Is Snowflake (SNOW) Pricing Look Stretched After Strong Multi Year Share Price Gains

- If you are wondering whether Snowflake's current share price lines up with its business fundamentals, you are not alone. This article focuses on what that price could imply about value.

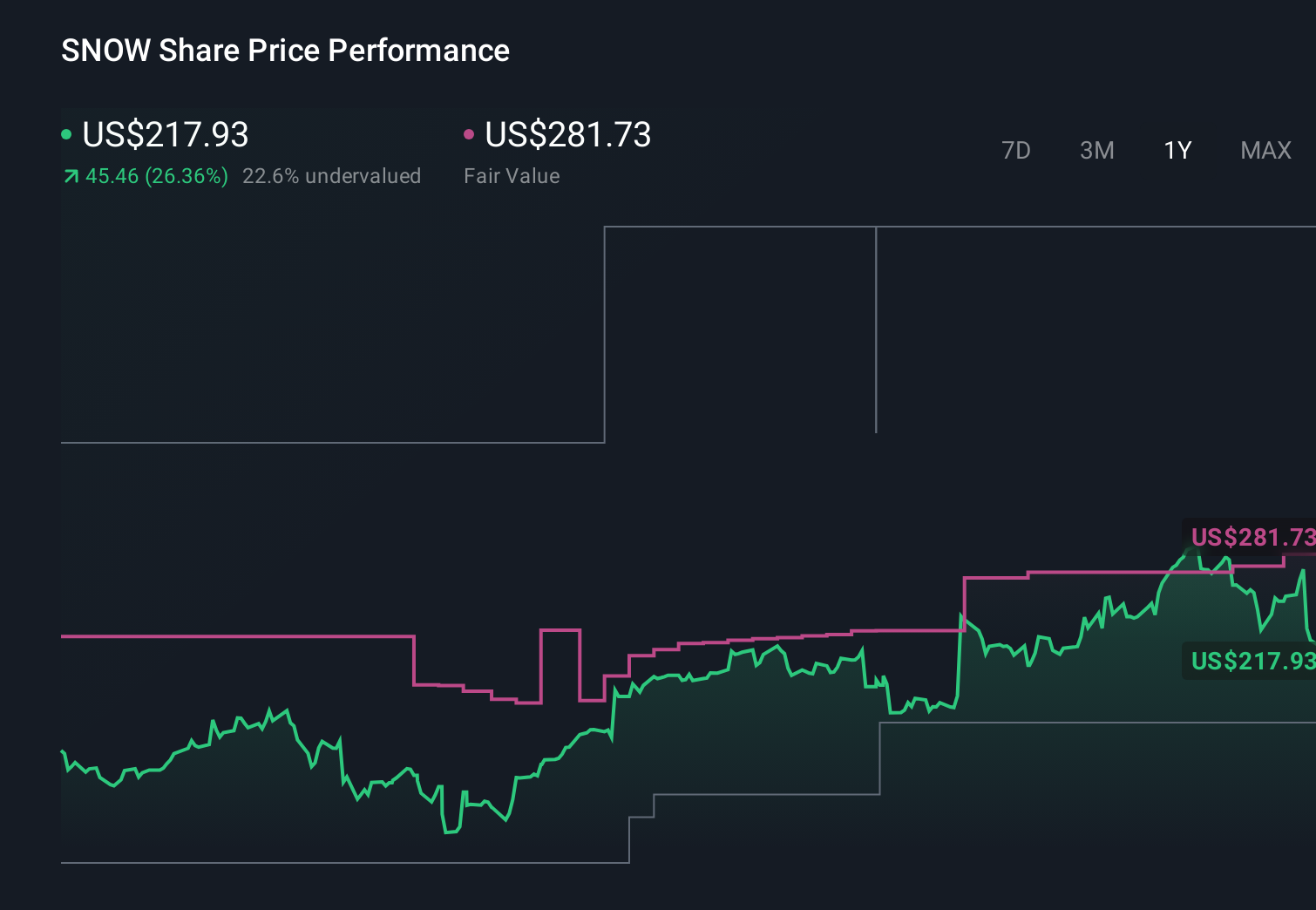

- Over the last week the stock returned 6.4%, with 3.6% over 30 days, 7.7% year to date, 45.0% over 1 year, 67.1% over 3 years and a 21.3% decline over 5 years. This gives you a mixed picture of recent momentum and risk.

- Recent market discussion around Snowflake has focused on its position in data warehousing and cloud software, as investors weigh how its products fit into broader trends in data infrastructure and analytics. These themes often influence how much investors are willing to pay for each dollar of current and potential future revenue.

- Right now Snowflake has a valuation score of 1/6, with 1 check suggesting the stock is undervalued and 5 checks suggesting it is not. Next we will look at what different valuation approaches say about that pricing and finish with a more holistic way to think about value.

Snowflake scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Snowflake Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model takes estimates of a company’s future cash flows, then discounts them back to today using a required rate of return to arrive at an implied value per share.

For Snowflake, the model used is a 2 Stage Free Cash Flow to Equity approach. The latest twelve month Free Cash Flow is about $758.8m. Analyst and extrapolated projections, provided by Simply Wall St, show Free Cash Flow in the projection period reaching $2.9b by 2030, with a series of annual forecasts between 2026 and 2035 that are discounted back to present values.

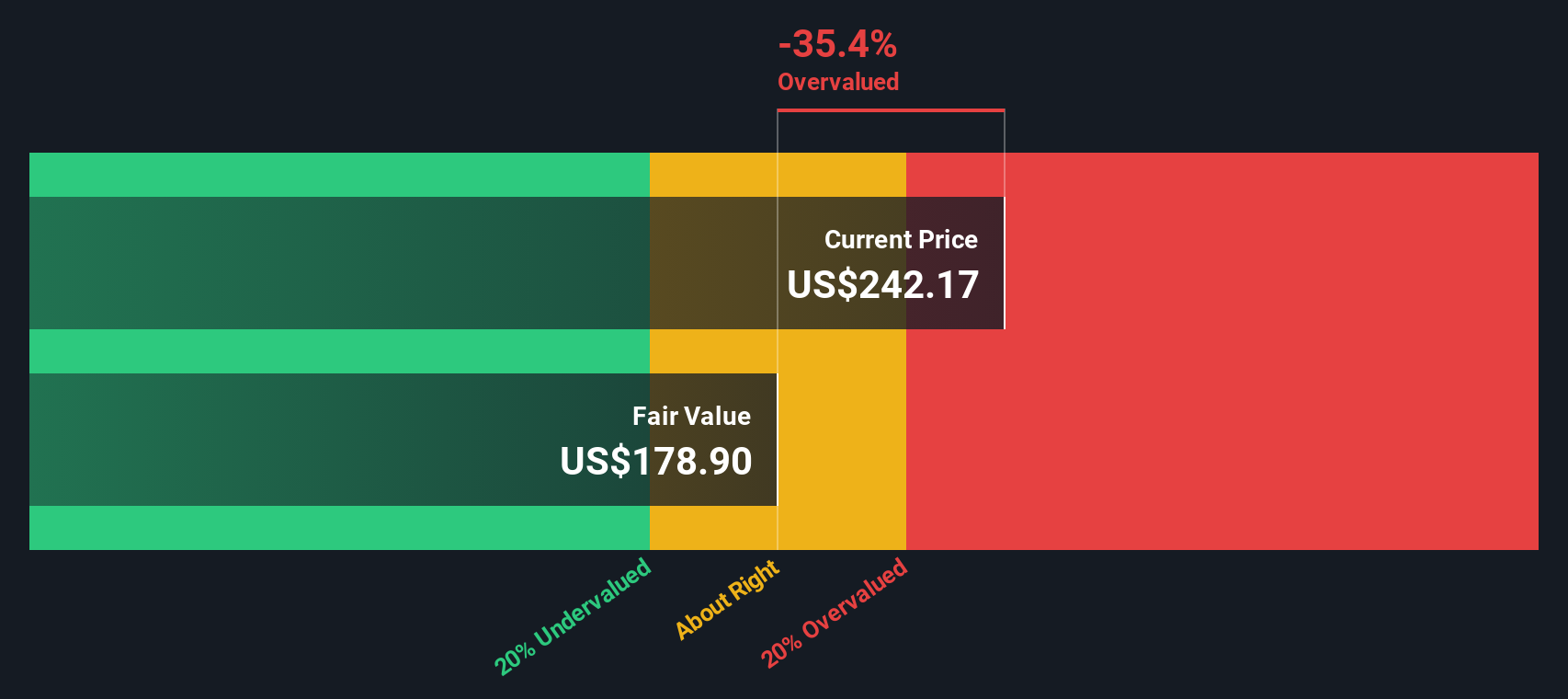

Adding these discounted cash flows together gives an estimated intrinsic value of $152.22 per share. Compared with the current share price, the model suggests the stock is around 53.4% above this DCF estimate, which points to Snowflake trading at a premium on this measure.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Snowflake may be overvalued by 53.4%. Discover 884 undervalued stocks or create your own screener to find better value opportunities.

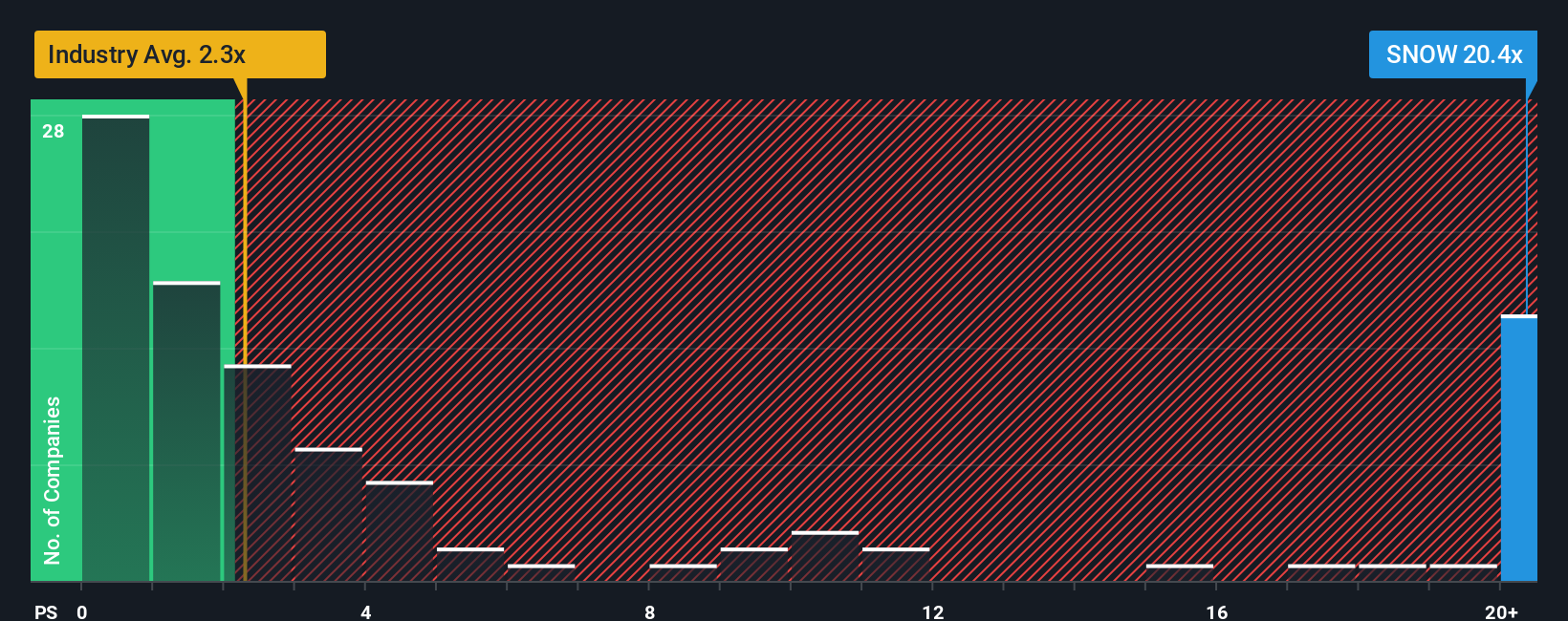

Approach 2: Snowflake Price vs Sales

Because Snowflake is not currently profitable on an earnings basis, the P/S ratio is a more practical way to think about what you are paying for its business today. For companies like this, investors often focus on how much revenue the firm already generates and what they are willing to pay for each dollar of those sales, given the company’s growth profile and risk.

Growth expectations and business risk usually drive what counts as a “normal” or “fair” P/S multiple. Higher expected growth and a stronger competitive position can support a higher multiple, while more uncertainty or weaker profitability tends to push the fair range lower.

Snowflake currently trades on a P/S ratio of 18.21x, which is close to the peer average of 18.87x and well above the broader IT industry average of 2.36x. Simply Wall St’s Fair Ratio for Snowflake is 13.16x. This Fair Ratio is a proprietary estimate of what the multiple might be after considering factors such as earnings growth, industry, profit margin, market cap and specific risks. Because it blends these company specific inputs, it can be more informative than looking only at peer or industry averages.

Comparing the current 18.21x P/S to the 13.16x Fair Ratio suggests the stock is pricing in more optimism than this model implies.

Result: OVERVALUED

P/S ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1444 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Snowflake Narrative

Earlier we mentioned that there is an even better way to think about value, and on Simply Wall St that comes through Narratives, where you write a simple story for Snowflake, link that story to your own revenue, earnings and margin assumptions, and the platform turns it into a fair value that you can compare with the current share price on the Community page used by millions of investors. Each Narrative updates automatically as new news or earnings arrive. For example, one Snowflake Narrative might see enterprise AI demand and product expansion supporting a fair value near US$440, while a more cautious Narrative focused on competition and execution risk might sit closer to US$170. By seeing these side by side, you can quickly judge whether today’s price lines up with the version of the story you actually believe.

Do you think there's more to the story for Snowflake? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal