The bottom line of the “soft landing” of the US economy is becoming more and more clear as the initial jobless claims have cooled down and productivity soared in the same frame as the AI torrent

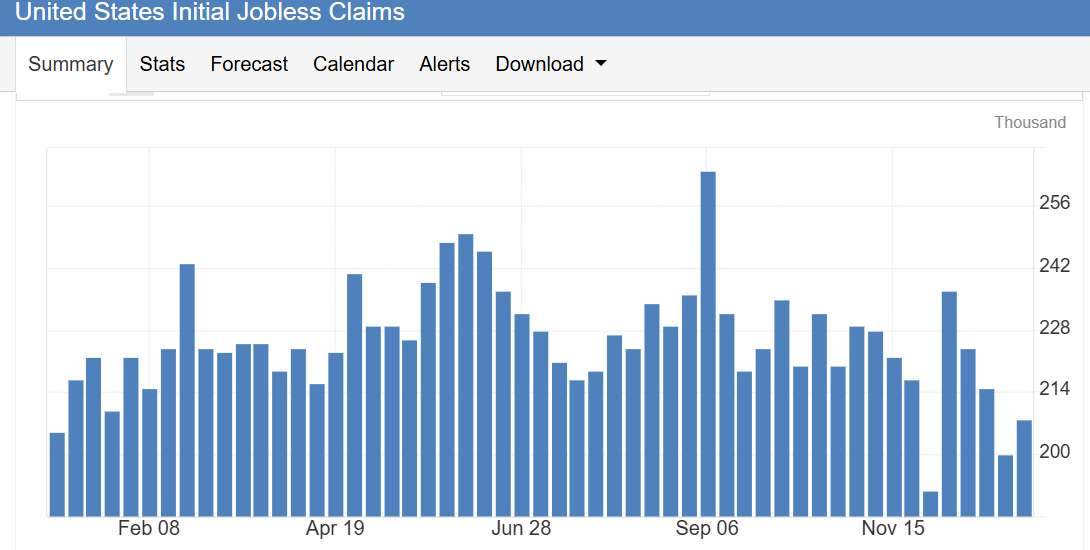

The Zhitong Finance App learned that statistics released by the US government on Thursday showed that US labor productivity accelerated to the strongest growth rate in two years in the third quarter, further indicating that the wave of AI-driven efficiency improvements led by the rise of ChatGPT is significantly curbing inflationary pressure from the wage level. Meanwhile, as of the week ending January 3 (including the New Year's Day holiday), the number of first-time jobless claims in the US increased by 8,000 from the previous week to 208,000, slightly lower than the market's general expectation of 210,000, and is still far below the average level of first-time jobless claims last year, strengthening the signs of a recovery in the labor market.

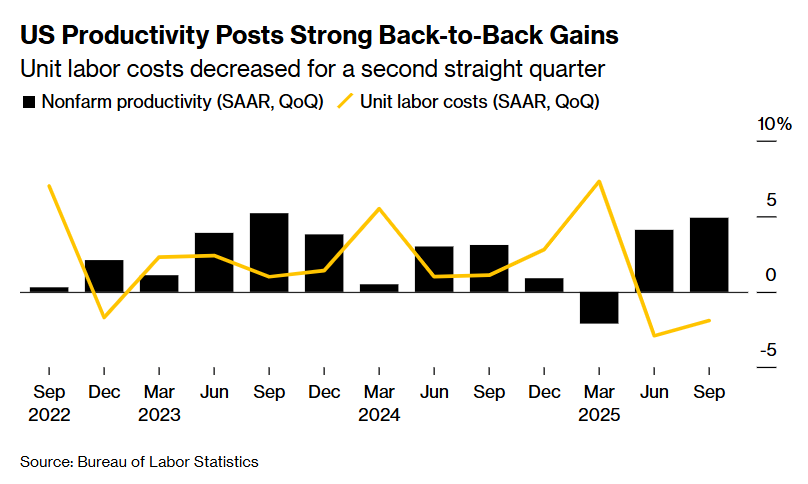

According to data released by the US Bureau of Labor Statistics (Bureau of Labor Statistics) on Thursday, the US non-farm productivity (that is, the hourly output of non-farm workers) soared sharply at an annualized quarterly rate of 4.9% (that is, compared to the second quarter's month-on-month), far higher than the 3% growth rate unanimously anticipated by the market. Previously, the increase of 4.1% in the second quarter after an upward revision.

The quarterly annualized rate of productivity soared to 4.9%, while initial recruitment fell to only 208,000, highlighting that the efficiency engine of US companies is holding back wage inflation, and recruitment is showing signs of a moderate recovery. The initial request to return to the historically low range meant that the “layoff side” had not worsened. This was the “no collapse of employment” required for a soft landing. Driven by an unprecedented wave of AI, the annual quarterly rate of productivity was +4.9%, and the annualized unit labor cost was -1.9% (falling for two consecutive quarters), highlighting the sharp increase in productivity and the continued reduction of inflation without significant sacrifices in employment.

Despite a significant slowdown in the US labor market throughout 2025, the US economy continued to grow at the fastest rate in two years in the third quarter. This trend is undoubtedly also closely linked to the surge in US productivity. Unit labor costs — the cost that companies pay employees to produce a unit of output — unexpectedly fell by 1.9%, after falling in the previous quarter. This marks the first time since 2019 that unit labor costs have declined for two consecutive quarters.

The productivity report also showed that US corporate output in the third quarter exceeded expectations by 5.4% on an annualized (i.e., YoY) basis, compared to 5.2% annualized growth in the previous three months.

The decline in employment costs highlights a subtle trend in the US economy: the labor market has weakened but has not fallen into the most pessimistic moment of continuous contraction. At the same time, US economic growth data centered on GDP, service sector PMI, and overall productivity are still stable.

Data released separately on Thursday showed that in the week ending January 3 (including the New Year's Day holiday), the number of first-time jobless claims increased by 8,000 to 208,000, and the number of renewed jobless claims (an indicator measuring the number of long-term beneficiaries) rose to 1.91 million in the previous week, slightly higher than the 1.9 million people generally expected by the market.

These statistics, which are closely related to the labor market, have fluctuated a lot in recent years. This is a typical sharp fluctuation in the number of people recruited in the labor market at this time of year, that is, from the end of each year to the beginning of the next year.

In addition to helping to control labor costs, the sharp recovery in productivity from the middle to the second half of 2025 also indicates that US companies are trying to significantly mitigate the impact of higher tariffs on imported goods. This also highlights how American companies can use artificial intelligence technology to maintain efficient operations with a leaner workforce.

The latest data may indicate that overall productivity in the US will increase further in the future, mainly due to the influx of artificial intelligence investment and various incentives for capital expenditure in the US under the “One Big Beautiful Bill Act” (One Big Beautiful Bill Act), a fiscal stimulus bill led by US President Donald Trump (Donald Trump).

Federal Reserve officials can also get some relief from continued efficiency gains, as this will limit inflationary pressure driven by wages and not provide significant support from the Federal Reserve's mindset of a “soft landing.” For many companies, labor costs are the biggest expense, so companies tend to actively switch to new technology and equipment to improve worker efficiency.

As the US non-farm payroll market has switched to a lower tier, economists generally expect wage growth to cool down. However, statistics released separately this week suggest that the job market may have gained some moderate expansion momentum at the end of the year. According to ADP Research, the number of people hired by US companies increased by 41,000 in December, compared to a significant decline in the previous month. Meanwhile, one indicator of service sector recruitment expanded last month to the strongest expansionary level since February.

Also on Thursday, the latest statistics from Challenger, Gray & Christmas showed that the number of layoffs announced by US companies in December was the lowest since July 2024; at the same time, recruitment intentions were at the highest level in any December since 2022. The government's monthly employment report will be released on Friday.

Challenger and ADP employment statistics, which have the title of “small non-farmer,” can be said to have marginally significantly strengthened the “soft landing” narrative. The US labor market presents a combination of “easing layoffs + recovering recruitment intentions”, which basically matches the “slowing growth without stalling” employment picture required for the economy's soft landing trajectory.

In the US market, several job market statistics for December show that after experiencing an obvious slowdown in recruitment in 2025, the labor market showed a certain degree of optimistic growth momentum as it entered the new year, which is certainly positive news for the US economic growth prospects in 2026.

The data released by the American Institute for Supply Management (ISM) on Wednesday also brought some encouragement at the “soft landing” narrative level at the end of the year: US service provider employment growth last month hit the strongest growth level since February. The service sector PMI rose to 54.4 in December, and the service sector employment segment rebounded to 52.0 (returning to the expansion range suggested above 50 points), indicating that employment in the service sector improved at the end of the year. However, the agency's index for measuring the number of workers employed in the manufacturing industry has been shrinking for 11 consecutive months, although the rate of contraction has slowed significantly compared to previous months.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal