ACV Auctions (ACVA) Valuation After Earnings Miss And 2025 Guidance Cut

ACV Auctions (ACVA) is back in focus after management reported revenues and earnings below expectations, tied to fewer listings converting into transactions, and cut its 2025 guidance. This has prompted institutions such as TimesSquare Capital to reassess their holdings.

See our latest analysis for ACV Auctions.

The 1 day share price return of a 0.94% decline and a 6.62% decline over 90 days suggest momentum has been fading, while the 59.93% 1 year total shareholder return loss points to investors reassessing growth prospects and risk after the guidance cut.

If ACV Auctions’ recent swings have you rethinking your approach, this could be a good moment to scan other auto related names through our auto manufacturers.

With ACV Auctions now trading at US$8.47, sitting at a steep 1 year total return loss and a value score of 2, you have to ask: is this weakness a genuine opportunity, or is the market already pricing in its growth reset?

Most Popular Narrative: 19% Undervalued

With ACV Auctions last closing at US$8.47 against a narrative fair value of US$10.46, the valuation hinges heavily on long term scaling of its model.

The company's successful commercialization of value added adjacent services such as ACV Transport and ACV Capital is increasing share of wallet among dealer partners and leveraging network effects, directly supporting both revenue acceleration and net margin improvement as operating scale increases.

Curious what kind of revenue climb, margin shift, and future earnings multiple are baked into that fair value? The narrative leans on ambitious growth, richer profitability, and a premium earnings framework. Want to see how those moving parts fit together and what has to go right for this pricing to hold up?

Result: Fair Value of $10.46 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, you also have to factor in softer dealer volumes and unproven projects such as new remarketing centers and Project Viper, which could weigh on margins if monetization lags.

Find out about the key risks to this ACV Auctions narrative.

Another View: Sales Multiple Sends A Different Signal

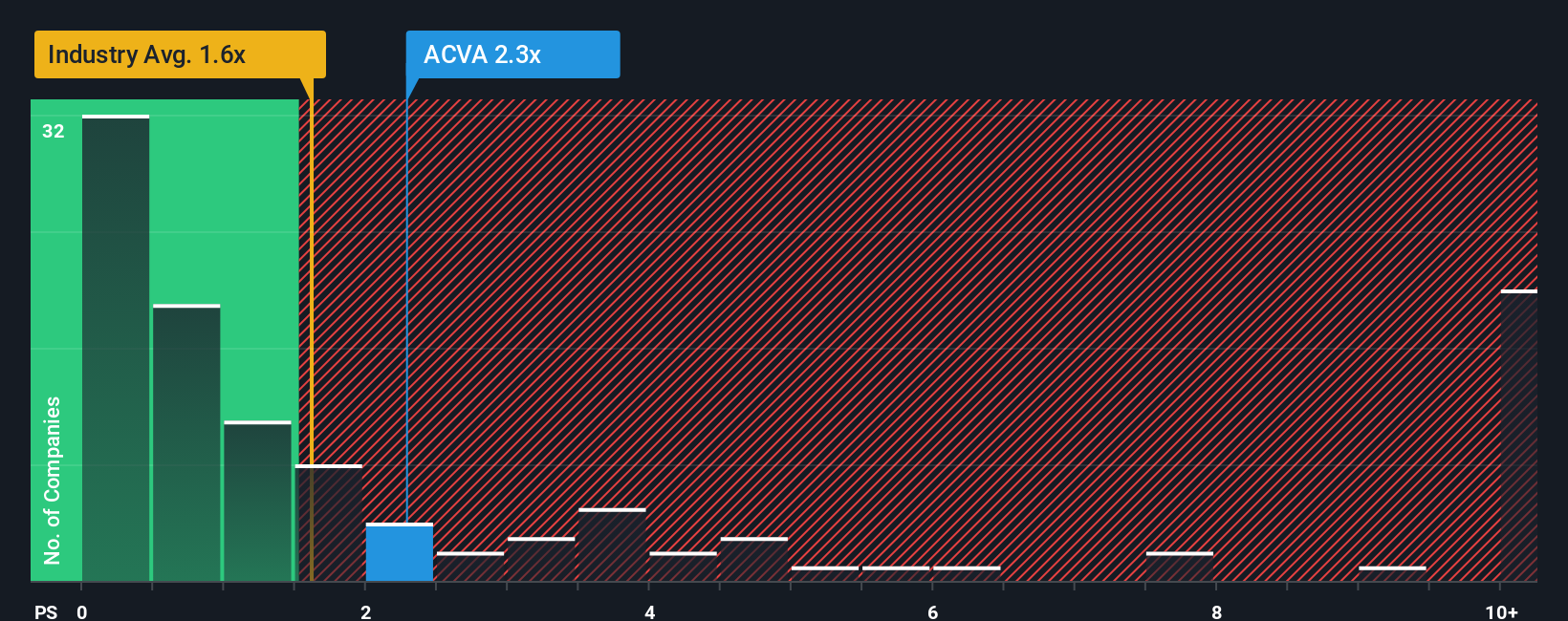

While the narrative fair value suggests ACV Auctions is 19% undervalued, its current P/S ratio of 2x screens as expensive. That compares with 1.2x for peers and a fair ratio of 1.2x, implying the market is already paying up for growth that still has to be earned.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own ACV Auctions Narrative

If you see the numbers differently, or want to test these assumptions against your own view, you can build a personalized thesis in minutes by starting with Do it your way.

A great starting point for your ACV Auctions research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready For More Investment Ideas?

If ACV Auctions has sharpened your thinking, do not stop here; broaden your watchlist with a few focused idea sets that match your style.

- Spot potential turnaround stories by scanning these 3545 penny stocks with strong financials that already show stronger balance sheets and fundamentals than most in their price range.

- Get early exposure to transformative trends by checking out these 29 quantum computing stocks that could benefit if quantum computing moves further into real world use.

- Strengthen your income focus by reviewing these 12 dividend stocks with yields > 3% that already offer yields above 3% and may suit a more cash flow oriented approach.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal