A Look At CRA International (CRAI) Valuation After Recent Share Price Momentum

CRA International stock triggered by recent performance

CRA International (CRAI) has caught investor attention after a recent run that includes a 14.49% move over the past month and a 19.63% gain over the past 3 months, prompting a closer look at its fundamentals.

See our latest analysis for CRA International.

Looking beyond the recent run, CRA International’s 1-year total shareholder return of 17.86% and 5-year total shareholder return of 283.90% point to momentum that has built over time. The recent 7-day and 30-day share price returns suggest that interest has picked up again at a share price of $214.55.

If CRA International’s recent move has you thinking about what else is working in this part of the market, it could be worth scanning fast growing stocks with high insider ownership as a next step.

With CRA International trading at $214.55, around a 30% discount to one intrinsic estimate and below a $252.50 analyst target, you have to ask yourself whether this is a genuine value opportunity or whether the market is already banking on future growth.

Most Popular Narrative: 15% Undervalued

With CRA International last closing at $214.55 against a narrative fair value of about $252.50, the valuation work suggests meaningful upside is already built into the model.

The revised price target around US$252.50 reflects confidence that the updated revenue growth and profit margin assumptions reasonably support the current earnings framework and P/E inputs. Being grouped with a curated list of peers across different industries is seen as a vote of confidence in CRA International's execution profile and its ability to participate in sector level opportunities.

Want to see what earnings path and margin profile sit behind that fair value? The narrative leans on steady revenue progress, resilient profitability and a richer future P/E multiple. Curious which specific assumptions have the most impact on that $252.50 figure and how sensitive it is to small changes in growth?

Result: Fair Value of $252.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this hinges on continued M&A and regulatory activity, as well as on CRA International managing talent retention and compensation, both of which could pressure margins if conditions shift.

Find out about the key risks to this CRA International narrative.

Another angle on valuation

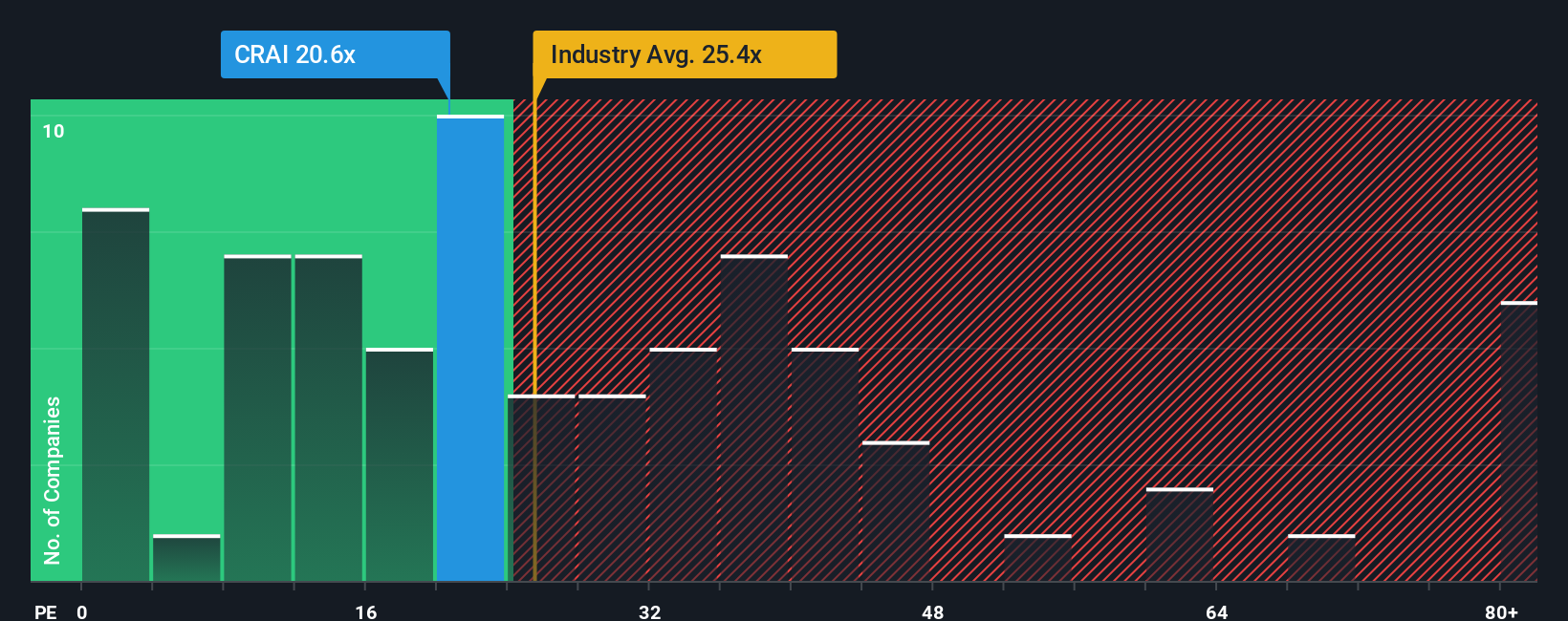

The first approach paints CRA International as about 30% below one intrinsic estimate. Its current P/E of 24.9x is well above a fair ratio of 18.4x, even if it sits roughly in line with the US Professional Services industry and below peers at 39.1x. Is the market already pricing in a lot of good news here, or is this a gap you think can close over time?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own CRA International Narrative

If you see the data differently or prefer to run your own numbers, you can sketch out a tailored CRA International story in minutes. To begin, start with Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding CRA International.

Looking for more investment ideas?

If CRA International has sparked your interest, do not stop here, use the Simply Wall St Screener to spark fresh ideas that fit your style and goals.

- Target income-focused opportunities by scanning these 12 dividend stocks with yields > 3% that might appeal if you want cash flow alongside potential capital returns.

- Spot potential value plays by reviewing these 882 undervalued stocks based on cash flows that currently trade below their estimated cash flow based fair values.

- Get ahead of emerging tech themes by checking out these 29 quantum computing stocks that could benefit as quantum computing research progresses.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal