A Look At GeneDx Holdings (WGS) Valuation After GenomeDx Prenatal Launch And New Chief Medical Officer Appointment

GeneDx Holdings (WGS) has introduced GenomeDx Prenatal, a whole genome sequencing test aimed at diagnosing fetal anomalies during pregnancy, and has appointed maternal infant health specialist Dr. Linda Genen as Chief Medical Officer.

See our latest analysis for GeneDx Holdings.

These prenatal and leadership updates come after a mixed stretch for the stock, with a 90-day share price return of 7.68% but a 30-day share price decline of 14.55%. The 1-year total shareholder return of 41.40% suggests longer term momentum has been stronger than recent trading implies.

If this kind of genomics story has your attention, it could be a good moment to look across the sector and scan healthcare stocks for other healthcare names catching interest.

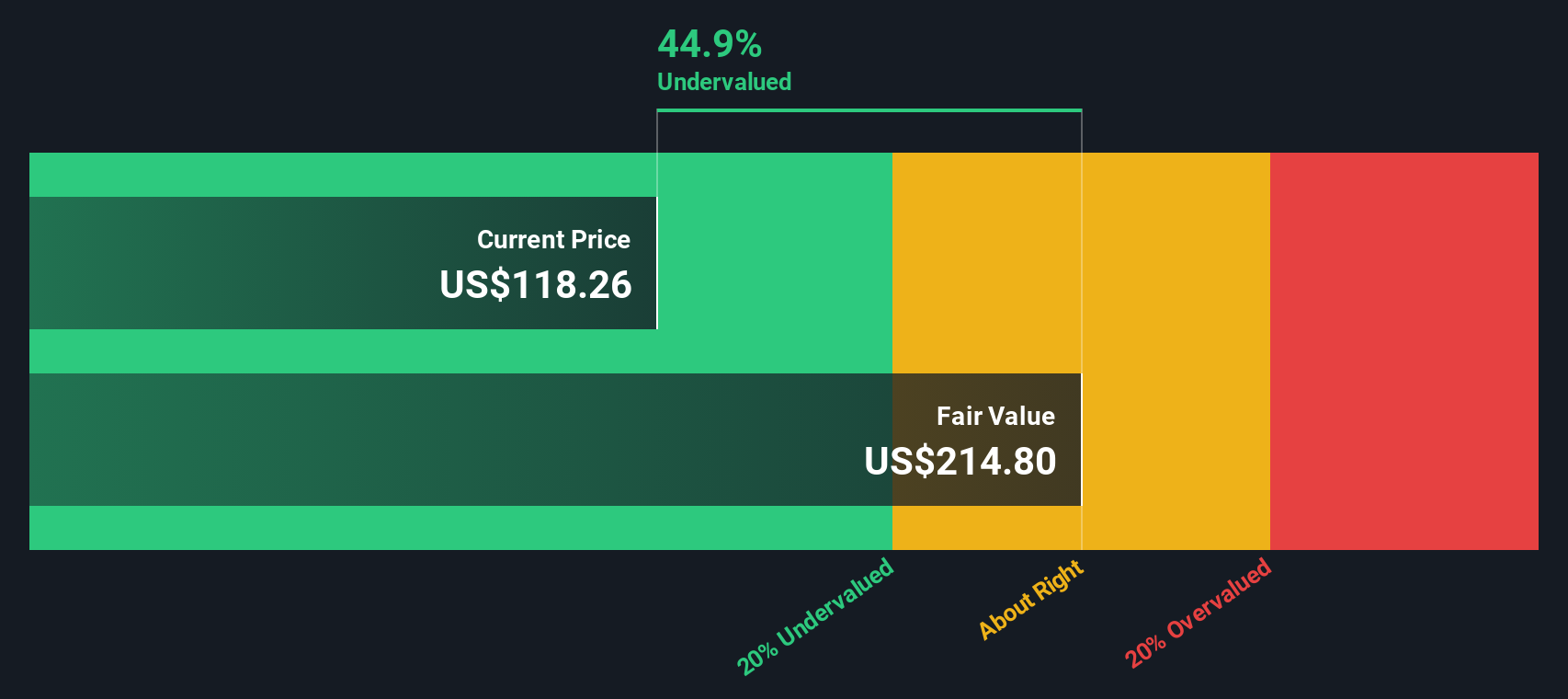

With GeneDx trading at $136.55, a 25% discount to the average analyst price target and an implied 56% intrinsic discount, the key question is whether this gap signals opportunity or whether the market is already accounting for future growth.

Most Popular Narrative: 17.1% Undervalued

With GeneDx at US$136.55 and the most followed fair value sitting at about US$164.78, the narrative is framing a meaningful valuation gap for readers to assess.

Ongoing development and enrichment of GeneDx's comprehensive rare disease genomic database strengthens product differentiation, enables premium pricing, and creates high barriers to entry, which some investors view as supporting sustained top-line growth and long-term profitability as data network effects compound.

Curious what would need to occur for that higher value to be supported? The narrative highlights assumptions around rapid earnings expansion, richer margins, and a future earnings multiple above typical healthcare names. Want to see how those elements are being combined?

Result: Fair Value of $164.78 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the story could change quickly if reimbursement support tightens or if customer adoption in new pediatric settings takes longer to materialize than analysts currently factor in.

Find out about the key risks to this GeneDx Holdings narrative.

Another Angle on Valuation

Our DCF model tells a much richer story than the 17.1% narrative gap alone. At US$136.55, GeneDx screens as trading at a 56.5% discount to an estimated fair value of US$314.13, which is a far bigger cushion than the narrative fair value implies. Could that gap reflect genuine mispricing or simply very optimistic cash flow assumptions?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own GeneDx Holdings Narrative

If parts of this story do not quite fit your view, or you prefer to work directly from the numbers, you can shape a custom thesis in minutes with Do it your way.

A great starting point for your GeneDx Holdings research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Ready for more investment ideas?

If you stop with just one company, you risk missing other opportunities that might fit your style even better, so widen your search before you commit.

- Spot potential value early by scanning these 884 undervalued stocks based on cash flows that screen for gaps between price and fundamentals that could matter to your portfolio.

- Ride powerful technology shifts by checking out these 26 AI penny stocks focused on companies linked to artificial intelligence themes.

- Boost your income focus by reviewing these 12 dividend stocks with yields > 3% that highlight companies offering yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal