The Bull Case For Aramark (ARMK) Could Change Following UAlbany Dining Overhaul Partnership And New Education Leaders

- In early January 2026, Aramark announced a 15-year partnership with the University at Albany to overhaul campus dining under the Great Dane Hospitality brand, introducing concepts like the District East food hall, the Global Food Emporium, tech-enabled convenience, and inclusive dining options.

- At the same time, Aramark’s appointments of Barbara Flanagan and Brisbane Vaillancourt to lead its collegiate and K-12 education segments highlight how leadership focus on student experience and operational efficiency is central to its push in the education dining market.

- We’ll now examine how this long-term UAlbany partnership, centered on tech-enabled and inclusive campus dining, may recalibrate Aramark’s investment narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Aramark Investment Narrative Recap

To own Aramark, you need to believe its long-duration contracts, especially in Education and Sports & Entertainment, can compound steady revenue while technology investments help protect thin margins from labor and healthcare cost pressures. The new 15‑year UAlbany partnership reinforces the long-term contract win catalyst in higher education, but it does not materially change the immediate risks tied to wage inflation, medical claims, and potential labor disruptions that can quickly squeeze profitability.

Among recent announcements, the appointment of Barbara Flanagan to lead Aramark Collegiate Hospitality looks most connected to the UAlbany deal, since both center on reshaping the student dining experience through innovation, inclusion, and operational discipline. For investors watching education as a growth engine, this pairing of a large, tech-enabled campus contract with an experienced operator in Collegiate Hospitality may be an important proof point for Aramark’s ability to convert institutional outsourcing demand into durable, higher quality revenue.

Yet behind these long contracts, investors should be aware that rising labor and healthcare costs could still...

Read the full narrative on Aramark (it's free!)

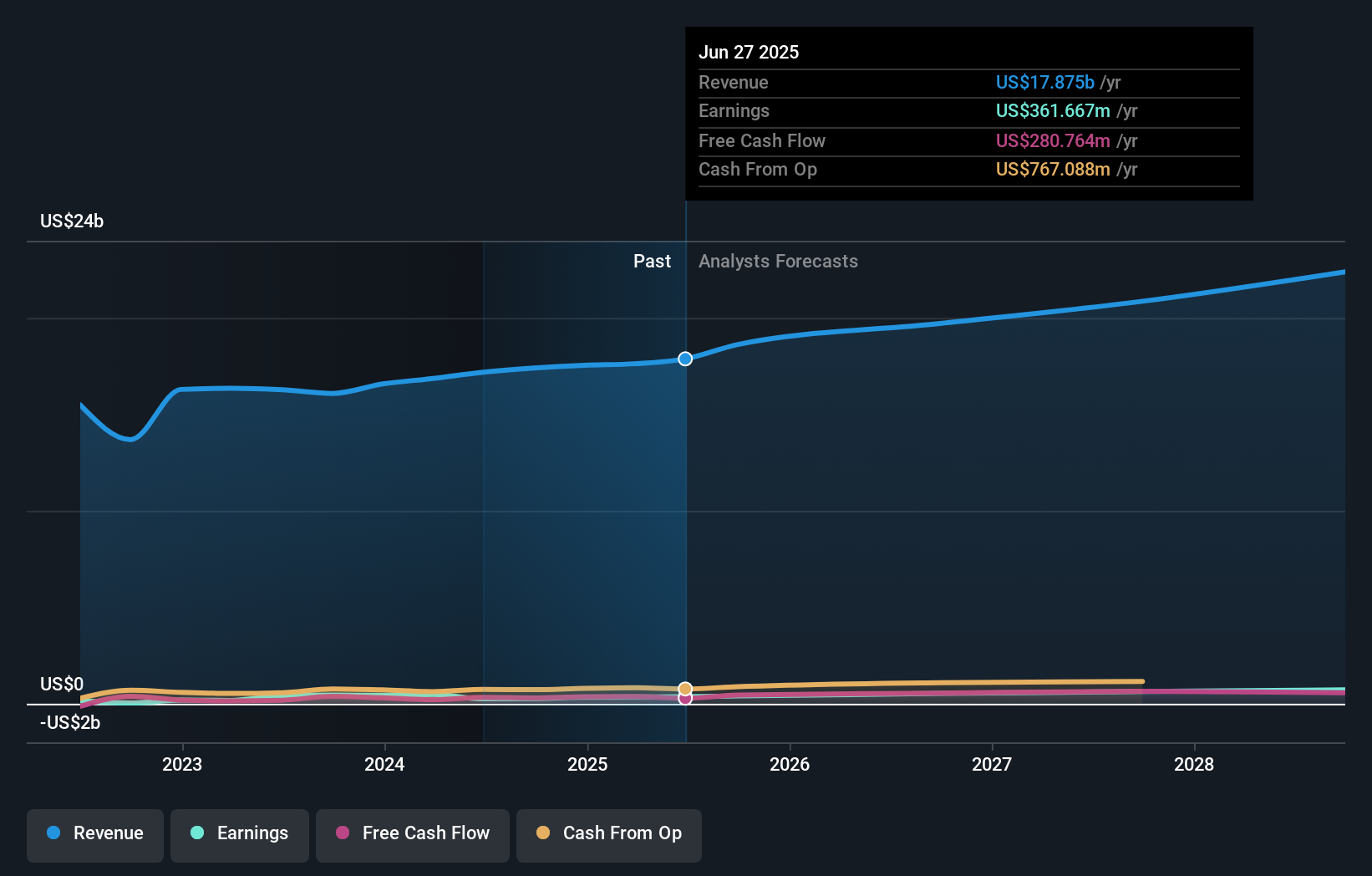

Aramark's narrative projects $21.9 billion revenue and $695.7 million earnings by 2028. This requires 7.1% yearly revenue growth and an earnings increase of about $334 million from $361.7 million today.

Uncover how Aramark's forecasts yield a $44.60 fair value, a 16% upside to its current price.

Exploring Other Perspectives

Two Simply Wall St Community fair value estimates span roughly US$29.99 to US$44.60, underlining how far apart individual views on Aramark can be. When you set that against the company’s push for large, multi year education contracts, it highlights why many investors compare several independent perspectives before deciding how much of Aramark’s future performance they want to factor in today.

Explore 2 other fair value estimates on Aramark - why the stock might be worth as much as 16% more than the current price!

Build Your Own Aramark Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Aramark research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Aramark research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Aramark's overall financial health at a glance.

Looking For Alternative Opportunities?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

- This technology could replace computers: discover 29 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal