A Look At Soitec’s (ENXTPA:SOI) Valuation After Recent Share Price Rebound And Analyst Target Gap

Soitec’s Recent Share Performance in Context

Soitec (ENXTPA:SOI) has attracted fresh attention after a period of mixed share performance, with the stock roughly flat over the past month but showing a return decline over the past 3 months.

See our latest analysis for Soitec.

That flat 1 month share price return sits between a sharp 7 day share price gain of 12.98% and a much weaker 3 month share price return of a 42.42% decline, while the 1 year total shareholder return of a 70.09% decline signals that recent momentum is picking up from a low base.

If Soitec’s recent rebound has you rethinking where growth could come from next, this can be a good moment to look at high growth tech and AI stocks as potential alternatives in the same broad theme.

With Soitec’s share price still far below its 1 year level despite recent gains, and with mixed signals from value metrics and growth figures, is this a reset that offers upside, or is the market already pricing in future growth?

Most Popular Narrative Narrative: 27.2% Undervalued

Compared with Soitec’s last close at €26.20, the most followed narrative points to a fair value of €36, framing the recent share slump against more upbeat long term assumptions.

The analysts have a consensus price target of €52.944 for Soitec based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €99.0, and the most bearish reporting a price target of just €32.0.

Are you curious what kind of earnings path and margin profile need to line up to support that higher value range, and how a richer P/E multiple fits in, without stretching assumptions too far? The full narrative lays out the revenue glide path, profitability step up and discount rate that all have to work together for €36 to make sense.

Result: Fair Value of $36 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the story can change quickly if excess customer inventories drag on longer than expected or if tougher SiC competition squeezes Soitec’s pricing power and margins.

Find out about the key risks to this Soitec narrative.

Another Angle On Valuation

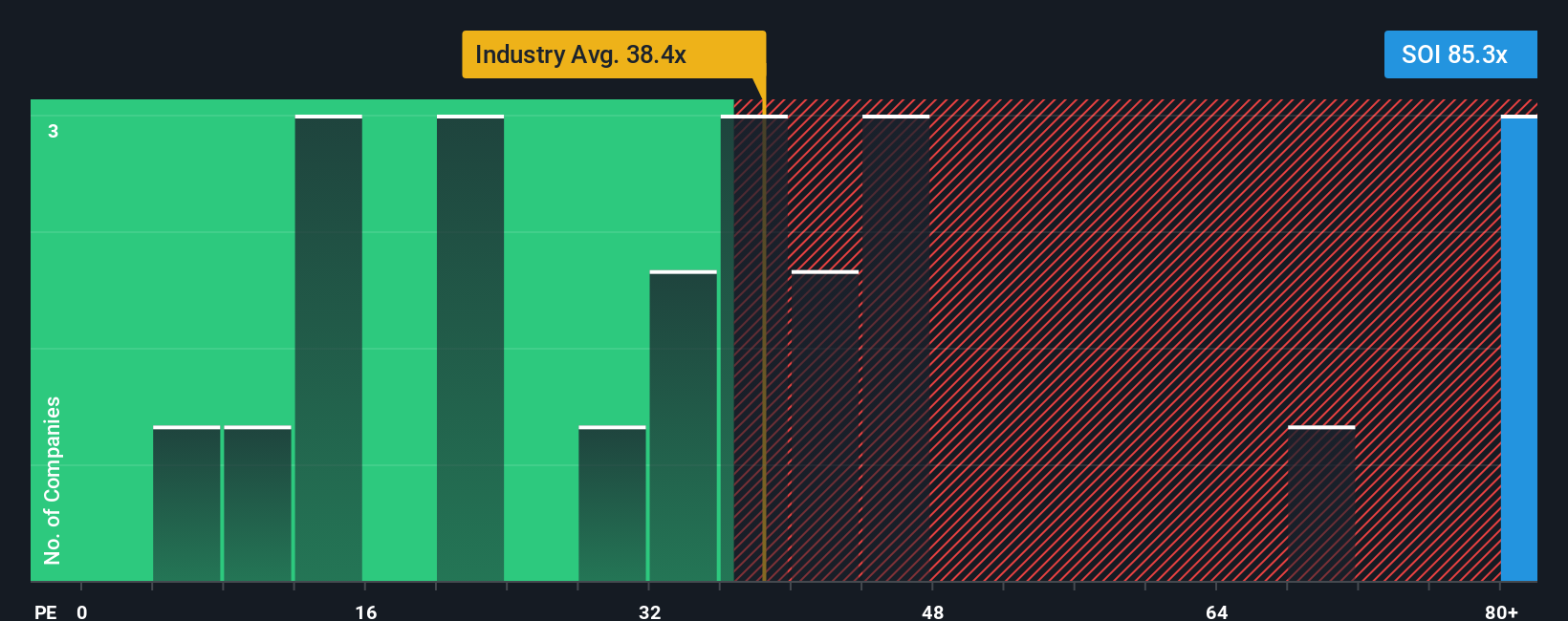

The popular narrative flags Soitec as 27.2% undervalued against a €36 fair value, yet the earnings multiple paints a tougher picture. At a P/E of 86.6x versus a fair ratio of 66.4x, peers at 68.6x and the wider European semiconductor group at 42.3x, the share looks expensive. Is this a case of earnings risk being underappreciated, or are investors paying up for a rebound that is still on paper?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Soitec Narrative

If you read this and think the assumptions do not quite fit your view, or you would rather test the numbers yourself, you can build a personal take in just a few minutes and Do it your way.

A great starting point for your Soitec research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Soitec has sharpened your focus on where to put capital to work next, do not stop here. Give yourself options and see what else the market is offering right now.

- Spot companies that combine low expectations with solid cash flow potential by checking out these 884 undervalued stocks based on cash flows before others start paying attention.

- Target the intersection of cutting edge technology and earnings potential by scanning these 26 AI penny stocks for businesses tied to the AI theme.

- Position yourself early in emerging themes across digital assets by reviewing these 79 cryptocurrency and blockchain stocks that are building businesses around blockchain and cryptocurrencies.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal