A Look At Stryker (SYK) Valuation After Raymond James Outperform Upgrade

Raymond James’ upgrade of Stryker (SYK) to “Outperform” has put the stock back in focus after the firm highlighted five years of double digit organic revenue growth and a stronger financial outlook.

See our latest analysis for Stryker.

The Raymond James upgrade appears to have acted as a fresh catalyst after a softer 90 day share price return of a 0.66% decline. The recent 7 day share price return of 4.63% and a 1 year total shareholder return of 1.94% suggest momentum is picking up from a relatively muted base.

If Stryker’s move has you rethinking the sector, this could be a useful moment to broaden your search across healthcare stocks that are catching market interest.

With Stryker now trading at $367.75 against an average analyst target of about $427, and recent returns still relatively modest, the key question is whether you are seeing an underappreciated compounder or a stock that already reflects expectations for future growth in its current price.

Most Popular Narrative: 13.9% Undervalued

The most followed narrative places Stryker’s fair value around $427.22 compared with the last close at $367.75, framing today’s price as a discount that depends heavily on long term growth and margin assumptions.

The ongoing industry shift to outpatient and minimally invasive procedures, where Stryker is a leading supplier of ASC infrastructure and advanced surgical solutions, positions the company to benefit from increased procedure volumes and deeper customer penetration, bolstering both revenue and operating leverage.

Curious how that growth story turns into a higher price tag? The narrative focuses on rising earnings power, richer margins and a premium future P/E that has to hold up. Want to see exactly what earnings, revenue and margin paths are included in that fair value, and how they compare with today’s multiples?

Result: Fair Value of $427.22 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this upbeat view could be challenged by longer regulatory delays on key products, as well as ongoing supply chain issues that pressure margins and hold back revenue progress.

Find out about the key risks to this Stryker narrative.

Another View: Rich Multiples Temper The Undervaluation Story

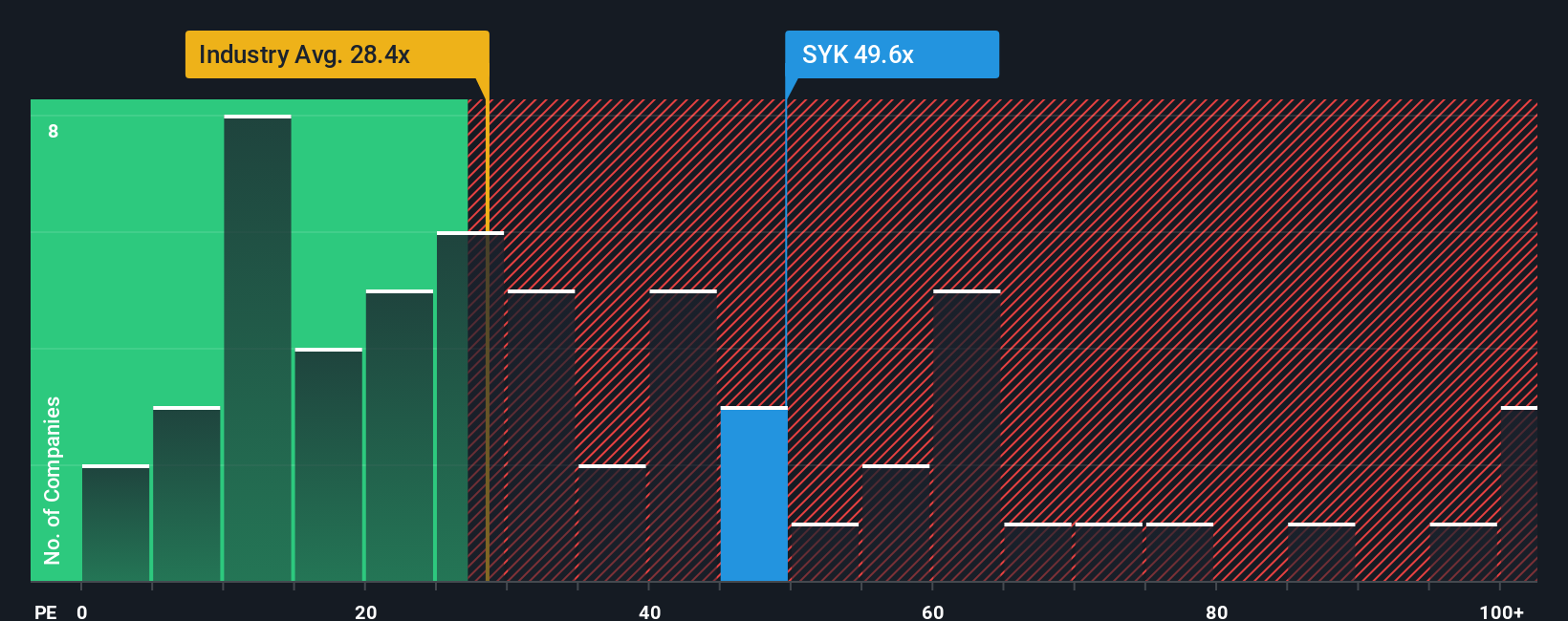

That 13.9% “undervalued” fair value hinges on long term growth and margin expansion, but the current P/E of 47.8x tells a tougher story. It sits above the Medical Equipment industry at 30.8x, peers at 42.9x, and even the fair ratio of 40.5x, which points to valuation risk rather than a clear bargain.

If the market edges closer to that 40.5x fair ratio, would you view that as a healthy reset, or instead as a signal to look elsewhere for potentially more attractive pricing?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Stryker Narrative

If you look at this and think the assumptions do not quite fit your view, you can test the numbers yourself, shape your own thesis and Do it your way

A great starting point for your Stryker research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Stryker has sharpened your thinking, do not stop there. Use this moment to broaden your watchlist with ideas that match your style and risk appetite.

- Target potential mispricings by checking out these 881 undervalued stocks based on cash flows that may offer more attractive entry points based on their cash flow profiles.

- Spot companies at the crossroads of medicine and machine learning by scanning these 29 healthcare AI stocks already on investors’ radars.

- Tap into the growing intersection of equities and digital assets with these 79 cryptocurrency and blockchain stocks that are tied to blockchain and cryptocurrency themes.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal