A Look At ServisFirst Bancshares (SFBS) Valuation After Recent Share Price Pullback And Mixed Returns

ServisFirst Bancshares (SFBS) has drawn investor attention after recent trading left the shares around $73.70, with returns mixed over different periods, including a modest gain year to date and a decline over the past 3 months.

See our latest analysis for ServisFirst Bancshares.

The recent 1-week share price return of 2.66% contrasts with a 90-day share price decline of 8.04%. Meanwhile, the 1-year total shareholder return of a 10.47% decline and the 5-year total shareholder return of 85.80% suggest that longer term momentum has been stronger than the recent pullback.

If ServisFirst’s moves have you thinking more broadly about financials and valuation, this could be a good moment to look at fast growing stocks with high insider ownership as potential next ideas.

With ServisFirst trading around $73.70, an indicated intrinsic discount of 48.13% and a 19.40% gap to the current analyst target, a key question arises: is this a genuine opportunity, or is future growth already fully priced in?

Most Popular Narrative Narrative: 16.2% Undervalued

The most followed narrative sets a fair value of US$88 for ServisFirst Bancshares against the recent US$73.70 close, framing the current discount in the context of earnings power and growth assumptions.

Successful back-office technology optimization and direct core processing arrangements are forecast to lower operational costs going forward, reinforcing ServisFirst's sector-leading efficiency ratios and supporting continued outperformance in net margins and earnings.

Curious what kind of revenue ramp, margin profile, and future P/E this narrative needs to justify that fair value? The full breakdown spells out those assumptions in detail, along with the 6.97% discount rate that underpins the model and the earnings path it is banking on.

Result: Fair Value of $88 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the story can change quickly if credit costs keep climbing, or if commercial real estate payoffs and tighter funding conditions weigh more heavily on loan growth and margins.

Find out about the key risks to this ServisFirst Bancshares narrative.

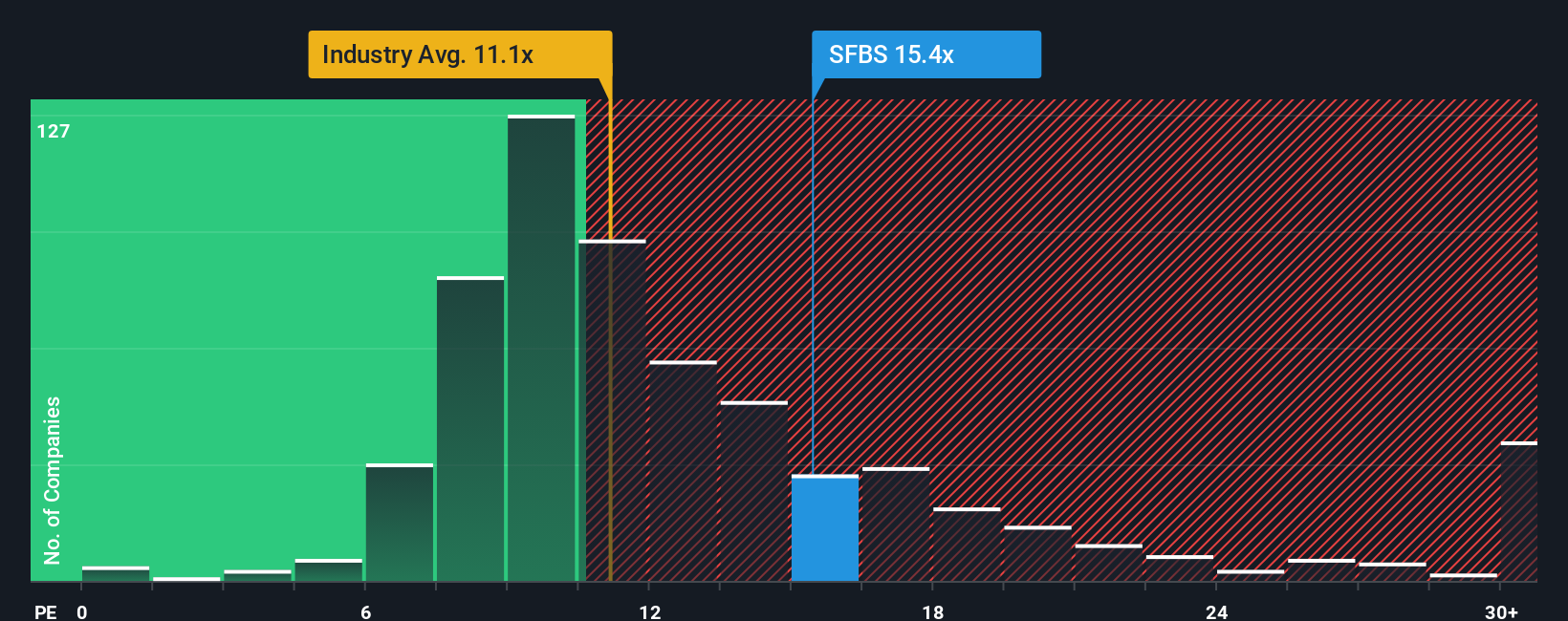

Another Angle on Valuation: Earnings Multiple Sends a Mixed Signal

The SWS DCF model suggests ServisFirst is trading at a 48.1% discount to an estimated fair value of US$142.10, which points to an undervalued setup. Yet on a simple P/E, the picture is less clear, with a few yellow flags for you to weigh up.

Today the shares trade on a P/E of 15.8x. This is cheaper than the peer average of 21x but more expensive than the US Banks industry at 11.9x. It is also above the fair ratio of 14.7x that the model suggests the market could move toward. That mix of discount and premium raises a practical question: is the DCF too generous, or is the earnings multiple still catching up?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own ServisFirst Bancshares Narrative

If you look at the numbers and come to a different conclusion, that is the point. The tools are there so you can build your own view in just a few minutes, Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding ServisFirst Bancshares.

Ready for more investment ideas?

If ServisFirst has sharpened your thinking, do not stop here, you will miss plenty of interesting setups if you only focus on a single stock.

- Scan for bold high-upside potential with these 3545 penny stocks with strong financials that already show solid financial underpinnings instead of chasing stories with no numbers behind them.

- Lean into structural tech shifts by checking out these 26 AI penny stocks, where artificial intelligence themes meet companies that are already listed and easier to research.

- Hunt for mispriced opportunities using these 884 undervalued stocks based on cash flows so you can quickly spot businesses the market may be pricing below their estimated cash flow value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal