Could Iberdrola’s 2025 Dividend Uplift Reframe Its Capital Allocation Story (BME:IBE)?

- Iberdrola has announced in the past that it plans to raise its 2025 dividend to €0.253 per share, signaling a higher cash distribution to investors.

- This planned dividend uplift highlights management’s emphasis on returning cash to shareholders alongside its large-scale energy infrastructure investment program.

- Next, we’ll examine how the planned 2025 dividend increase interacts with Iberdrola’s long-term grid and clean energy investment narrative.

Rare earth metals are the new gold rush. Find out which 39 stocks are leading the charge.

Iberdrola Investment Narrative Recap

To own Iberdrola, you need to believe in regulated grid growth and long-term clean energy demand, while accepting regulatory and financing risk as central to the story. The planned 2025 dividend uplift to €0.253 per share does not materially change the near term picture, but it does put more focus on how comfortably future cash flows and balance sheet strength can support both higher payouts and the accelerated investment plan.

The recent €5,000,000,000 follow on equity offering is especially relevant here, because it underpins Iberdrola’s ability to fund its expanded network capex while supporting its dividend ambitions. For shareholders, this pairing of fresh equity with a higher future dividend links directly to the key catalyst of regulated asset base growth, but it also sharpens attention on execution risks around regulation, financing conditions and returns on the enlarged asset base.

Yet investors should also be aware that if regulatory frameworks tighten or financing costs rise, the sustainability of those higher dividends and growth plans could...

Read the full narrative on Iberdrola (it's free!)

Iberdrola's narrative projects €50.1 billion revenue and €7.0 billion earnings by 2028. This requires 3.7% yearly revenue growth and about a €2.2 billion earnings increase from €4.8 billion today.

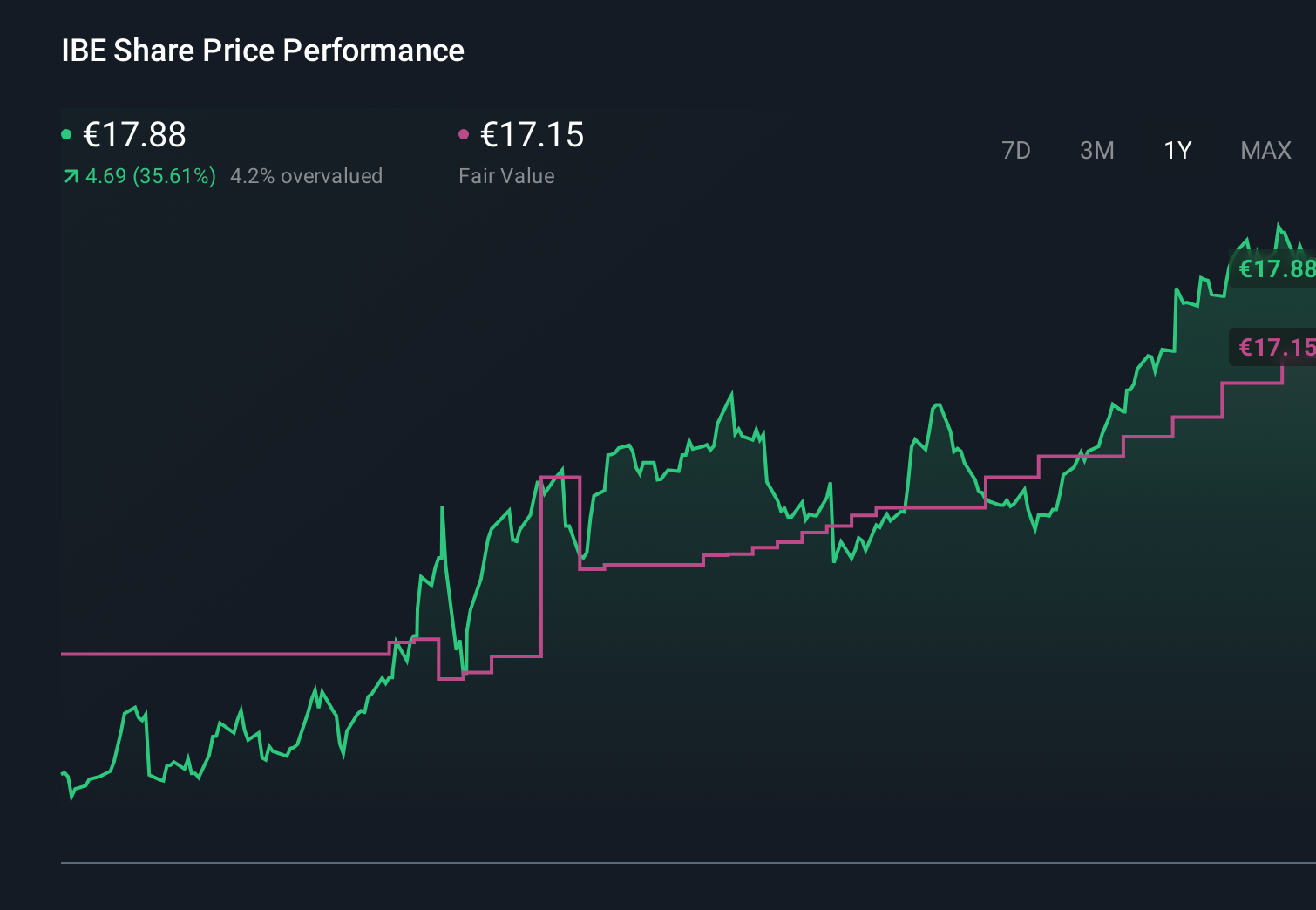

Uncover how Iberdrola's forecasts yield a €17.32 fair value, a 9% downside to its current price.

Exploring Other Perspectives

Eleven members of the Simply Wall St Community currently place Iberdrola’s fair value anywhere between €0.36 and €17.32, with estimates spread across the full range. When you compare those views with Iberdrola’s heavy dependence on regulated markets and ongoing equity funding needs, it underlines why you may want to review several different risk and return scenarios before forming your own view.

Explore 11 other fair value estimates on Iberdrola - why the stock might be worth as much as €17.32!

Build Your Own Iberdrola Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Iberdrola research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Iberdrola research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Iberdrola's overall financial health at a glance.

Contemplating Other Strategies?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal