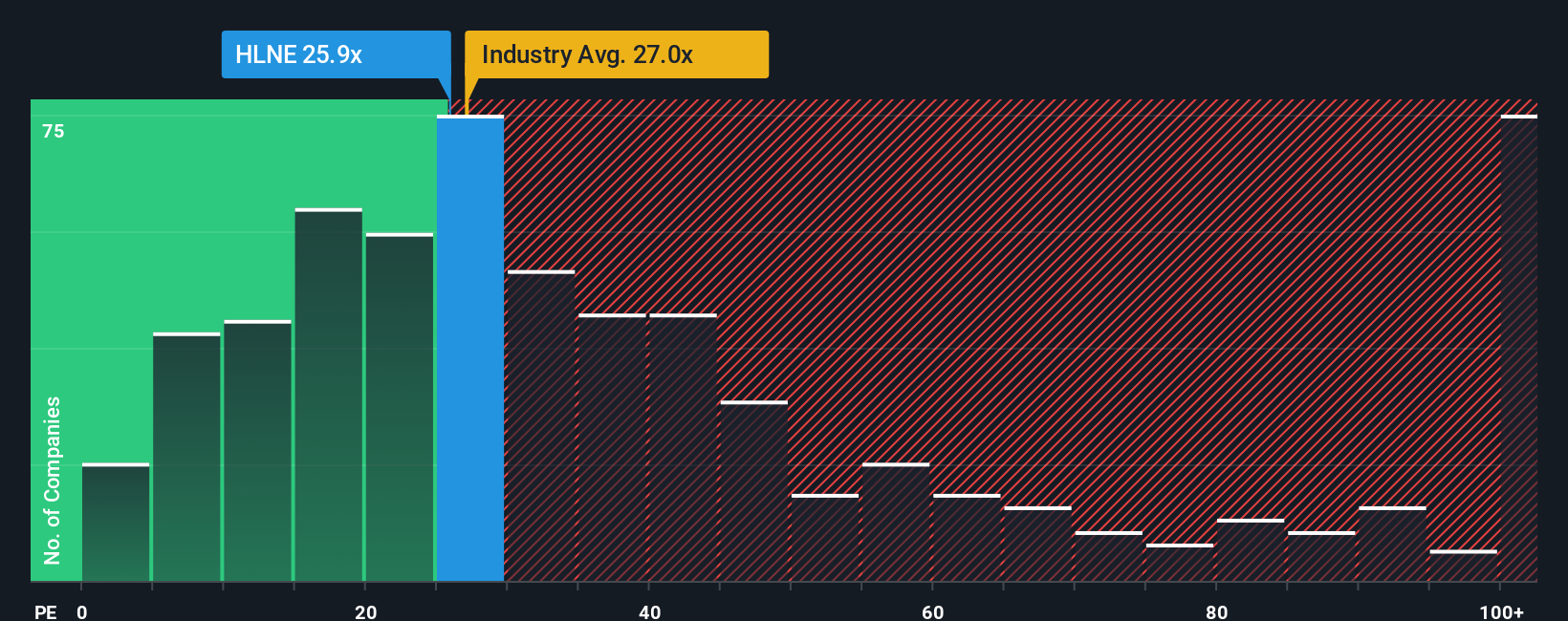

That 6.7% narrative discount paints Hamilton Lane as slightly undervalued. However, if you look at the current P/E of 27.9x versus peers at 14x and the broader US Capital Markets industry at 25.7x, the picture shifts toward a fuller price and higher valuation risk if growth expectations soften.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Hamilton Lane Narrative

If you see the story differently, or prefer to work from the raw numbers yourself, you can build a fresh narrative in minutes: Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Hamilton Lane.

Looking for more investment ideas?

If Hamilton Lane is on your radar, do not stop here. Use the same framework to hunt for fresh ideas across different themes and risk profiles.

- Hunt for potential value opportunities by scanning these 877 undervalued stocks based on cash flows that might be trading below what their cash flows suggest.

- Ride powerful tech trends by checking out these 27 AI penny stocks that are leaning into artificial intelligence and automation.

- Target income-focused opportunities by reviewing these 12 dividend stocks with yields > 3% that already offer yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal