3 Stocks That May Be Trading At An Estimated Discount Of Up To 21.8%

As the U.S. stock market experiences mixed signals with major indices like the Dow Jones climbing while the Nasdaq faces pressure from data-storage shares, investors are keenly observing sectors and stocks that might offer value amidst this volatility. In such a climate, identifying undervalued stocks can be particularly appealing, as they present opportunities to capitalize on potential price corrections when broader economic conditions stabilize or improve.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| VTEX (VTEX) | $3.64 | $7.06 | 48.5% |

| Sea (SE) | $139.24 | $274.79 | 49.3% |

| MGM Resorts International (MGM) | $34.12 | $67.98 | 49.8% |

| Huntington Bancshares (HBAN) | $18.14 | $36.10 | 49.7% |

| Heritage Financial (HFWA) | $23.88 | $46.53 | 48.7% |

| Hecla Mining (HL) | $21.37 | $41.37 | 48.3% |

| Freshworks (FRSH) | $11.93 | $23.64 | 49.5% |

| Fifth Third Bancorp (FITB) | $49.17 | $95.23 | 48.4% |

| Fidelity National Information Services (FIS) | $66.73 | $131.06 | 49.1% |

| CNB Financial (CCNE) | $25.87 | $50.74 | 49% |

Here we highlight a subset of our preferred stocks from the screener.

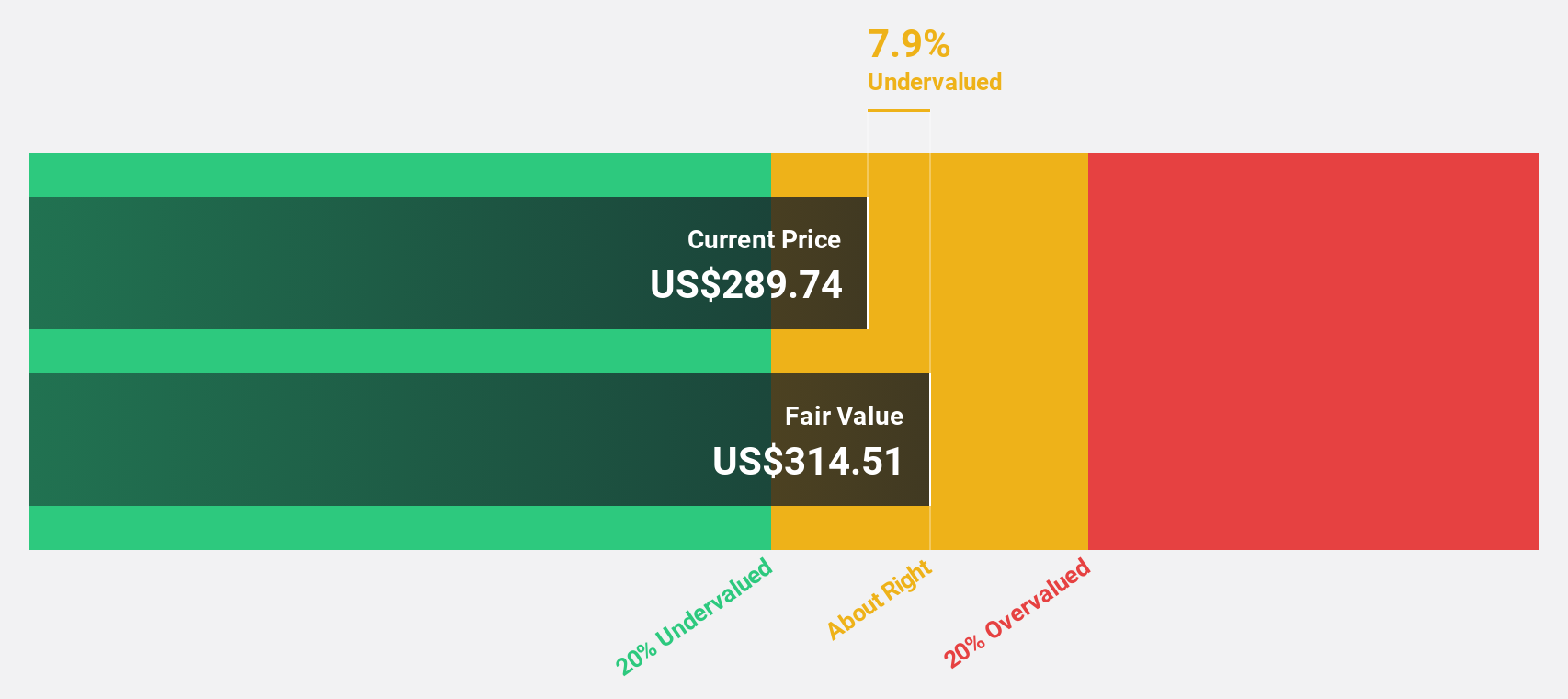

Zscaler (ZS)

Overview: Zscaler, Inc. is a global cloud security company with a market cap of $35.41 billion.

Operations: The company generates revenue primarily through sales of subscription services to its cloud platform and related support services, amounting to $2.83 billion.

Estimated Discount To Fair Value: 20.2%

Zscaler is trading at US$231.16, below its estimated fair value of US$289.66, indicating potential undervaluation based on cash flows. Despite significant insider selling recently, analysts agree the stock price could rise by 39.6%. Revenue growth is forecasted to outpace the broader U.S. market at 15.8% annually, with expected profitability within three years. Recent strategic partnerships and executive changes aim to bolster Zscaler's position in AI-driven cybersecurity solutions.

- Our comprehensive growth report raises the possibility that Zscaler is poised for substantial financial growth.

- Click here to discover the nuances of Zscaler with our detailed financial health report.

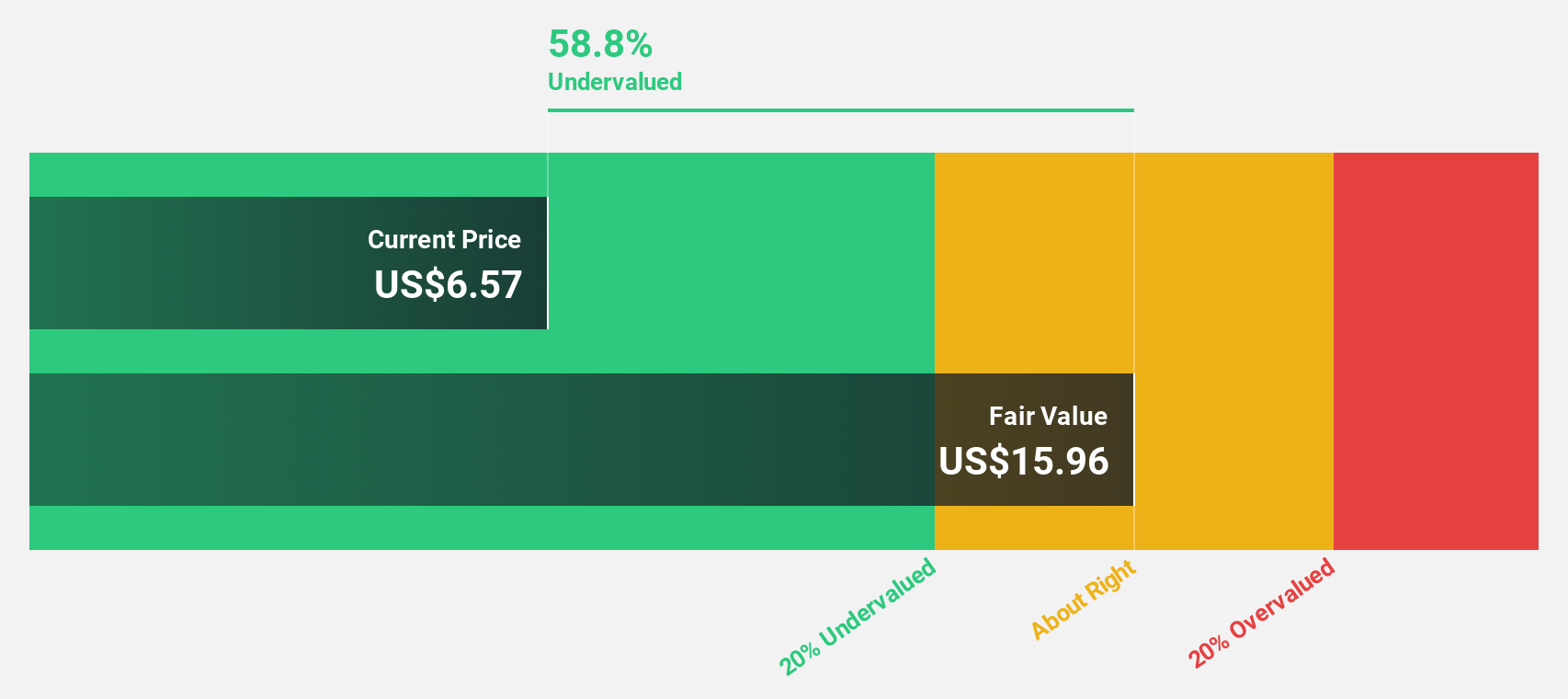

Compass (COMP)

Overview: Compass, Inc. operates as a real estate brokerage service provider in the United States with a market capitalization of approximately $6.05 billion.

Operations: Compass generates revenue from its Internet Information Providers segment, amounting to $6.64 billion.

Estimated Discount To Fair Value: 19.8%

Compass is trading at $11.84, below its estimated fair value of $14.76, suggesting it may be undervalued based on cash flows. Recent fixed-income offerings totaling $1.6 billion could strengthen its financial position amid forecasted revenue growth of 11.7% annually, surpassing the U.S. market average but remaining under 20%. While profitability is anticipated within three years, current low return on equity and recent net losses highlight potential risks for investors seeking undervalued opportunities.

- According our earnings growth report, there's an indication that Compass might be ready to expand.

- Take a closer look at Compass' balance sheet health here in our report.

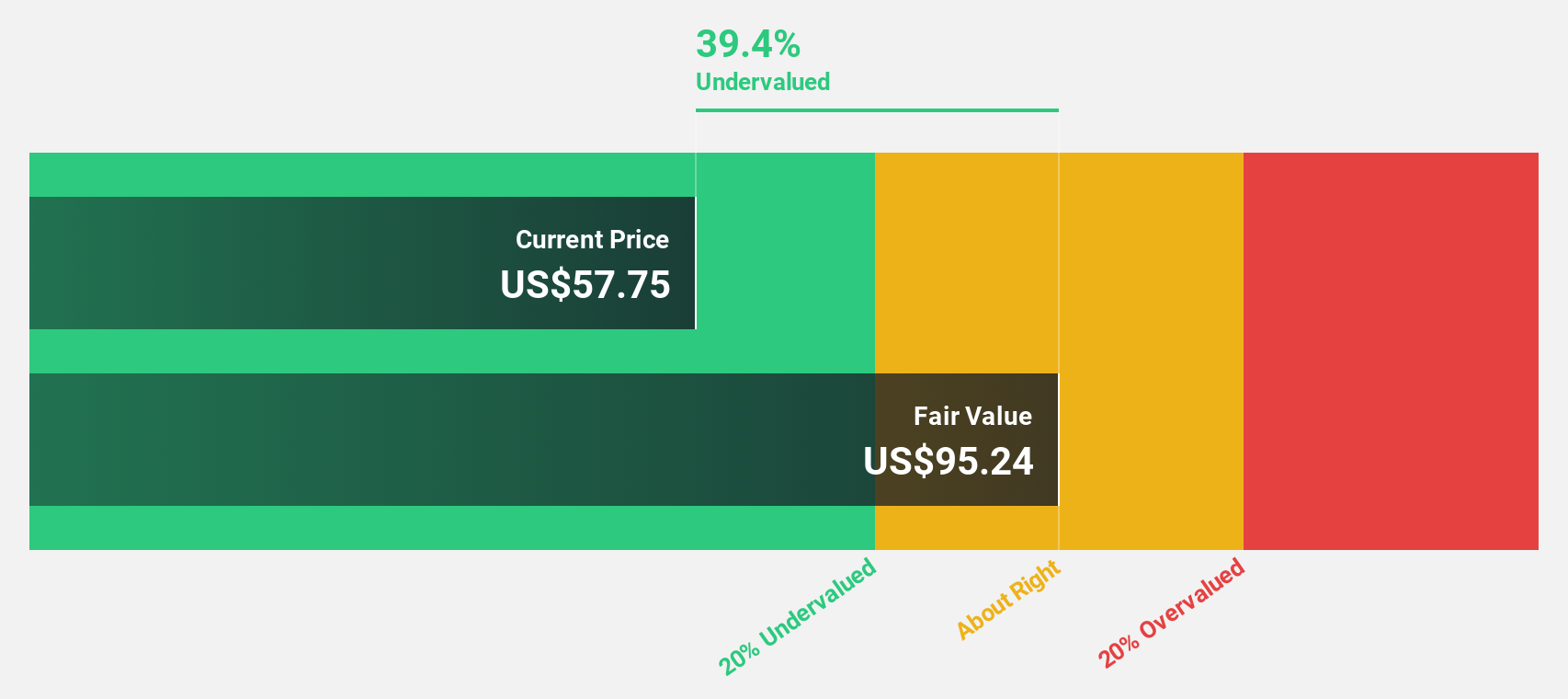

Viking Holdings (VIK)

Overview: Viking Holdings Ltd operates in the passenger shipping and transport sector across North America, the United Kingdom, and internationally, with a market cap of $32.86 billion.

Operations: The company's revenue is primarily derived from its Ocean segment, generating $2.66 billion, and its River segment, contributing $2.92 billion.

Estimated Discount To Fair Value: 21.8%

Viking Holdings, trading at US$73.6, is valued below its estimated fair value of US$94.12, reflecting potential undervaluation based on cash flows. Despite a high debt level, its earnings are projected to grow annually by 25.4%, outpacing the U.S. market average of 16%. Recent strategic partnerships and expansions enhance brand visibility and operational scale, while strong revenue growth at 12.7% annually further supports its investment appeal amidst industry-leading innovations.

- Upon reviewing our latest growth report, Viking Holdings' projected financial performance appears quite optimistic.

- Get an in-depth perspective on Viking Holdings' balance sheet by reading our health report here.

Turning Ideas Into Actions

- Dive into all 191 of the Undervalued US Stocks Based On Cash Flows we have identified here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal