Assessing Genmab’s Valuation As Anthropic AI Collaboration Targets Faster Drug Development

Genmab (CPSE:GMAB) recently announced a collaboration with Anthropic to deploy Claude powered AI agents across its research and development operations. The initiative aims to speed up data handling, analysis and documentation in support of key clinical programs.

See our latest analysis for Genmab.

The Anthropic deal lands after a busy few months for Genmab, which has included refocusing its late stage pipeline by discontinuing acasunlimab, reaffirming 2025 guidance and preparing an update at the J.P. Morgan Healthcare Conference. Against that backdrop, the share price has a 7.92% year to date share price return and a 35.42% total shareholder return over one year, while the 3 year and 5 year total shareholder returns of 21.81% and 16.01% declines show longer term momentum has yet to fully recover.

If Genmab’s push into AI supported drug development has caught your eye, this could be a good moment to scan other healthcare stocks that might fit a similar research led profile.

With the shares roughly level with analyst targets but trading on an internal estimate that suggests a large intrinsic discount, you have to ask yourself: is this a genuine opportunity or is the market already pricing in future growth?

Most Popular Narrative Narrative: 5.4% Overvalued

Against Genmab’s last close of DKK2,166, the most followed narrative points to a fair value of DKK2,054.66, framing the current price as slightly rich.

Strong recurring royalty streams from established partnered products (such as DARZALEX) and a rising contribution from wholly owned product sales underpin stable, predictable cash flows. This provides financial flexibility for pipeline investment and margin expansion.

Want to see what is behind this modest premium to fair value? The narrative highlights steady double digit growth, firm margins, and a higher future earnings multiple. Curious how those elements combine into one price tag?

Result: Fair Value of DKK2,054.66 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that story can change if drug pricing pressure tightens in key markets or if more late stage trials disappoint and weaken confidence in the pipeline.

Find out about the key risks to this Genmab narrative.

Another View: Multiples Paint a Different Picture

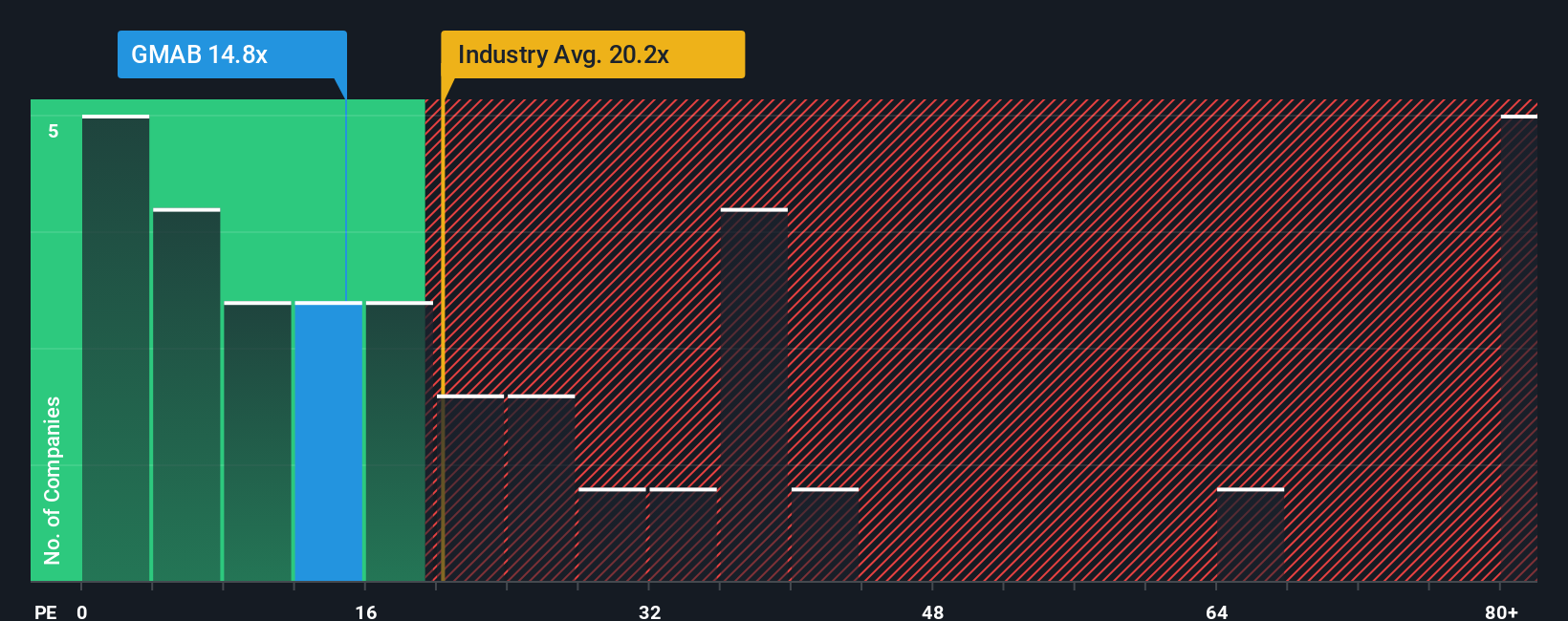

The analysts’ fair value points to Genmab as 5.4% overvalued, yet our P/E based checks tell a different story. At 13.2x earnings, the shares sit below the European Biotechs average of 16.2x and the peer average of 17.1x, and below a fair ratio of 19.5x. If the market ever moves closer to that fair ratio, does today’s price still feel stretched?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Genmab Narrative

If the data points you see here suggest a different story, you can quickly compile the numbers into a version that matches your view, then Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Genmab.

Looking for more investment ideas?

If Genmab has sharpened your interest in focused research stories, do not stop here. Broaden your watchlist now and give yourself more options to compare.

- Spot potential bargains by scanning these 884 undervalued stocks based on cash flows that the market may be pricing cautiously compared to their cash flow strength.

- Tap into structural tech shifts with these 26 AI penny stocks that are building products around artificial intelligence.

- Strengthen your income focus by reviewing these 12 dividend stocks with yields > 3% offering yields above 3% that might suit a cash return oriented approach.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal