A Look At Retail Estates (ENXTBR:RET) Valuation After The CEO Transition To Nicolas Beaussillon

Retail Estates (ENXTBR:RET) is in focus after the company confirmed that Nicolas Beaussillon has taken over as Chief Executive Officer from Jan De Nys, a change tied to the firm’s age limit policy.

See our latest analysis for Retail Estates.

The CEO transition appears to come against a backdrop of steady price momentum, with a 1 day share price return of 3.01% lifting the share price to €65.1 and a 1 year total shareholder return of 17.19%. This suggests interest has been building rather than fading.

If this leadership change has you thinking about where else capital might work hard, it could be a good moment to check out fast growing stocks with high insider ownership as a way to spot other potential ideas.

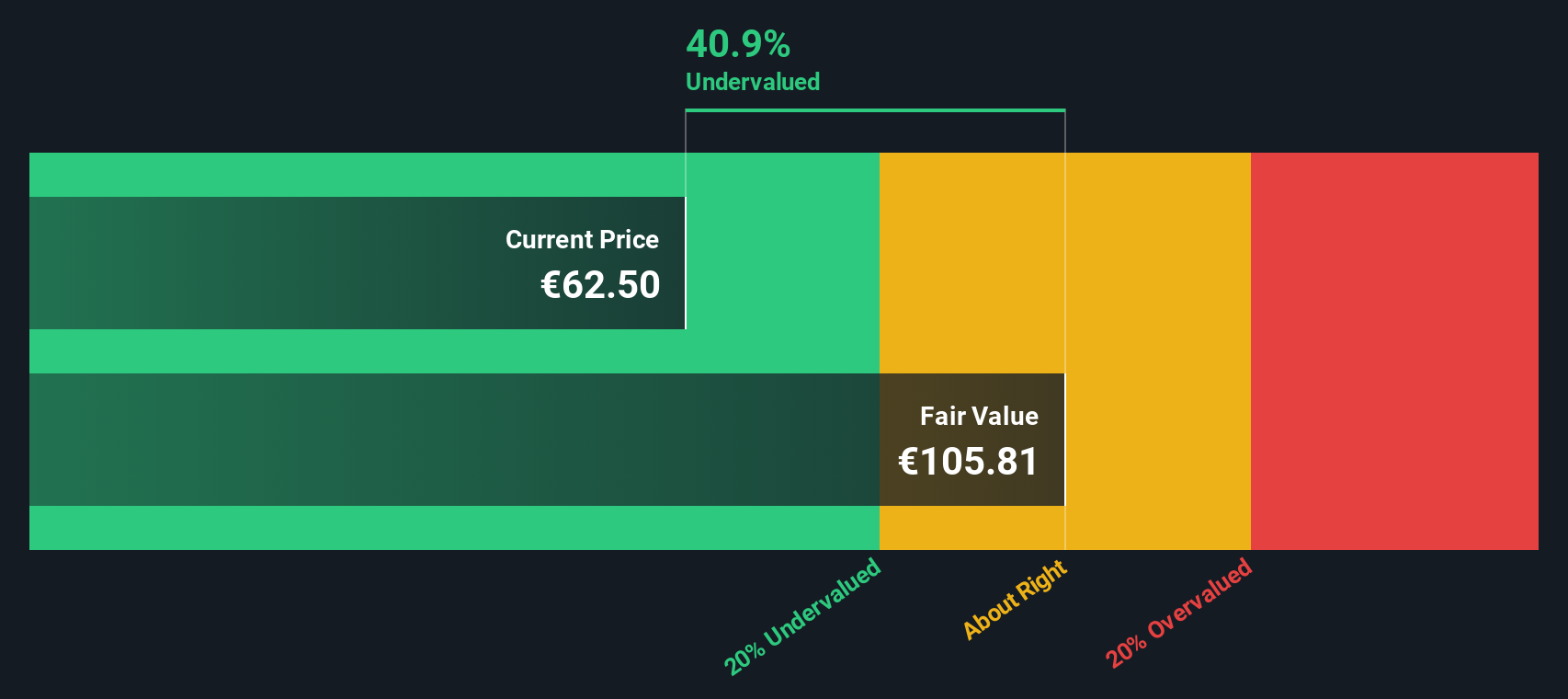

With Retail Estates trading at €65.1 alongside an indicated intrinsic discount of about 18% and around a 9% gap to analyst targets, investors may ask whether there is still a buying opportunity here or whether potential future growth is already reflected in the price.

Price to Earnings of 8.7x: Is it justified?

With Retail Estates trading on a P/E of 8.7x against a last close of €65.1, the shares look cheaper than many peers on an earnings basis.

The P/E multiple compares the share price to earnings per share, so for a real estate investment trust like Retail Estates it gives a quick read on how the market is valuing its current earnings stream.

Retail Estates screens as good value on this metric, with its 8.7x P/E sitting well below the peer average of 16.8x and the wider European retail REITs average of 16.5x. That is a sizeable gap, which indicates the market is valuing each euro of Retail Estates earnings at around half the level seen for comparable companies.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 8.7x (UNDERVALUED)

However, you still need to weigh risks such as changes in demand for out of town retail space and any shift in occupancy from the current 97.45% level.

Find out about the key risks to this Retail Estates narrative.

Another View: What Our DCF Model Suggests

The low 8.7x P/E presents Retail Estates as inexpensive, and our DCF model points in the same direction. It goes a step further, with an estimated fair value of €78.95 compared to the current €65.1. If both perspectives suggest potential value, what is the market still concerned about?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Retail Estates for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 884 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Retail Estates Narrative

If you look at the numbers and come to a different conclusion, or simply prefer to test your own view, you can build a custom thesis in just a few minutes with Do it your way.

A great starting point for your Retail Estates research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If Retail Estates has sharpened your thinking, do not stop here. Broaden your watchlist with focused stock ideas built from clear data and consistent rules.

- Spot early movers by scanning these 3545 penny stocks with strong financials that already show stronger financial underpinnings than most investors expect at this size.

- Ride breakthrough trends by zeroing in on these 26 AI penny stocks positioned at the crossroads of artificial intelligence and real business applications.

- Focus on value by filtering for these 884 undervalued stocks based on cash flows where prices sit below what their cash flows may justify.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal