Is Atmos Energy (ATO) Pricing Reflect Long Term Returns And Safety Investments

- If you are wondering whether Atmos Energy at around US$166 is offering fair value or if you are paying up for quality, this article walks through what the current market price might be telling you.

- The stock has seen a 21.8% return over the last year, alongside a 53.4% return over three years and 113.0% over five years. This is despite the year-to-date move being a 1.9% decline, with smaller 0.9% and 0.6% declines over the last 7 and 30 days.

- Recent attention on Atmos Energy has focused on its role as a regulated gas utility and its ongoing investments in system upgrades and infrastructure safety. These factors can influence how investors think about long-term stability and pricing power. Together, these themes help frame why the share price performance has looked relatively resilient over multi-year periods even when short-term moves have been more muted.

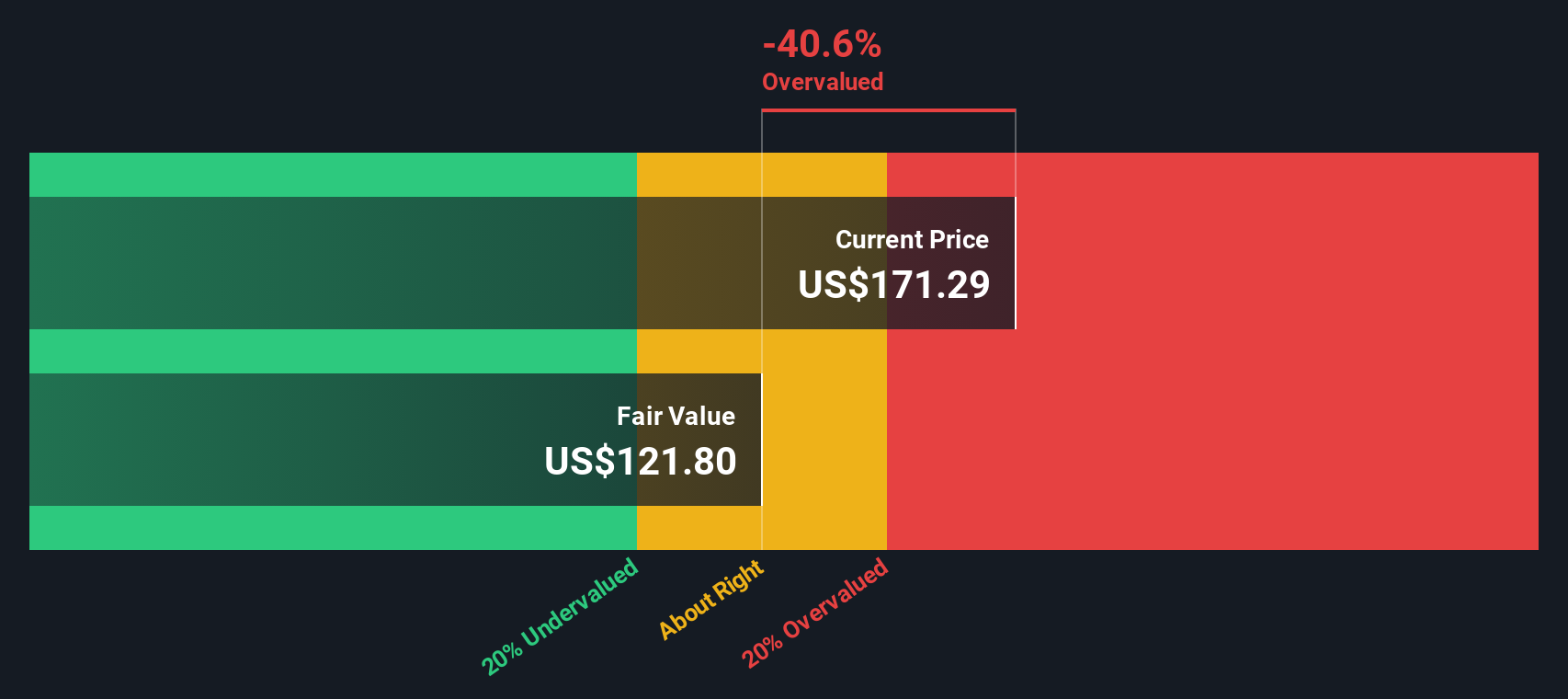

- At present, Atmos Energy scores a 1 out of 6 on Simply Wall St's valuation checks. In this article, we will look at what that means using several valuation approaches, and then finish with a way of thinking about value that goes beyond any single model.

Atmos Energy scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Atmos Energy Dividend Discount Model (DDM) Analysis

The Dividend Discount Model estimates what a stock might be worth by projecting all future dividends, applying an assumed growth rate, then discounting those cash flows back to today.

For Atmos Energy, the model uses a current dividend per share of about US$4.51, a return on equity of 9.01% and a payout ratio of roughly 47.27%. Simply Wall St caps the long term dividend growth rate at 3.26% from an initially higher 4.75%, while the broader expected growth input is 4.75%. This cap is intended to keep the dividend growth assumption in a range that appears more sustainable over time.

Based on these dividend projections, the DDM output suggests an intrinsic value of roughly US$121.96 per share. Compared with the recent share price around US$166, the model implies the stock is about 36.2% overvalued on this dividend based view.

Result: OVERVALUED

Our Dividend Discount Model (DDM) analysis suggests Atmos Energy may be overvalued by 36.2%. Discover 881 undervalued stocks or create your own screener to find better value opportunities.

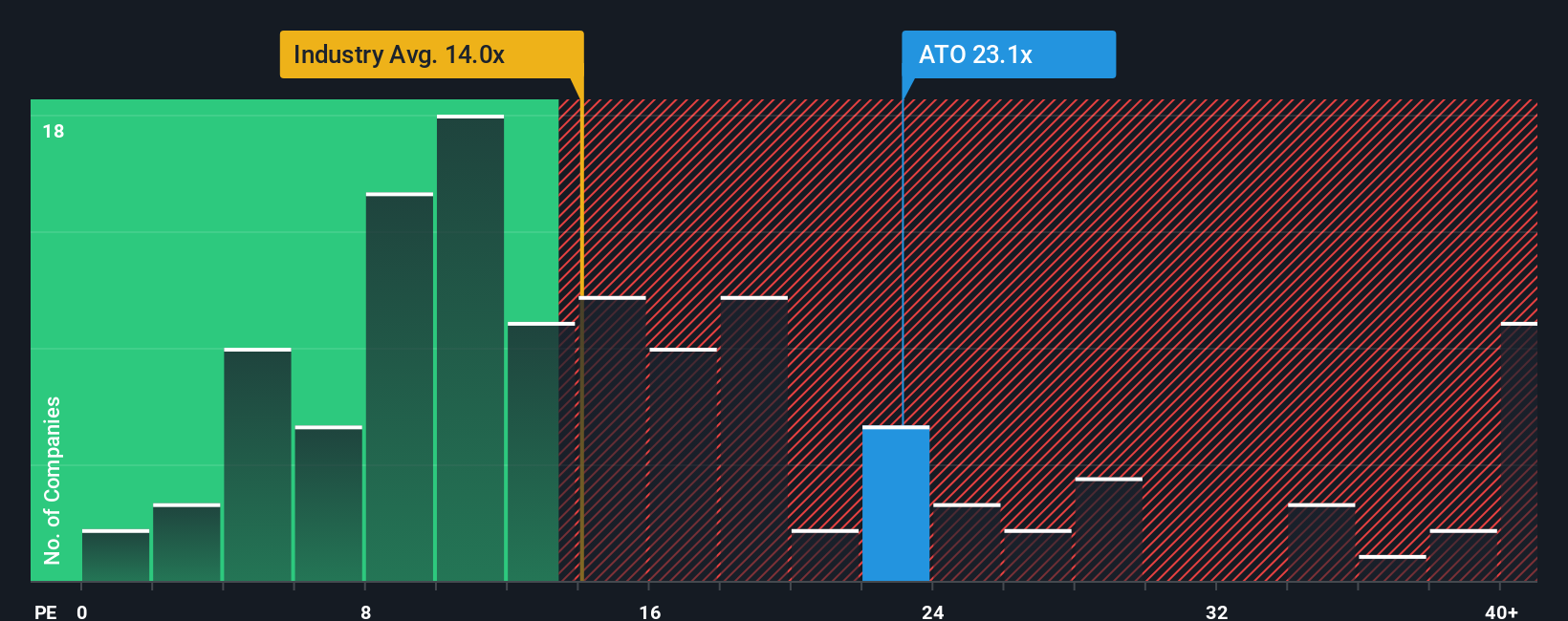

Approach 2: Atmos Energy Price vs Earnings

The P/E ratio is a common way to think about valuation for profitable companies because it ties what you pay directly to the earnings the business is currently generating. In general, higher expected earnings growth and lower perceived risk tend to support a higher P/E, while slower growth or higher risk usually line up with a lower “normal” range.

Atmos Energy currently trades on a P/E of about 22.4x. That sits above the Gas Utilities industry average of roughly 14.1x and also above the peer group average of about 17.3x, which suggests the market is willing to pay a higher price for each dollar of Atmos Energy’s earnings compared with many of its listed peers.

Simply Wall St’s Fair Ratio for Atmos Energy is 22.7x. This is a proprietary estimate of what the P/E might look like once you factor in company specific traits such as earnings growth, profit margins, industry, market cap and identified risks. Because it adjusts for these characteristics, the Fair Ratio can be more tailored than a simple comparison with broad industry or peer averages. With the current P/E of 22.4x sitting close to the Fair Ratio of 22.7x, the shares look priced at roughly the level this framework would suggest.

Result: ABOUT RIGHT

P/E ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1446 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Atmos Energy Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. These let you connect your view of Atmos Energy’s story to a financial forecast and a fair value, all within Simply Wall St’s Community page. There you can see how different investors frame the same stock, compare their Fair Value estimates with the current share price to decide whether they see Atmos as priced attractively or not, and watch those Narratives update automatically as new news or earnings arrive. One investor might build a thesis closer to the higher Fair Value estimate around US$176 based on expectations for earnings and margins, while another leans toward the lower end around US$141 because they focus more on risks such as higher capital spending, regulation or long term gas demand. You can then decide which story feels more realistic to you.

Do you think there's more to the story for Atmos Energy? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal