Hisamitsu Pharmaceutical (TSE:4530) Margin Improvement Challenges Cautious Growth Narratives

Hisamitsu Pharmaceutical (TSE:4530) has reported Q3 2026 results with revenue of ¥39,571 million and basic EPS of ¥69.15, setting the tone for a quarter where profitability remains firmly in focus. The company has seen quarterly revenue move between ¥35,665 million and ¥44,753 million over the past six reported periods, while basic EPS has ranged from ¥35.13 to ¥111.00. This gives investors a clear view of how the top line and EPS have tracked through recent quarters. With trailing 12 month EPS at ¥277.47 and net profit margins higher than a year ago, the latest earnings update points to a period where margin quality sits at the center of the story.

See our full analysis for Hisamitsu Pharmaceutical.With the headline numbers on the table, the next step is to see how this earnings print lines up against the prevailing narratives around Hisamitsu Pharmaceutical’s growth, profitability, and risk profile.

Curious how numbers become stories that shape markets? Explore Community Narratives

Margins Strengthen With 12.6% Net Profit Level

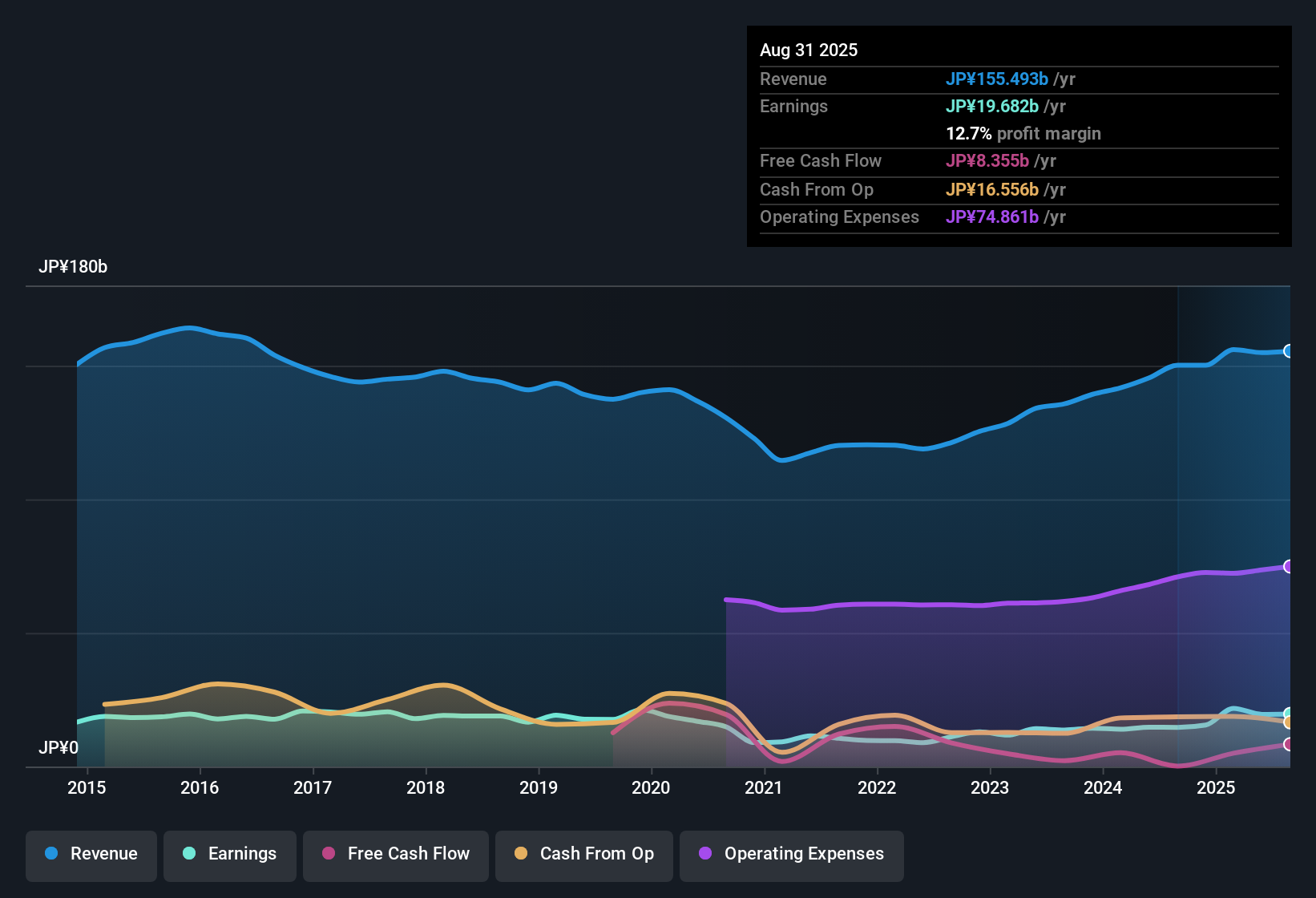

- Over the last 12 months, Hisamitsu converted ¥159,267 million in revenue into ¥19,988 million of net income, giving a 12.6% net profit margin compared with 10.3% the year before.

- Bulls point to this 12.6% margin and 28.6% earnings growth over the year as proof that profitability is resilient, yet the data also show only about 4.4% annual revenue growth, which can cap how far that bullish view can lean on margins alone.

- The trailing 12 month EPS of ¥277.47 is materially higher than the quarterly EPS run rate, so the bullish angle is heavily supported by the full year, not just a single strong period.

- At the same time, revenue over the last year grew at roughly the same 4.4% pace that forecasts point to, so the improved margin rather than rapid sales growth is doing most of the work for that bullish story.

Premium 22.6x P/E Versus Peers

- The shares trade on a trailing P/E of 22.6x, which sits above the peer average of 11.5x and the JP Pharmaceuticals industry average of 17x.

- Critics highlight this higher multiple as a bearish talking point, and the figures give that concern some footing because the company’s 4.4% forecast revenue growth and 0.3% forecast earnings growth trail the broader JP market expectations of 4.7% and 8.6%.

- When earnings are forecast to grow only 0.3% per year while the market is at 8.6%, paying a 22.6x P/E versus 17x for the industry is the kind of gap bears focus on.

- However, the 16.8% five year annualized earnings growth and 28.6% growth over the past year partly explain why the multiple has been able to sit above peers even with these slower forward estimates.

DCF Fair Value Sits Well Above ¥6,440 Share Price

- The current share price of ¥6,440 is about 31.2% below a DCF fair value estimate of ¥9,357.68, based on the figures provided.

- Supporters of a bullish view argue that this DCF gap, together with the trailing 12 month EPS of ¥277.47 and 28.6% earnings growth, suggests the market is not fully reflecting the company’s recent profitability in the price.

- The implied DCF discount is substantial, while the company has produced ¥19,988 million of net income over the last year, giving concrete earnings behind that valuation signal.

- At the same time, forecasts for 0.3% yearly earnings growth and modest 4.4% revenue growth offer a counterpoint, which can explain why the price has not moved closer to the DCF fair value yet.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Hisamitsu Pharmaceutical's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Hisamitsu pairs stronger margins with relatively modest 4.4% revenue growth and 0.3% earnings growth forecasts, which lag broader market expectations and raise questions about future momentum.

If you want companies where growth expectations are doing more of the heavy lifting, check out CTA_SCREENER_LARGE_CAP_HIGH_GROWTH_POTENTIAL to quickly spot established names forecast for stronger earnings gains.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal