Uncovering US Market's Hidden Gems Three Promising Small Caps

In a market where major stock indexes are showing mixed results, with the Dow Jones Industrial Average rising and the Nasdaq being pulled down by data-storage shares, investors are keenly observing small-cap opportunities as potential growth drivers. With the services sector expanding and manufacturing struggling, uncovering promising small-cap stocks can be a strategic move in navigating these dynamic economic conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| First Bancorp | 57.63% | 1.47% | -2.43% | ★★★★★★ |

| Sound Financial Bancorp | 34.24% | 1.40% | -12.55% | ★★★★★★ |

| Franklin Financial Services | 127.01% | 5.48% | -4.56% | ★★★★★★ |

| Epsilon Energy | NA | 2.43% | -4.36% | ★★★★★★ |

| Affinity Bancshares | 43.06% | 2.84% | 3.44% | ★★★★★★ |

| Metalpha Technology Holding | NA | 75.66% | 28.60% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 13.18% | 16.77% | ★★★★★☆ |

| Seneca Foods | 41.64% | 2.31% | -23.77% | ★★★★★☆ |

| FRMO | 0.10% | 35.28% | 40.61% | ★★★★★☆ |

| Union Bankshares | 369.65% | 1.12% | -7.45% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

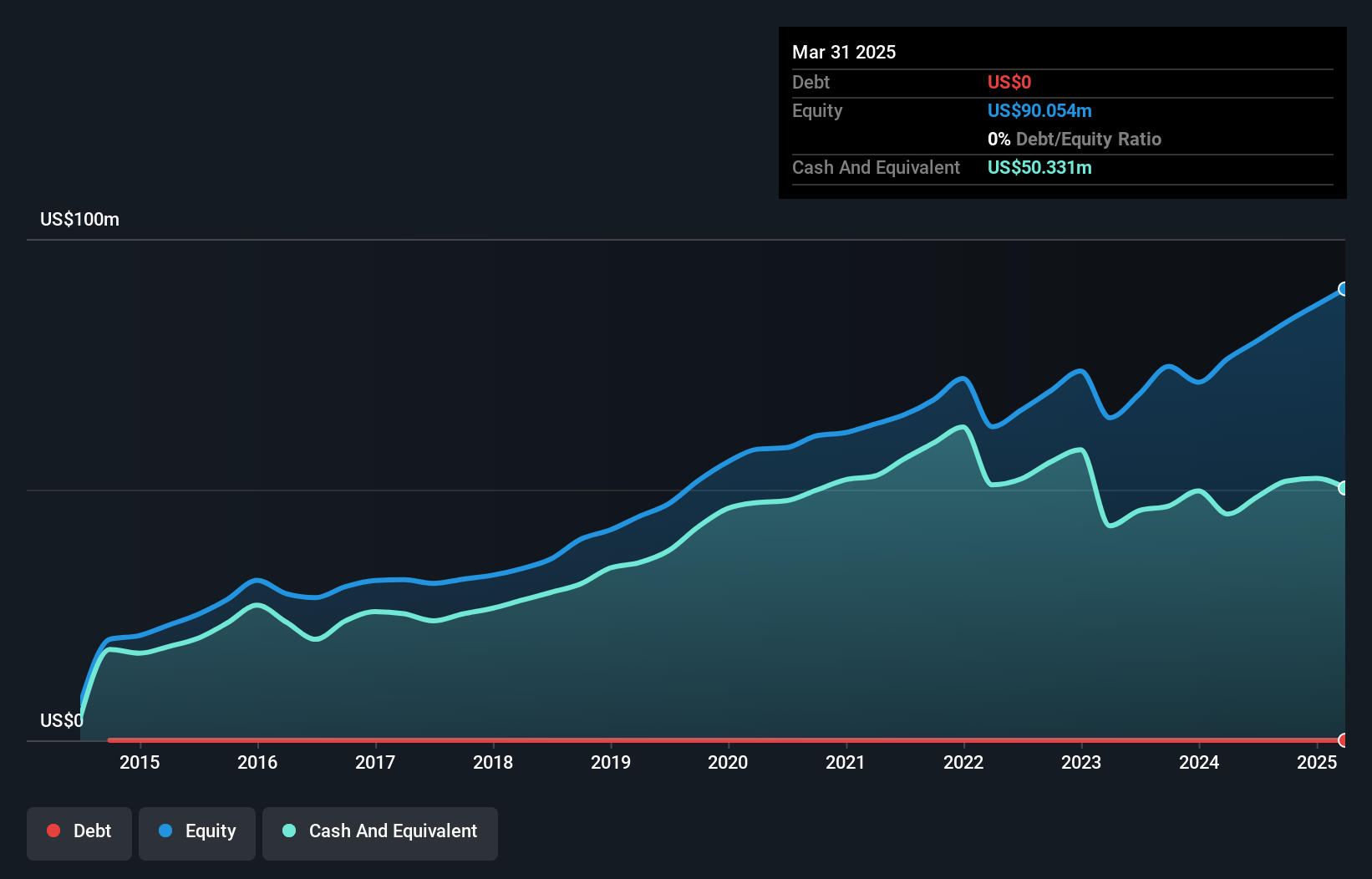

IRADIMED (IRMD)

Simply Wall St Value Rating: ★★★★★★

Overview: IRADIMED CORPORATION develops, manufactures, markets, and distributes MRI-compatible medical devices and related accessories, disposables, and services in the United States and internationally with a market cap of $1.25 billion.

Operations: IRADIMED generates revenue primarily from its patient monitoring equipment segment, which contributes $80.51 million. The company exhibits a strong gross profit margin of 78.5%, reflecting efficient production and sales strategies in its operations.

IRADIMED, a nimble player in the medical equipment sector, has shown impressive earnings growth of 13.7% over the past year, outpacing the industry average of 12.5%. With no debt on its books for five years and consistent free cash flow generation, IRADIMED offers a robust financial foundation. The introduction of their MRI-compatible IV pump is poised to drive significant replacement cycles and expand their market footprint. However, recent insider selling raises eyebrows about potential internal concerns. A special dividend of US$0.50 per share further underscores its commitment to returning value to shareholders amidst these dynamics.

Resolute Holdings Management (RHLD)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Resolute Holdings Management, Inc. operates as an alternative asset management platform with a market cap of $1.72 billion.

Operations: RHLD generates revenue primarily through management fees and performance-based incentives. The company reported a gross profit margin of 65% in the latest financial period. Operating expenses are largely driven by personnel costs and administrative expenses.

Resolute Holdings Management, a nimble player in the Professional Services sector, has demonstrated impressive earnings growth of 296.7% over the past year, far outpacing the industry average of 8.1%. Despite this surge, it grapples with a high net debt to equity ratio of 97.3%, though its interest payments are comfortably covered by EBIT at 21.4 times coverage. The company is trading significantly below its estimated fair value by approximately 70.9%, offering potential upside for investors seeking undervalued opportunities. However, recent financial results show a net loss of US$0.231 million for Q3 and US$4.21 million over nine months in 2025, indicating challenges that need addressing despite robust free cash flow improvements to US$163.82 million as of late September 2025 from earlier periods.

- Click to explore a detailed breakdown of our findings in Resolute Holdings Management's health report.

Learn about Resolute Holdings Management's historical performance.

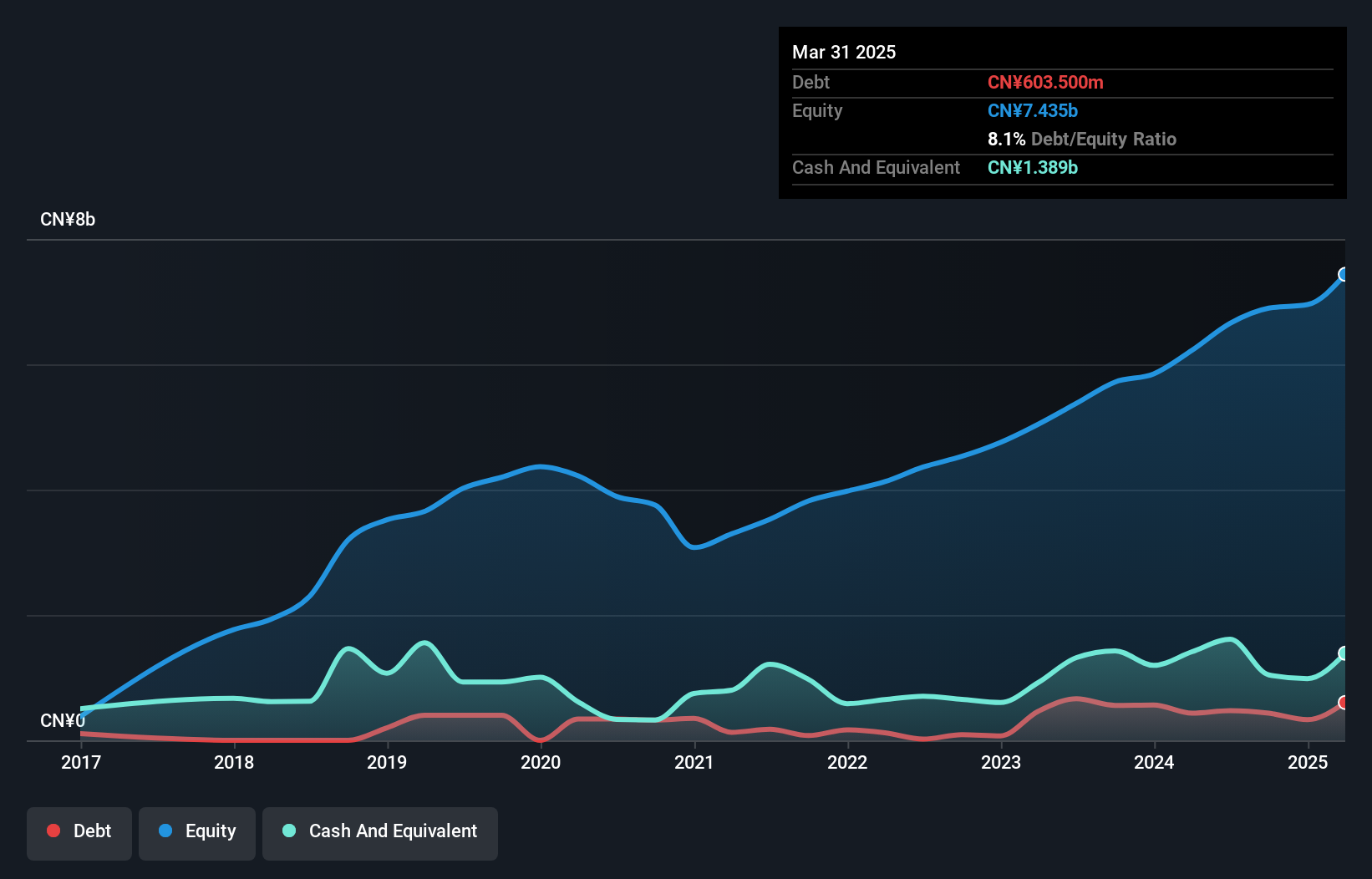

X Financial (XYF)

Simply Wall St Value Rating: ★★★★★★

Overview: X Financial operates as an online personal finance company in the People's Republic of China, with a market cap of approximately $255.37 million.

Operations: With revenue from unclassified services amounting to CN¥7.88 billion, X Financial focuses on its online personal finance operations in China.

X Financial, a player in the consumer finance sector, has shown impressive earnings growth of 33.5% over the past year, surpassing its industry peers. Despite a significant one-off loss of CN¥3.2 billion affecting recent results, the company has reduced its debt-to-equity ratio from 8.6 to 7.1 over five years and holds more cash than total debt, indicating financial resilience. Recent revenue for Q3 reached CN¥1,960 million compared to CN¥1,582 million last year with net income climbing to CN¥421 million from CN¥376 million previously. Additionally, X Financial completed a share repurchase program worth $51.99 million covering 4.15% of shares outstanding.

- Delve into the full analysis health report here for a deeper understanding of X Financial.

Assess X Financial's past performance with our detailed historical performance reports.

Key Takeaways

- Embark on your investment journey to our 297 US Undiscovered Gems With Strong Fundamentals selection here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal