Assessing Silicon Motion Technology (SIMO) Valuation After MindOne AI Smartphone Collaboration And Investor Conference Spotlight

Silicon Motion Technology (SIMO) is back in focus after iKKO, MediaTek, and SIMO jointly unveiled MindOne, a card sized AI smartphone built around always on AI connectivity, along with fresh visibility from recent investor conferences.

See our latest analysis for Silicon Motion Technology.

Those AI connectivity headlines and a busy investor conference schedule have arrived alongside a strong run in the shares, with a 7 day share price return of 19.77% and a 1 year total shareholder return of 107.56% suggesting momentum has been building from both shorter term trading and longer term holding periods.

If MindOne has you thinking more broadly about AI hardware and connectivity, this could be a good time to scan high growth tech and AI stocks for other potential ideas in the space.

With Silicon Motion Technology up more than 100% over the past year and trading only slightly below the average analyst price target of US$114, the key question is whether there is still a buying opportunity here or if the market is already pricing in future growth.

Most Popular Narrative Narrative: 2.6% Undervalued

Against the last close at US$111.03, the most followed narrative is anchored on a fair value of about US$114, built around AI driven storage demand.

The rapid expansion of high-performance storage demand from AI, data centers, cloud computing, and edge computing is fueling adoption of advanced NAND controller solutions, particularly Silicon Motion's PCIe Gen 5 and enterprise-focused MonTitan controllers, supporting robust future revenue and margin growth as these markets scale.

Curious how this story gets to that price? It leans on brisk revenue growth, higher margins, and a slimmer future earnings multiple than many chip peers.

Result: Fair Value of $114 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, there are real swing factors here, including intense price competition in NAND controllers and customer concentration that could pressure margins or disrupt that AI driven storage thesis.

Find out about the key risks to this Silicon Motion Technology narrative.

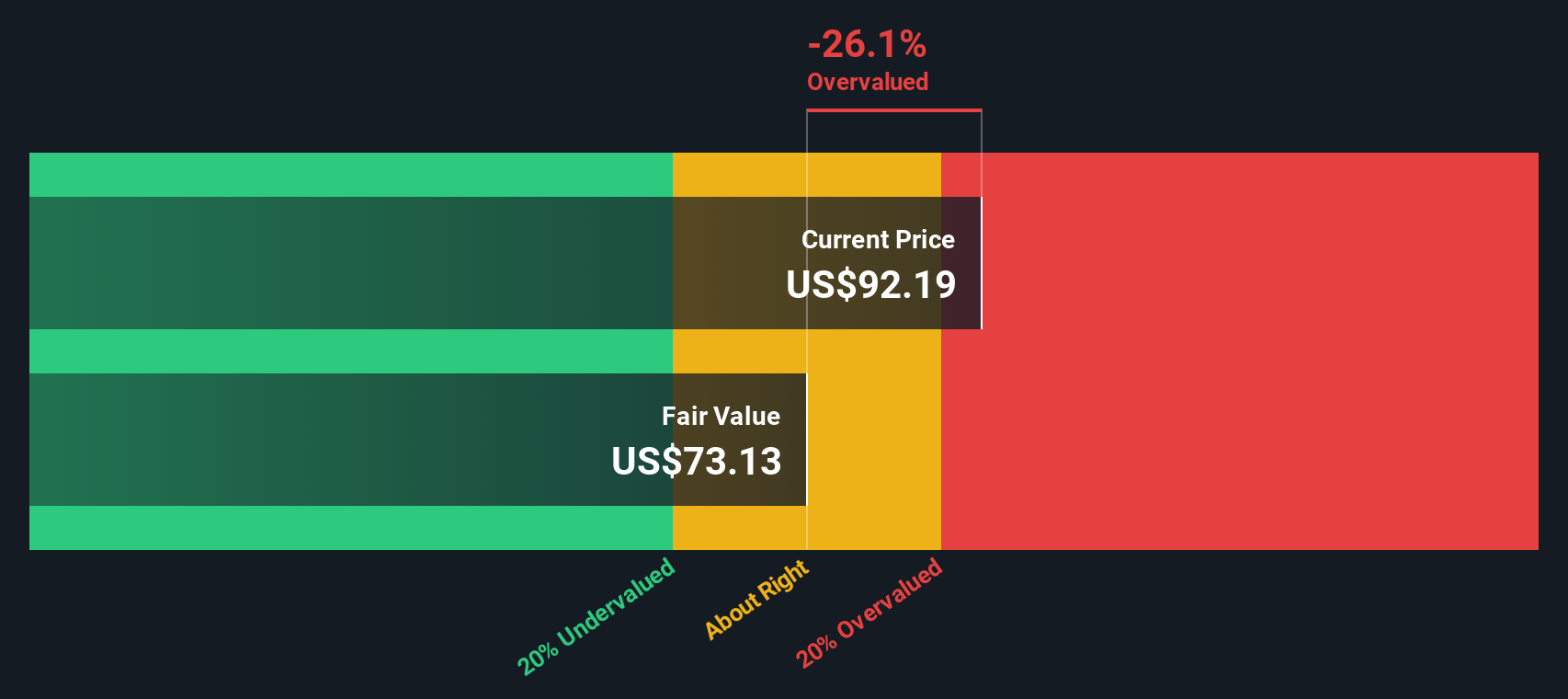

Another Angle: DCF Flags a Very Different Story

While the popular AI storage narrative points to a fair value of about US$114 and calls Silicon Motion slightly undervalued, our DCF model takes a far more cautious stance. On that measure, SIMO screens as expensive, with the current price well above an estimated fair value of US$36.51. The gap raises a simple question for you: which set of assumptions feels more realistic?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Silicon Motion Technology for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 878 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Silicon Motion Technology Narrative

If you look at these assumptions and feel unsure, or simply prefer to stress test the numbers yourself, you can create your own view in a few minutes and Do it your way.

A great starting point for your Silicon Motion Technology research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Hungry For More Stock Ideas?

If SIMO has sparked your interest, do not stop here. The best opportunities often sit just beyond the first idea that caught your eye.

- Target stronger income potential by scanning these 12 dividend stocks with yields > 3% that might suit a portfolio focused on regular cash returns.

- Spot potential early movers in AI by checking out these 27 AI penny stocks that link cutting edge technology with real business models.

- Hunt for mispriced opportunities with these 878 undervalued stocks based on cash flows that could offer more compelling entry points than headline names.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal