Don't just use it as a “safe haven”! The US medical sector rips off the defensive label, and investing in 2026 depends on these three major trends

The Zhitong Finance App learned that for a long time, the healthcare sector in the US stock market has been viewed as a defensive sector, thanks to the steady growth trend of leading companies in the industry and impressive dividend yields. But now, this market positioning is quietly changing.

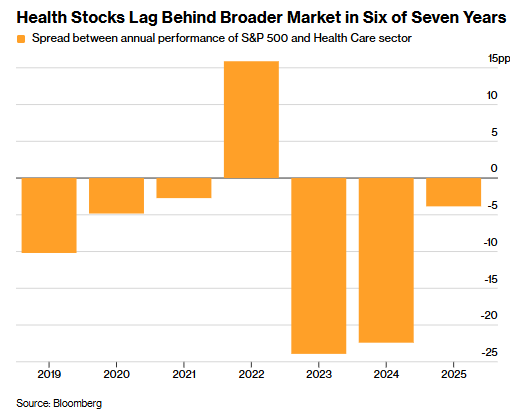

After many years of losing ground, the healthcare sector achieved a strong rebound in the previous quarter, becoming the best-performing sector among the 11 major industries in the S&P 500 index.

This strong rebound was helped by tariff agreements with the Trump administration, intensive mergers and acquisitions, and broad prospects for a new generation of diet pills. Meanwhile, given investors' growing concerns about overvalued tech stocks, sectors such as healthcare, which had previously underperformed, have greatly increased their appeal to investors seeking other growth opportunities. Against this backdrop, many investment professionals expect the healthcare sector's upward momentum to continue until 2026.

“Right now, many investors are examining technology stocks and wondering 'How long can this wave of markets last? How much more can it rise? '” Bob Lang, chief options analyst at options trading analysis agency Explosive Options, said.

Instead, Lang sees the healthcare sector as a more aggressive investment target. He added, “Investors are pouring into healthcare stocks that they think have value and can bring more lucrative returns. Everyone is chasing high-yield, high-performing stocks, and the healthcare sector is a leader among them.”

However, although the sector has ushered in new growth opportunities, investing in healthcare stocks in 2026 will still be a game for stock selectors.

“Some segments of the healthcare sector require investors to be extra careful, but there is no shortage of real highlights,” said Brian Mulberry, portfolio manager at Zacks Investment Management. “In the new year, being able to accurately select companies that will benefit from a new round of regulatory policies will be the key to investment success or failure.”

Here are the three core trends the healthcare sector needs to focus on in 2026:

Weight loss medicine racetrack

Over the past three years, diet pills have been a hot topic in healthcare. Analysts pointed out that this trend will continue to heat up in 2026, and oral obesity treatment drugs will be the core catalyst for the development of this racetrack.

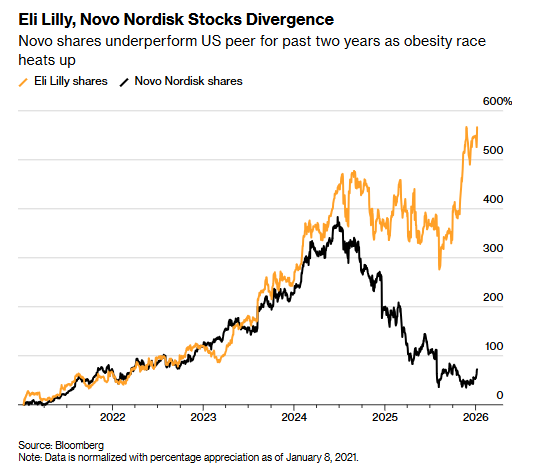

The US Food and Drug Administration (FDA) is expected to decide whether to approve LLY.US (LLY.US) oral obesity treatment in early 2026. Prior to that, Novo Nordisk (NVO.US)'s competitive oral medication was approved by regulators for marketing in late December last year. Goldman Sachs predicts that with the approval of this series of drugs, the diet medicine market will open up new growth space, and the market size is expected to reach 95 billion US dollars by the end of this decade.

Meanwhile, according to the agreement reached with the Trump administration, diet pill injections will be covered by the US federal Medicare (Medicare) from 2026, benefiting more patients.

“As drug production capacity continues to rise and innovations continue to emerge — especially with breakthroughs in oral medications, and successful entry into core markets such as federal Medicare and Medicaid (Medicaid), I think the diet medicine circuit will continue to grow rapidly,” said Kevin Gade, portfolio manager at Bahl & Gaynor.

Pharmaceutical companies, including Eli Lilly and Novo Nordisk, are also stepping up the development of a new generation of GLP-1 diet drugs, striving to achieve breakthroughs in the frequency of administration, efficacy, control of side effects, and ease of use.

“The introduction of GLP-1 drugs has enabled us to examine some pharmaceutical companies from the perspective of technology companies. Their growth expectations have also reached a level difficult for traditional pharmaceutical companies to reach,” said Mark Malek, Chief Investment Officer of Sibert Financial.

However, the price war between the two industry leaders in the obesity treatment drug market is still a sharp sword hanging above the sector. The two companies are seizing market advantage in a variety of ways, including cooperating with drug benefit management agencies, providing discounts to self-funded patients, and signing health insurance supply agreements directly with employers — the Drug Benefits Administration is the core agency responsible for managing the American people's drug benefits.

David Miller, co-founder and chief investment officer of Catalyst Funds, believes that the intense competition among major pharmaceutical companies over low-cost diet pills in 2026 may make the investment prospects on this racetrack confusing. “There are certainly investment opportunities in this area, but it has become much more difficult to profit from them.”

The boom in mergers and acquisitions

The concentrated outbreak of mergers and acquisitions in the healthcare sector in the second half of 2025, compounded the market's expectation that the Fed's interest rate cut would bring lower financing costs, is injecting strong confidence into the industry's continued recovery.

According to data compiled by analysts Michael Shah and Andrew Galler, as of December 1 of last year, 28 healthcare sector mergers and acquisitions exceeding 1 billion US dollars had been announced or completed during the year, compared to only 25 for the full year of 2024; in terms of transaction size, the total amount of mergers and acquisitions in the healthcare industry exceeded 103 billion US dollars in 2025, far exceeding 63 billion US dollars in 2024.

“We can finally express with confidence that we are optimistic about the future of the industry in 2026, rather than just being hopeful or cautious,” said Arda Ural, head of the American life sciences business at Ernst & Young.

As of mid-December of last year, large pharmaceutical companies had cash reserves of about 200 billion US dollars, stable balance sheets, and sufficient flexibility in mergers and acquisitions. Faced with the revenue gap brought about by the upcoming expiration of many of its best-selling drug patents, pharmaceutical companies' mergers and acquisitions momentum will continue to rise.

Next week, the annual event in the healthcare field, the J.P. Morgan Healthcare Conference, will kick off in San Francisco. This conference has always been a centralized launch window for industry mergers and acquisitions.

“Large pharmaceutical companies urgently need to fill gaps in their R&D pipelines,” said Terence McManus, healthcare portfolio manager at Bellevue Asset Management. “They have sufficient capital and the current regulatory environment is stabilizing, so the wave of mergers and acquisitions will be the main theme of the industry throughout 2026.”

As another important form of mergers and acquisitions, the initial public offering (IPO) market is also showing signs of recovery, with biotech companies performing particularly well. According to compiled data, biotech IPOs that landed on the US exchange in 2025 raised a total of 11 billion US dollars, an increase of 61% over 2024.

Investors' enthusiasm for this high-risk circuit can also be seen from the trend of the Nasdaq Biotech Index: the index rebounded more than 50% from April's low and hit a record high in December.

Health insurance industry

In contrast, the growth prospects for health insurance companies face more uncertainty.

Insurance companies that focus on the Medicare advantage plan market were initially full of expectations due to President Trump's re-election. They had anticipated that the Trump administration would increase financial subsidies to private providers of geriatric health insurance.

However, to the contrary, these insurers are under pressure to increase costs in both the federal Medicare and the Affordable Care Act (commonly known as “Obamacare”) underwriting business. Industry giants such as Molina Healthcare Inc. (MOH.US), United Health (UNH.US), and CNC.US (CNC.US) all fell by more than 30% in 2025, causing heavy losses.

On the positive side, medical insurance is a short-term business, that is, the profit margin is under pressure, and companies can also adjust the pricing of insurance products the following year. Some investors believe that the worst period for the industry may be over, and current stock prices fully reflect the potential risks.

However, judging from negative factors, subsidy policies related to the Affordable Care Act are about to expire, which may cause millions of Americans to abandon health insurance. This will not only directly impact the revenue of insurance companies, but will also trigger a reverse selection effect — young health groups will withdraw from the health insurance market, and eventually the remaining insured will be the elderly and infirm groups, further driving up insurance companies' compensation costs.

“There are still significant value investment opportunities in the health insurance industry,” said Christopher Hart, portfolio manager at Boston Partners, but he also admits that he is still cautious about this sector. “I will only consider investing more in the health insurance sector when the prospects for stabilizing the profitability of the industry become more clear.”

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal