Asian Value Stocks Estimated Up To 38.4% Below Intrinsic Value

As global markets navigate a complex landscape of economic indicators and geopolitical tensions, investors are increasingly turning their attention to the Asian market for opportunities. In this environment, identifying undervalued stocks can be particularly rewarding, as these equities may offer significant potential relative to their intrinsic value.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Zhejiang Century Huatong GroupLtd (SZSE:002602) | CN¥19.06 | CN¥37.98 | 49.8% |

| Xiamen Amoytop Biotech (SHSE:688278) | CN¥82.07 | CN¥161.67 | 49.2% |

| WuXi XDC Cayman (SEHK:2268) | HK$68.40 | HK$135.71 | 49.6% |

| PeptiDream (TSE:4587) | ¥1747.00 | ¥3449.68 | 49.4% |

| Mobvista (SEHK:1860) | HK$15.44 | HK$30.63 | 49.6% |

| Meitu (SEHK:1357) | HK$7.42 | HK$14.63 | 49.3% |

| CURVES HOLDINGS (TSE:7085) | ¥792.00 | ¥1577.34 | 49.8% |

| Contec.Co.Ltd (KOSDAQ:A451760) | ₩14490.00 | ₩28785.36 | 49.7% |

| ASE Technology Holding (TWSE:3711) | NT$273.50 | NT$538.87 | 49.2% |

| Aidma Holdings (TSE:7373) | ¥3160.00 | ¥6305.80 | 49.9% |

Let's review some notable picks from our screened stocks.

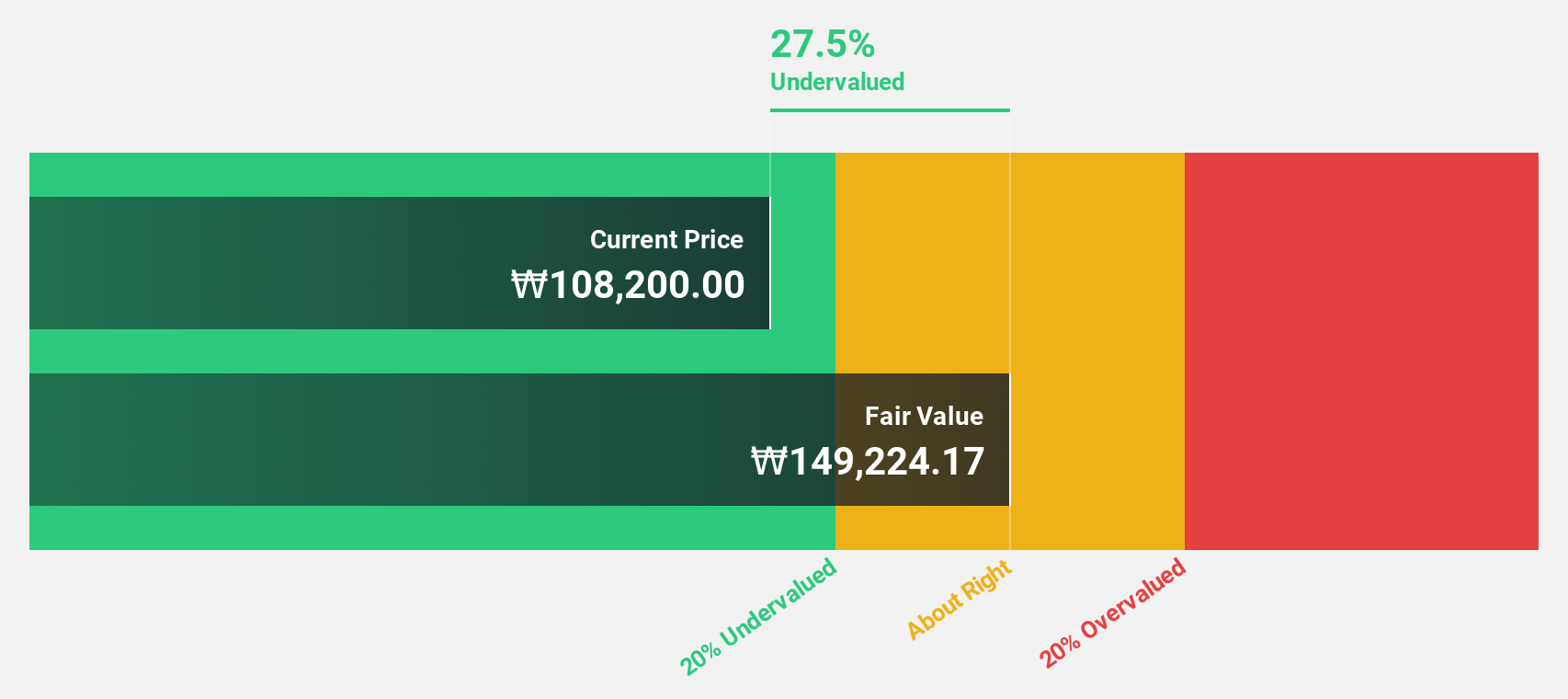

ST PharmLtd (KOSDAQ:A237690)

Overview: ST Pharm Co., Ltd. offers manufacturing services for active pharmaceutical ingredients and intermediates, with a market cap of ₩2.65 trillion.

Operations: The company's revenue segments include Raw Material Manufacturing at ₩286.25 billion and Clinical Trial Contract Research at ₩37.48 billion.

Estimated Discount To Fair Value: 15.9%

ST Pharm Ltd. is trading at ₩128,200, slightly below its estimated fair value of ₩152,429.94, offering a modest undervaluation based on discounted cash flow analysis. Despite one-off items affecting recent results, the company's earnings are forecast to grow significantly at 37.9% annually over the next three years—outperforming the Korean market's growth rate of 32.8%. Recent presentations and earnings calls indicate management's focus on aligning with global industry trends for sustained growth.

- Our expertly prepared growth report on ST PharmLtd implies its future financial outlook may be stronger than recent results.

- Get an in-depth perspective on ST PharmLtd's balance sheet by reading our health report here.

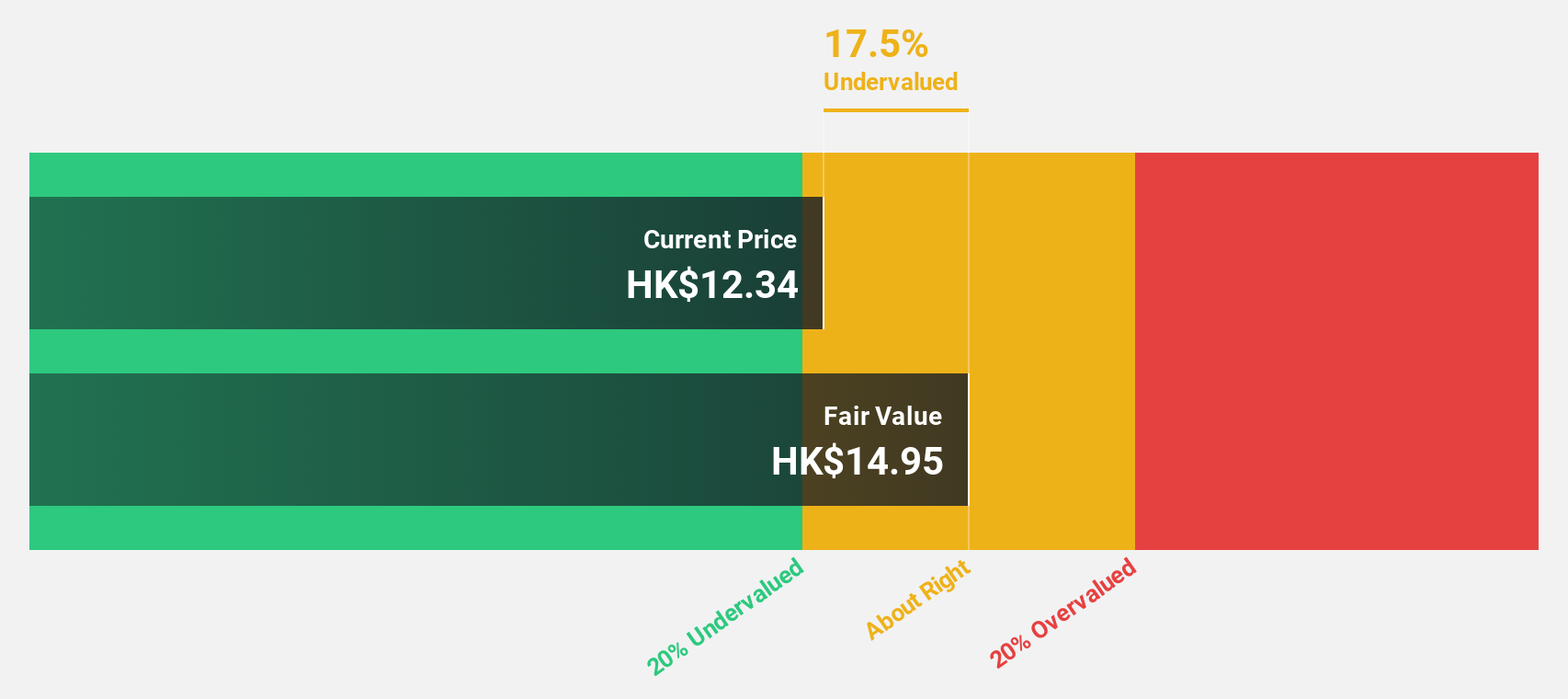

MicroPort NeuroScientific (SEHK:2172)

Overview: MicroPort NeuroScientific Corporation specializes in providing neuro-interventional medical devices and has a market cap of HK$7.49 billion.

Operations: The company generates revenue of CN¥736.47 million from its Surgical & Medical Equipment segment.

Estimated Discount To Fair Value: 20.2%

MicroPort NeuroScientific, trading at HK$13, is undervalued compared to its estimated fair value of HK$16.28, offering a significant discount based on discounted cash flow analysis. Despite revenue growth forecasts of 16.9% annually being moderate relative to some expectations, the company's earnings are projected to grow significantly at 27.6% per year—outpacing the Hong Kong market's average growth rate of 12%. Recent board changes could enhance strategic direction and operational efficiency.

- The analysis detailed in our MicroPort NeuroScientific growth report hints at robust future financial performance.

- Take a closer look at MicroPort NeuroScientific's balance sheet health here in our report.

Shenzhen Transsion Holdings (SHSE:688036)

Overview: Shenzhen Transsion Holdings Co., Ltd. and its subsidiaries offer smart devices and mobile services across Africa, South and Southeast Asia, the Middle East, Latin America, and globally, with a market cap of CN¥77.14 billion.

Operations: Shenzhen Transsion Holdings Co., Ltd. generates revenue through its provision of smart devices and mobile services across various regions, including Africa, South and Southeast Asia, the Middle East, Latin America, and other international markets.

Estimated Discount To Fair Value: 38.4%

Shenzhen Transsion Holdings is trading at CN¥67.01, significantly below its estimated fair value of CN¥108.75, according to discounted cash flow analysis. Despite a decline in net income to CN¥2.15 billion for the first nine months of 2025 compared to the previous year, earnings are projected to grow substantially at 30.1% annually over the next three years, surpassing market averages and indicating strong future profitability potential despite current revenue challenges.

- According our earnings growth report, there's an indication that Shenzhen Transsion Holdings might be ready to expand.

- Click to explore a detailed breakdown of our findings in Shenzhen Transsion Holdings' balance sheet health report.

Where To Now?

- Unlock more gems! Our Undervalued Asian Stocks Based On Cash Flows screener has unearthed 256 more companies for you to explore.Click here to unveil our expertly curated list of 259 Undervalued Asian Stocks Based On Cash Flows.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal