Marzetti (MZTI) Valuation Check After Record Quarter And Strong Branded And Licensed Product Demand

Marzetti (MZTI) is in focus after reporting quarterly results that topped revenue expectations, with record sales, gross profit, and operating income drawing renewed attention to its mix of branded products and licensed sauces.

See our latest analysis for Marzetti.

At a share price of $165.06, Marzetti’s recent 4.07% 1 month share price return sits against a 1 year total shareholder return of 0.58% decline and a 5 year total shareholder return of 5.86%, suggesting modest long term gains with only recently improving momentum around its record quarter.

If Marzetti’s latest quarter has you looking around the food space, it could be a moment to size up opportunities across healthcare stocks as another defensive corner of the market.

With record quarterly results, 3.5% revenue growth and an annual revenue base of about US$1.94b, plus a near 20% discount to the US$197.20 analyst target, the key question is whether Marzetti is still mispriced or if the market already reflects its future growth potential.

Most Popular Narrative: 17.1% Undervalued

With Marzetti last closing at US$165.06 against a narrative fair value of US$199, the current price sits below what this widely followed view suggests.

The launch of newly licensed and branded products (such as the national rollout of Texas Roadhouse dinner rolls and new core brand innovations) is expected to drive retail volume growth and further premiumization, directly supporting top-line revenue and, given the mix shift, potentially expanding net margins.

Want to see what is behind that valuation gap? The narrative leans heavily on gradually rising margins and earnings, plus a richer P/E than the broader food group. Curious which assumptions really carry the weight here?

Result: Fair Value of $199 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the narrative could unravel if private label growth squeezes pricing power, or if higher soybean oil and packaging costs persistently pressure margins.

Find out about the key risks to this Marzetti narrative.

Another View: What The P/E Ratio Is Saying

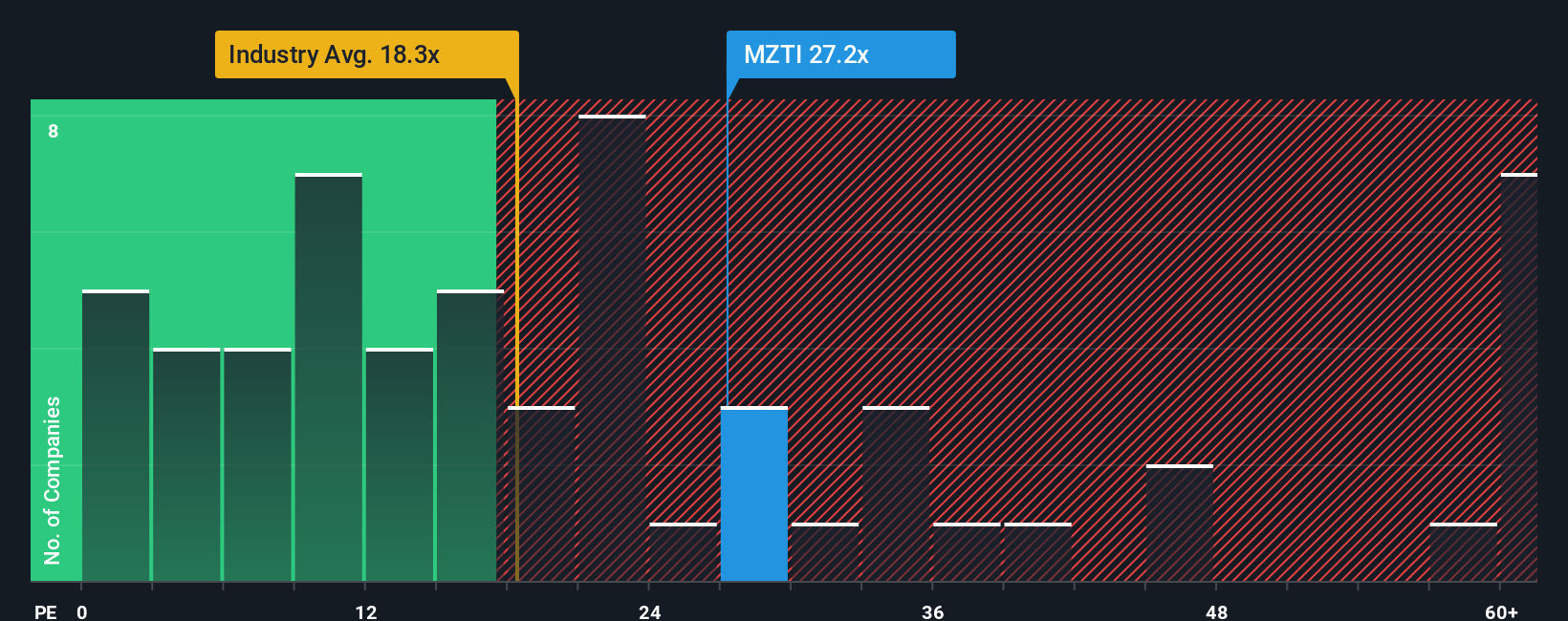

While the consensus narrative tags Marzetti as 17.1% undervalued at a fair value of US$199, the current P/E of 26.8x paints a tougher picture. It is higher than both the US Food industry average of 19.8x and an estimated fair ratio of 15.7x, which points to a rich valuation and less room for disappointment. The key question is whether the story is about potential upside or about how much optimism is already priced in.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Marzetti Narrative

If you see the numbers differently, or prefer to test the assumptions yourself, you can build a custom view in minutes with Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Marzetti.

Ready For More Investment Ideas?

If Marzetti has sharpened your appetite for opportunities, do not stop here; the next step is lining up fresh ideas that could reshape your portfolio.

- Scan for potential value where expectations look too low by checking out these 883 undervalued stocks based on cash flows that might warrant a closer look.

- Tap into powerful long term themes by reviewing these 27 AI penny stocks shaping how artificial intelligence shows up in real businesses.

- Target income focused opportunities by filtering for these 12 dividend stocks with yields > 3% that already carry yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal