Silicon Industry Branch: Weak demand logic for industrial silicon dominates the market this week and continues to fluctuate

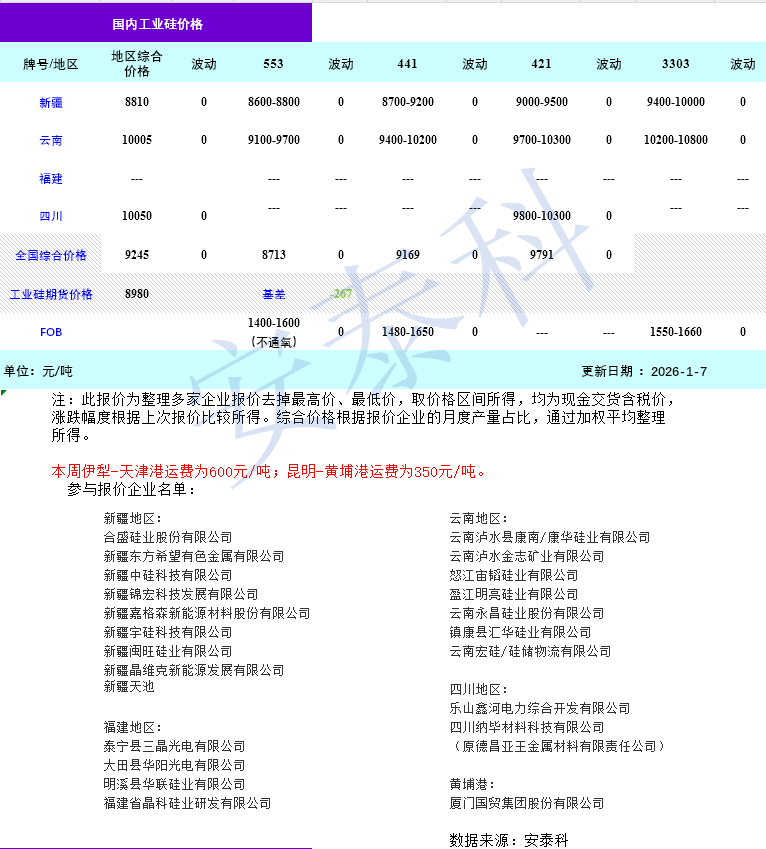

The Zhitong Finance App learned that the Silicon Industry Branch published an article stating that the overall operation of the industrial silicon market was stable this week, and the current performance is divided. In terms of futures, the closing price of the main contract 2605 rose from 8,860 yuan/ton before the holiday season to 8,980 yuan/ton, with a cumulative increase of 120 yuan/ton during the period. On the spot side, the comprehensive price of industrial silicon across the country remained stable. According to Antec statistics, it was reported at 9,245 yuan/ton on January 7, the same as last week. Among the specific specifications, 553 #价格报8713元 /ton and 441 #价格报9169元 /ton did not fluctuate. In terms of regional prices, the comprehensive prices of Xinjiang, Yunnan and Sichuan are 8810 yuan/ton, 10005 yuan/ton, and 1,050 yuan/ton, respectively; export FOB prices have also remained stable.

Industrial silicon production remained stable overall this week, but there were slight declines in some regions. Supported by the New Year's Eve atmosphere and long orders, most corporate quotes remain close to the level of cash costs. Despite recent improvements in futures markets and a slight recovery in shipments, under pressure to execute long orders, companies are not very willing to adjust prices. Most of them still focus on maintaining existing customers, and have not actively adjusted quotes yet. Overall, although some companies have entered the loss range, most companies maintain normal production due to annual production plans and long order fulfillment considerations to guarantee customer supply and stabilize market share. From the perspective of cost support, some enterprises in Xinjiang are currently still near the cash cost line, and it is expected that short-term prices will continue to fluctuate weakly.

At the same time, although product prices in the three major downstream sectors have recently risen to varying degrees, actual demand has not picked up at the same time. Among them, the rise in the prices of silicone and polysilicon is mainly due to companies jointly implementing production cuts to support product prices, yet demand for industrial silicon remains relatively low in the short term. On the other hand, due to seasonal factors, aluminum alloy's driving effect on industrial silicon demand is limited.

Currently, the industrial silicon market as a whole is dominated by weak demand logic. Social inventories are slowly being eliminated, and downstream production cuts further suppress procurement intentions. Inventory has accumulated again in some regions, and price increases are facing obvious resistance. Despite cost support on the supply side, it is expected that short-term industrial silicon prices will continue to fluctuate in the range against the backdrop of no substantial recovery in demand and continued inventory pressure. The key to the subsequent evolution of the market is still the recovery progress of downstream demand and the actual elimination of social inventories.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal