A Look At Green Brick Partners (GRBK) Valuation As Investor Interest Builds In Its Housing Exposure

Event driven interest in Green Brick Partners

Recent attention around Green Brick Partners (GRBK) centers on its focus on fast growing U.S. housing markets, effective execution, and ability to address structural housing shortages, prompting many investors to take a closer look.

See our latest analysis for Green Brick Partners.

At a share price of US$64.46, Green Brick Partners has seen fairly steady near term trading, and its 1 year total shareholder return of 16.21% and 3 year total shareholder return of 136.90% point to momentum that has built over time rather than faded.

If Green Brick's focus on high demand housing has your attention, it could be a good moment to broaden your search with fast growing stocks with high insider ownership.

With Green Brick posting a 1 year total return of 16.21%, a 3 year total return of 136.90%, and trading near analysts’ price target of US$62, you have to ask: is there still a buying opportunity here or is future growth already priced in?

Most Popular Narrative: 4% Overvalued

With Green Brick Partners trading at US$64.46 versus a narrative fair value of US$62, the current price sits slightly above that framework's estimate and puts the focus firmly on the assumptions behind it.

Elevated interest rates and persistent affordability headwinds are prompting Green Brick to increase price concessions and incentives (now 7.7% of unit revenue, up from 4.5% YoY), leading to declining average sales prices and compressing homebuilding gross margins. Further margin deterioration or stagnant revenue could result if rates remain high or rise further.

Want to see what keeps this valuation above fair value despite pressure on pricing and margins? The narrative leans on detailed revenue, earnings and discount rate assumptions that could change how you look at that US$62 figure.

Result: Fair Value of $62 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, record home closings in key markets and a low net debt position could support earnings resilience and weaken the case that current margins need to compress further.

Find out about the key risks to this Green Brick Partners narrative.

Another Angle on Valuation

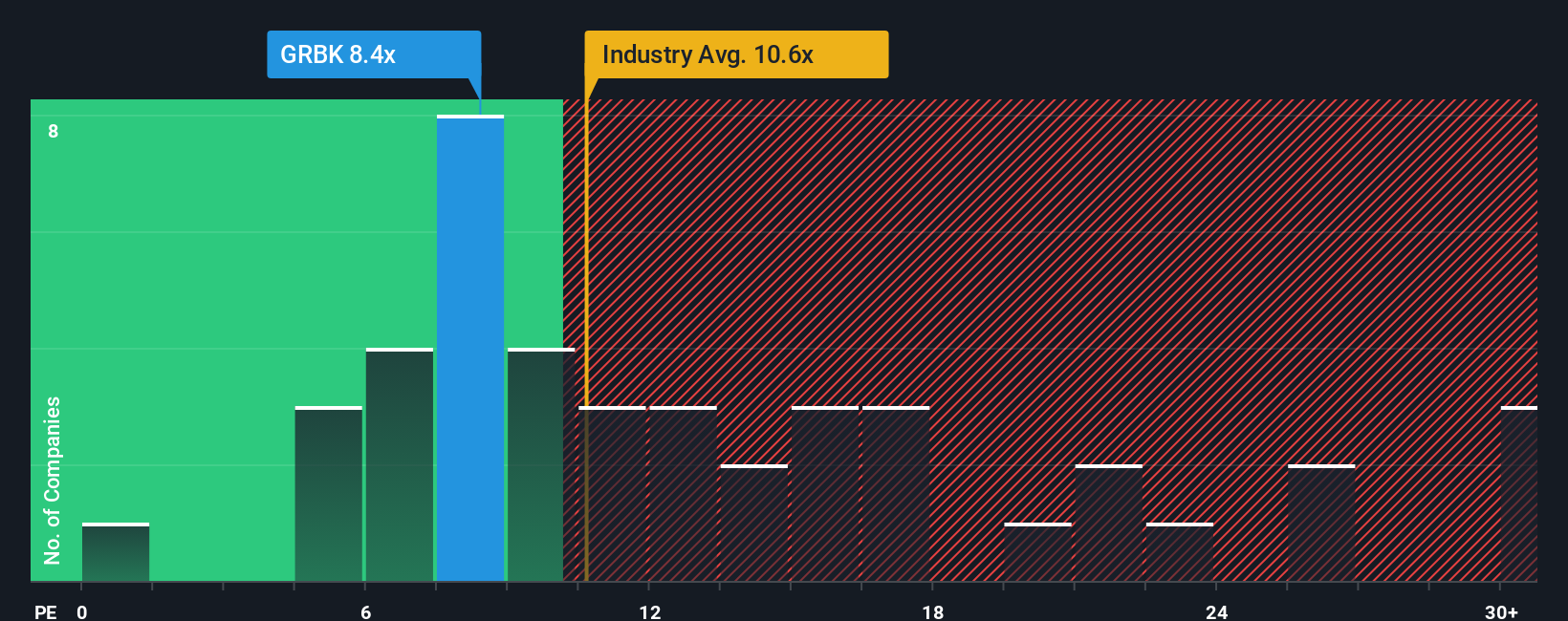

While the narrative fair value of US$62 points to Green Brick Partners as 4% overvalued, the P/E picture is more mixed. The current P/E of 8.4x sits below the US Consumer Durables average of 10.4x; it is slightly above peer levels at 7.9x and below a fair ratio of 10.5x. Is that a margin of safety or a sign the stock is already fully appreciated?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Green Brick Partners Narrative

If you look at the numbers and reach a different conclusion, or simply prefer your own framework, you can build a full view in minutes with Do it your way.

A great starting point for your Green Brick Partners research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If Green Brick is just one piece of your watchlist, do not stop here. Cast a wider net and let fresh ideas challenge your current assumptions.

- Spot potential value in companies the market may be overlooking by scanning these 884 undervalued stocks based on cash flows with strong cash flow support.

- Evaluate opportunities linked to digital finance trends by assessing businesses tied to these 79 cryptocurrency and blockchain stocks and broader blockchain adoption.

- Explore income opportunities by filtering for these 12 dividend stocks with yields > 3% that could strengthen your portfolio's cash return profile.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal