Assessing Amkor Technology (AMKR) Valuation After Needham’s Upgraded AI Packaging Outlook

Analyst firm Needham & Company has taken a more optimistic view on Amkor Technology (AMKR), pointing to its position in advanced semiconductor packaging for AI chips and the potential for outsourced work from Taiwan Semiconductor Manufacturing Co.

See our latest analysis for Amkor Technology.

The recent enthusiasm around Amkor, including its 25 year high tied to AI packaging expectations, aligns with strong momentum, with a 90 day share price return of 72.12% and a 1 year total shareholder return of 105.50%.

If AI packaging is on your radar, this may be a useful moment to scan other chip related names using our high growth tech and AI stocks.

With Amkor trading at $52.72 against an analyst target of $39.38 and an intrinsic value estimate that sits below the market, you have to ask yourself: is there still a buying opportunity here, or is the AI future already priced in?

Price-to-Earnings of 42.3x: Is it justified?

On a P/E of 42.3x at a last close of US$52.72, Amkor screens slightly expensive versus its own fair P/E estimate and roughly in line with the wider semiconductor group.

The P/E multiple compares the current share price to earnings per share and is a quick way to see how much investors are paying for each dollar of profit. For a company like Amkor, which is tied to semiconductor packaging and testing, the P/E often reflects expectations around future chip demand and how much of that work it can capture.

Here, the market is assigning a P/E of 42.3x. This is the same as the US semiconductor industry average and below the 48.4x peer group average. At the same time, it sits above the estimated fair P/E of 40.2x, suggesting the valuation is leaning ahead of where our fair ratio work implies the multiple could settle if expectations cool.

Compared with the industry, Amkor looks priced in line with the typical semiconductor name, yet cheaper than its immediate peer set on this earnings measure. The gap to the fair P/E ratio is small but points to the market paying a premium versus where earnings alone would anchor the stock, leaving less room if sentiment around results or AI packaging demand softens.

Explore the SWS fair ratio for Amkor Technology

Result: Price-to-Earnings of 42.3x (OVERVALUED)

However, the current share price premium to both analyst targets and intrinsic value estimates, alongside reliance on AI driven packaging demand, could quickly unwind if expectations reset.

Find out about the key risks to this Amkor Technology narrative.

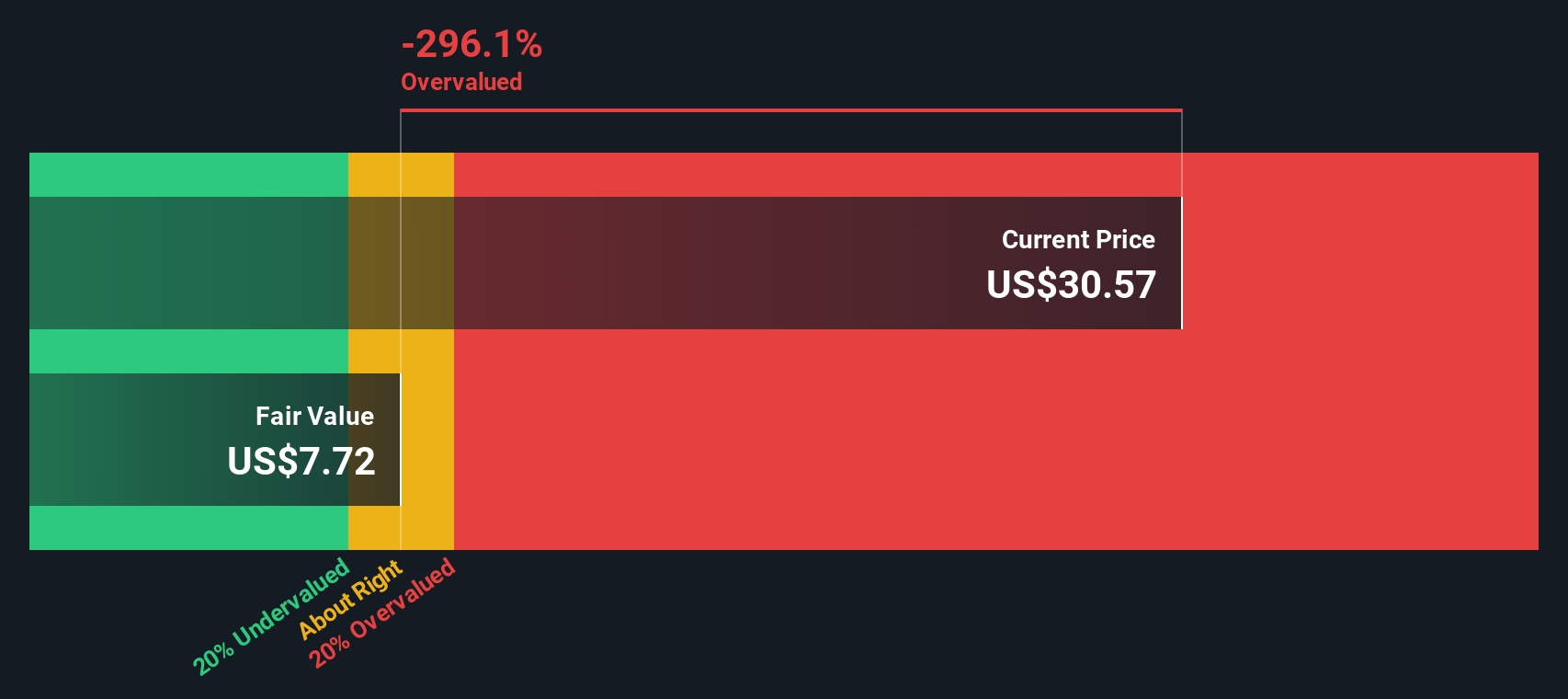

Another View: Our DCF Model Flags Clear Overvaluation

While the P/E suggests Amkor is roughly in line with the broader chip group, our DCF model comes out much tougher. It points to a fair value of about US$4.19 per share, which is far below the current US$52.72 price, implying a richly valued stock rather than a bargain. If earnings or AI excitement cool, that kind of gap can matter a lot for your downside.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Amkor Technology for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 883 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Amkor Technology Narrative

If you reach a different conclusion or simply prefer to weigh the numbers yourself, you can shape a personalised view in just a few minutes, starting with Do it your way.

A great starting point for your Amkor Technology research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If you stop at Amkor, you could miss other opportunities that fit your style, so use the screener to widen your options and sharpen your watchlist.

- Spot potential mispriced stocks early by checking out these 883 undervalued stocks based on cash flows that may offer more compelling entry points.

- Explore the AI build out with these 27 AI penny stocks that sit at the heart of data, chips, and computing power.

- Access fast growing niches through these 79 cryptocurrency and blockchain stocks tied to blockchain, digital assets, and next generation payment rails.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal