Assessing Tractor Supply (TSCO) Valuation After Recent Share Price Weakness

Why Tractor Supply Stock Is On Investors’ Radar Today

Tractor Supply (TSCO) shares have been under pressure recently, with the stock showing negative returns over the past week, month, past 3 months, and year. This performance is prompting investors to reassess what they are paying for this rural retailer.

See our latest analysis for Tractor Supply.

With the latest share price at $49.89 and a 30 day share price return of a 6.47% decline, recent weakness contrasts with a 5 year total shareholder return of 76.70%, suggesting momentum has faded even as long term holders still sit on gains.

If Tractor Supply’s recent pullback has you reassessing retail ideas, it could be a useful moment to broaden your search with fast growing stocks with high insider ownership.

With revenue at US$15.4b, net income of US$1.1b and a recent share price pullback, the key question now is whether Tractor Supply is trading below its underlying worth or if the market already reflects its future growth potential.

Most Popular Narrative: 21% Undervalued

At a last close of $49.89 versus a narrative fair value of $63.15, the current price sits well below what this framework suggests, with that gap built on a detailed view of future earnings and margins.

Analysts expect earnings to reach $1.4 billion (and earnings per share of $2.76) by about September 2028, up from $1.1 billion today. In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 29.2x on those 2028 earnings, up from 28.8x today.

Curious what justifies paying a premium P/E multiple for a rural retailer, and which growth and margin assumptions sit behind that confidence? The most followed narrative sketches out a revenue path, a profit step up and a richer multiple than the broader specialty retail group. It also incorporates ongoing buybacks that quietly lift earnings per share. If you want to see exactly how those moving parts combine into that higher fair value, the full narrative lays the entire blueprint out for you.

Result: Fair Value of $63.15 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that upbeat fair value story still depends on comparable sales holding up and on tariff or cost pressures not squeezing margins more than expected.

Find out about the key risks to this Tractor Supply narrative.

Another Way To Look At Valuation

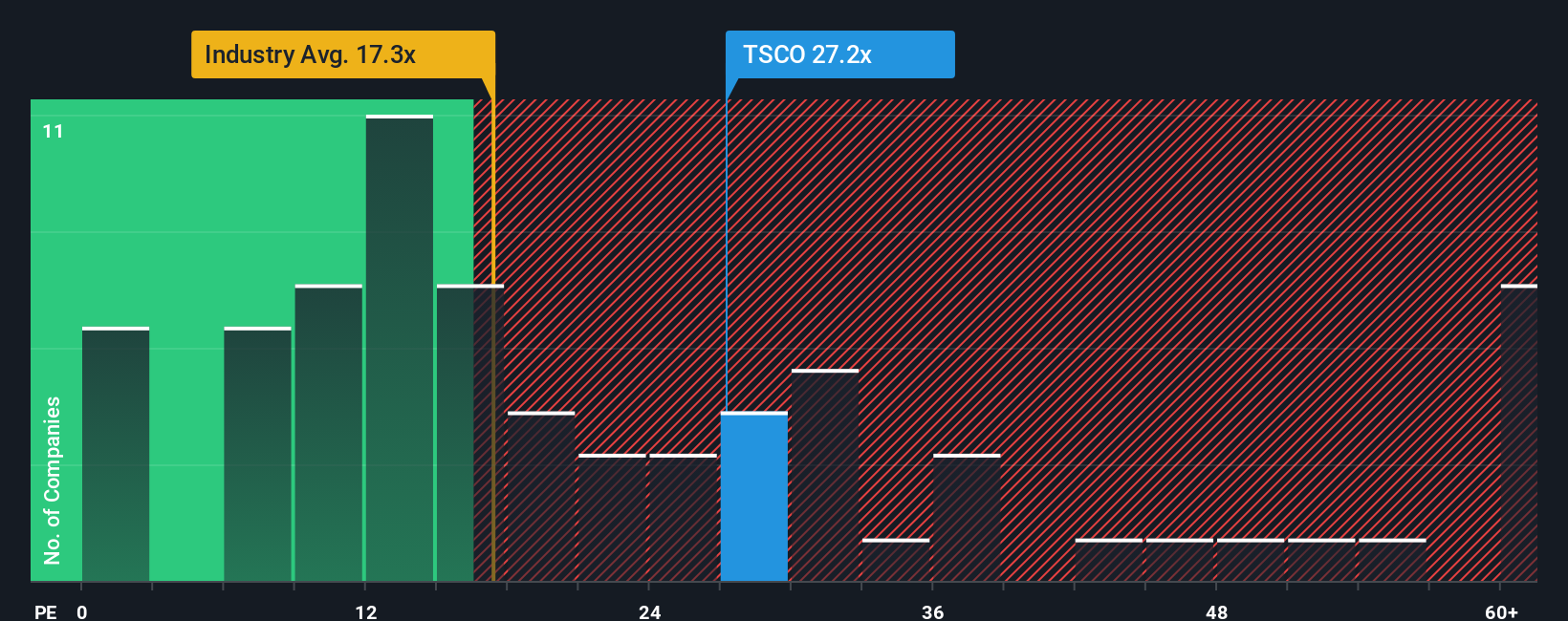

The narrative fair value points to Tractor Supply being 21% undervalued, but the current P/E of 23.9x tells a more cautious story. It sits above both the US Specialty Retail average of 20.7x and the fair ratio of 18x, which suggests less room for error if sentiment or earnings soften.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Tractor Supply Narrative

If you look at this and think the story should read differently, or you just prefer testing the numbers yourself, you can spin up your own view in a few minutes with Do it your way.

A great starting point for your Tractor Supply research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If Tractor Supply got you thinking harder about where you put your money next, do not stop here; some of the most interesting ideas sit just beyond your current watchlist.

- Spot potential early movers by checking out these 3543 penny stocks with strong financials that already back their story with solid financials and balance sheets.

- Evaluate the growth of digital infrastructure by scanning these 79 cryptocurrency and blockchain stocks shaping payments, security, and blockchain applications across different industries.

- Strengthen your income stream by reviewing these 12 dividend stocks with yields > 3% that combine higher yields with disciplined payout histories.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal