Top Asian Dividend Stocks Offering Yields Up To 7.0%

As Asian markets navigate a landscape of mixed economic signals, with China showing signs of manufacturing recovery and Japan experiencing shifts in monetary policy, dividend stocks have emerged as a compelling option for investors seeking stability amid uncertainty. In this context, selecting dividend stocks with robust yields can provide a steady income stream while potentially offering resilience against market volatility.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Yamato Kogyo (TSE:5444) | 3.60% | ★★★★★★ |

| Torigoe (TSE:2009) | 4.21% | ★★★★★★ |

| NCD (TSE:4783) | 3.75% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 3.92% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 4.09% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.36% | ★★★★★★ |

| Changjiang Publishing & MediaLtd (SHSE:600757) | 4.64% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.83% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 3.75% | ★★★★★★ |

| Binggrae (KOSE:A005180) | 4.50% | ★★★★★★ |

Click here to see the full list of 990 stocks from our Top Asian Dividend Stocks screener.

We'll examine a selection from our screener results.

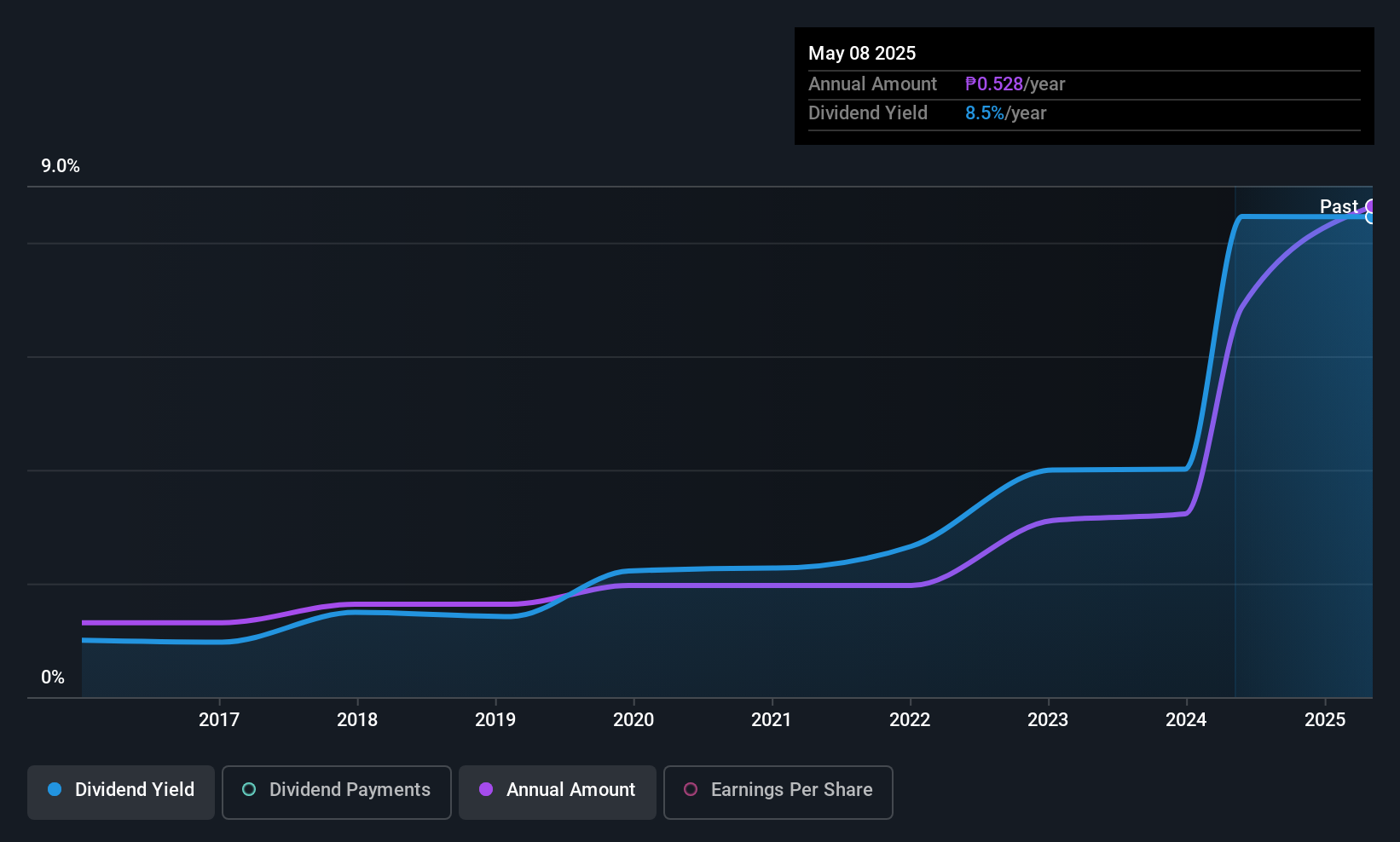

Cosco Capital (PSE:COSCO)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Cosco Capital, Inc. operates in the Philippines across various sectors including retail, real estate, liquor distribution, and oil and mineral exploration with a market capitalization of approximately ₱52.51 billion.

Operations: Cosco Capital's revenue is primarily derived from its grocery retail segment at ₱235.28 billion, followed by liquor distribution at ₱20.21 billion, specialty retail at ₱2.09 billion, and real estate and property leasing at ₱2.09 billion, with additional contributions from energy and minerals amounting to ₱586.18 million.

Dividend Yield: 7.1%

Cosco Capital's dividend payments are well-covered by both earnings and cash flows, with payout ratios of 18.5% and 16.9%, respectively. Despite a top-tier dividend yield of 7.07% in the Philippine market, its dividends have been volatile over the past decade, indicating an unreliable track record. Recent earnings growth supports potential sustainability, as net income for the first nine months of 2025 increased to PHP 10.70 billion from PHP 10.04 billion year-on-year.

- Click here to discover the nuances of Cosco Capital with our detailed analytical dividend report.

- The valuation report we've compiled suggests that Cosco Capital's current price could be quite moderate.

Essex Bio-Technology (SEHK:1061)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Essex Bio-Technology Limited is an investment holding company that develops, manufactures, and sells biologic drugs in China, Hong Kong, and internationally with a market cap of HK$2.33 billion.

Operations: Essex Bio-Technology generates revenue through its key segments, including Surgical (HK$884.30 million), Ophthalmology (HK$811.46 million), and Provision of Services (HK$22.05 million).

Dividend Yield: 3.4%

Essex Bio-Technology's dividends are well-supported by earnings and cash flows, with payout ratios of 23.5% and 45.7%, respectively. Despite trading at a significant discount to its estimated fair value, the dividend yield of 3.41% is below the top quartile in Hong Kong. The company's dividend history has been volatile over the past decade, reflecting an unstable track record despite recent earnings growth of 19.1%.

- Unlock comprehensive insights into our analysis of Essex Bio-Technology stock in this dividend report.

- Our expertly prepared valuation report Essex Bio-Technology implies its share price may be lower than expected.

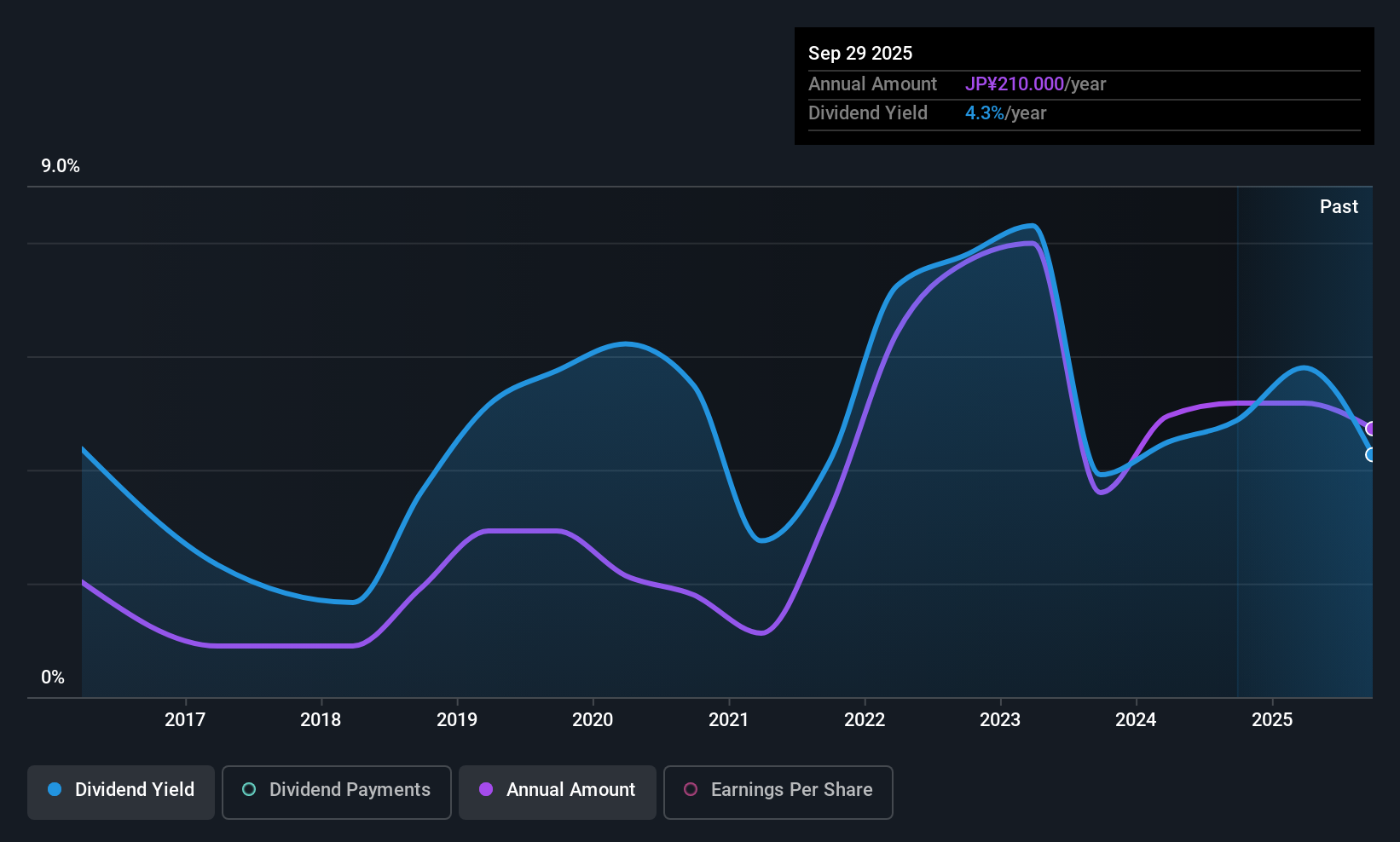

NS United Kaiun Kaisha (TSE:9110)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: NS United Kaiun Kaisha, Ltd. operates in marine transportation services both domestically and internationally, with a market cap of ¥153.65 billion.

Operations: NS United Kaiun Kaisha, Ltd. generates revenue from its Ocean Shipping Business, which accounts for ¥198.35 billion, and its Domestic Shipping Business, contributing ¥31.86 billion.

Dividend Yield: 3.8%

NS United Kaiun Kaisha's dividend payments are well-supported by earnings and cash flows, with payout ratios of 26.4% and 20.8%, respectively. The company recently increased its dividend guidance to ¥140 per share for the fiscal year ending March 2026, reflecting a commitment to shareholder returns amid improved earnings forecasts. Despite trading below estimated fair value, the dividend yield of 3.76% ranks in Japan's top quartile, though historical volatility suggests an unstable track record over the past decade.

- Delve into the full analysis dividend report here for a deeper understanding of NS United Kaiun Kaisha.

- Insights from our recent valuation report point to the potential undervaluation of NS United Kaiun Kaisha shares in the market.

Key Takeaways

- Take a closer look at our Top Asian Dividend Stocks list of 990 companies by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal