Assessing Sonoco Products (SON) Valuation As Analyst Upgrades And Downgrades Signal Divided Sentiment

Recent analyst moves around Sonoco Products (SON) highlight a split view on the stock, with both upgrades and downgrades pointing to differing expectations for how its packaging business might perform.

See our latest analysis for Sonoco Products.

Sonoco Products' recent 11.73% 1 month share price return and 13.06% 3 month share price return, against a 1 year total shareholder return of 1.42%, suggests short term momentum is improving while longer term results remain more muted. This frames the mixed analyst calls as a reassessment of risk and growth potential around its US$45.71 share price.

If this kind of split sentiment has you looking wider, it could be a useful moment to scan fast growing stocks with high insider ownership as a way to spot other stocks with strong internal conviction.

With Sonoco Products trading at US$45.71 against an average analyst target of US$53.25 and an indicated intrinsic discount of 56.07%, you have to ask: is this genuine value or is the market already pricing in future growth?

Most Popular Narrative Narrative: 14.2% Undervalued

Compared with Sonoco Products' last close at US$45.71, the most followed narrative anchors on a fair value of US$53.25, framing the current debate around how durable its earnings power could be.

Sonoco is capitalizing on surging demand for sustainable and recyclable packaging by expanding its premium product lines (e.g., all-paper and paper-bottom cans) and winning notable sustainability awards, which is expected to drive revenue growth and enable pricing power that supports increased net margins.

Curious what sits behind that US$53.25 figure? The narrative leans on targeted revenue growth, rising margins and a lower future earnings multiple than many packaging peers. The specific mix of volume expectations, margin reset and discount rate assumptions is where the story really gets interesting.

Result: Fair Value of $53.25 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that story could change quickly if integration issues at SMP EMEA weigh on margins, or if softer demand in Europe and Asia persists longer than expected.

Find out about the key risks to this Sonoco Products narrative.

Another View: Multiples Paint a Tougher Picture

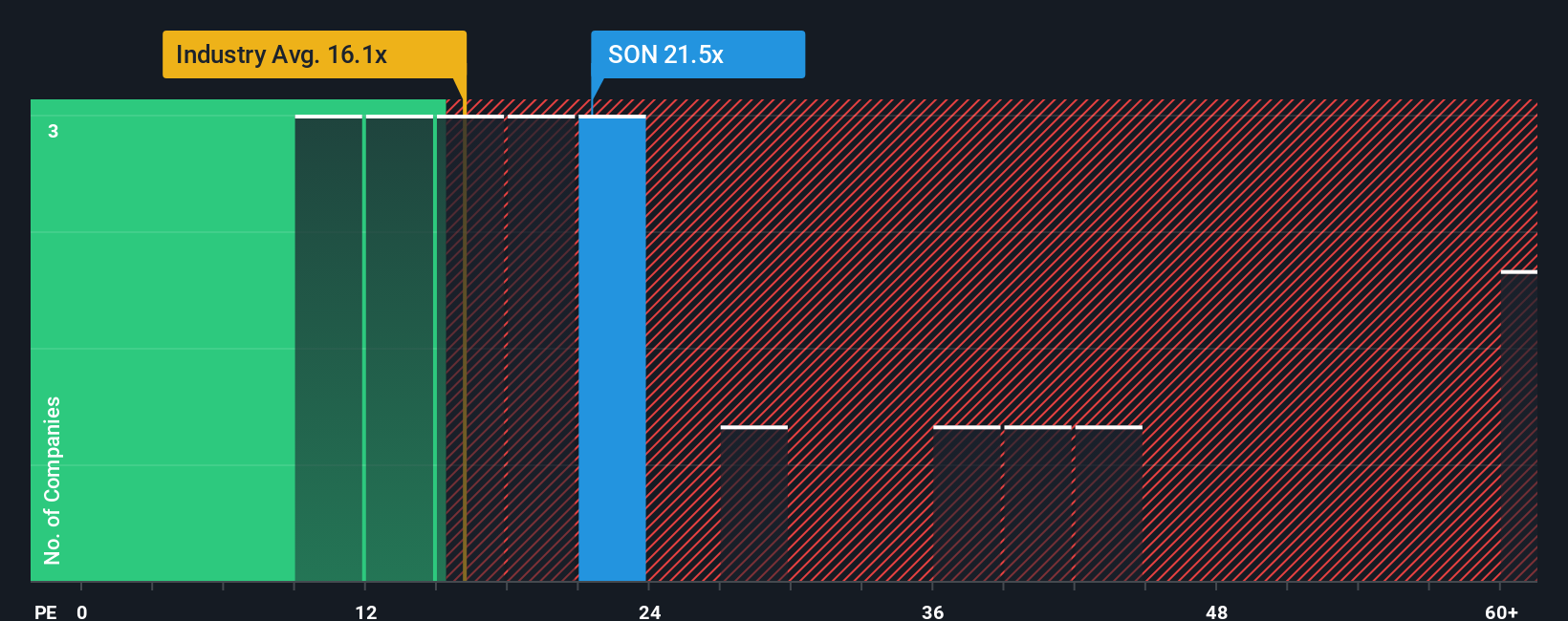

While the narrative and fair value estimate point to upside, the current P/E of 24.4x tells a different story. It sits above both the peer average of 16.2x and an estimated fair ratio of 19.1x, which suggests the market is already baking in a lot of optimism and leaves less room for error.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Sonoco Products Narrative

If you see the data differently, or prefer to test your own assumptions, you can create a complete Sonoco view in minutes by starting with Do it your way.

A great starting point for your Sonoco Products research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Sonoco Products has sparked your interest, do not stop here. Broaden your watchlist with ideas shaped by real data so you do not miss what comes next.

- Spot early movers by scanning these 3545 penny stocks with strong financials that combine smaller market sizes with stronger financial footing than many investors expect.

- Ride long term tech trends by focusing on these 26 AI penny stocks that tie artificial intelligence themes to listed companies you can actually analyse.

- Hunt for potential mispricings by filtering for these 884 undervalued stocks based on cash flows where current prices sit below what their cash flows might justify.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal