Seagate Technology (STX) Is Up 11.9% After AI-Focused HAMR Ramp And Nasdaq-100 Debut - Has The Bull Case Changed?

- In recent days, Seagate Technology has reported strong revenue growth, record gross margins and accelerated ramp-up of its Mozaic HAMR drives, coinciding with its inclusion in the Nasdaq-100 Index and heightened attention on AI-driven storage demand.

- Investor focus has sharpened as Nvidia’s CEO highlighted a large, still-underserved AI storage market and Seagate’s HAMR technology lead, while Seagate’s own CEO executed preset share sales, prompting debate about how AI infrastructure spending may reshape the company’s long-term prospects.

- We’ll now examine how Seagate’s Mozaic HAMR ramp and AI-related storage demand may influence its existing investment narrative and assumptions.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Seagate Technology Holdings Investment Narrative Recap

To own Seagate today, you need to believe that AI-driven data growth and the Mozaic HAMR transition can support durable demand and healthy margins, despite high debt and intense competition from SSDs. Recent AI-related headlines and sharp share price swings highlight that the key near term catalyst remains evidence of sustained cloud and hyperscale orders, while the biggest risk is that expectations outpace actual storage spending. So far, the news mainly amplifies, rather than changes, that setup.

The most relevant recent development is Seagate’s ramp of Mozaic HAMR drives, now qualified by several major cloud customers alongside record gross margins. This directly ties into the AI storage narrative that propelled the stock to new highs, but it also raises the bar for upcoming earnings updates, where investors will look for confirmation that HAMR volume, pricing and profitability can keep up with the heightened expectations now embedded in the share price.

Yet against this optimism, investors should be aware that Seagate’s high debt load and balance sheet fragility could become far more important if...

Read the full narrative on Seagate Technology Holdings (it's free!)

Seagate Technology Holdings' narrative projects $12.0 billion revenue and $2.5 billion earnings by 2028. This requires 9.5% yearly revenue growth and a $1.0 billion earnings increase from $1.5 billion today.

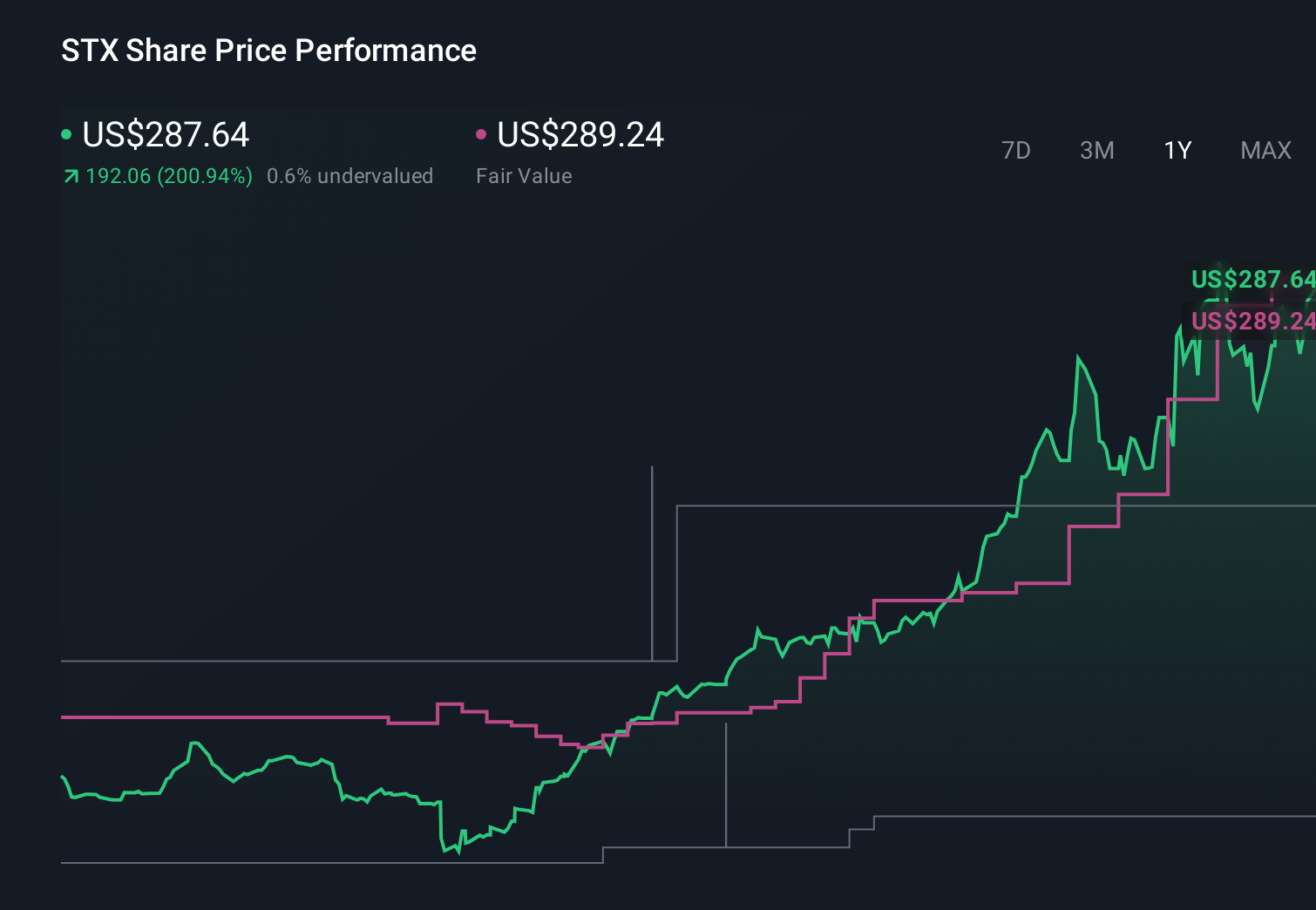

Uncover how Seagate Technology Holdings' forecasts yield a $297.09 fair value, a 4% downside to its current price.

Exploring Other Perspectives

Four fair value estimates from the Simply Wall St Community span roughly US$297 to US$427 per share, showing how far apart individual views can be. When you set those opinions against Seagate’s reliance on a successful Mozaic HAMR ramp to justify current expectations, it underlines why checking several alternative viewpoints can matter for your own assessment.

Explore 4 other fair value estimates on Seagate Technology Holdings - why the stock might be worth as much as 39% more than the current price!

Build Your Own Seagate Technology Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Seagate Technology Holdings research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Seagate Technology Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Seagate Technology Holdings' overall financial health at a glance.

No Opportunity In Seagate Technology Holdings?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Rare earth metals are the new gold rush. Find out which 39 stocks are leading the charge.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal